The Christian right, or the religious right, are Christian political factions which are characterized by their strong support of socially conservative and traditionalist policies. Christian conservatives seek to influence politics and public policy with their interpretation of the teachings of Christianity.

The Christian Coalition of America (CCA), a 501(c)(4) organization, is the successor to the original Christian Coalition created in 1987 by religious broadcaster and former presidential candidate Marion Gordon "Pat" Robertson. This US Christian advocacy group includes members of various Christian denominations, including Baptists (50%), mainline Protestants (25%), Roman Catholics (16%), and Pentecostals among communicants of other churches.

The Freedom From Religion Foundation (FFRF) is an American nonprofit organization that advocates for atheists, agnostics, and nontheists. Formed in 1976, FFRF promotes the separation of church and state, and challenges the legitimacy of many federal and state programs that are faith-based. It supports groups such as nonreligious students and clergy who want to leave their faith.

Laïcité is the constitutional principle of secularism in France. Article 1 of the French Constitution is commonly interpreted as the separation of civil society and religious society. It discourages religious involvement in government affairs, especially in the determination of state policies as well as the recognition of a state religion. It also forbids government involvement in religious affairs, and especially prohibits government influence in the determination of religion, such that it includes a right to the free exercise of religion.

"Separation of church and state" is a metaphor paraphrased from Thomas Jefferson and used by others in discussions regarding the Establishment Clause and Free Exercise Clause of the First Amendment to the United States Constitution which reads: "Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof..."

United States non-profit laws relate to taxation, the special problems of an organization which does not have profit as its primary motivation, and prevention of charitable fraud. Some non-profit organizations can broadly be described as "charities" — like the American Red Cross. Some are strictly for the private benefit of the members — like country clubs, or condominium associations. Others fall somewhere in between — like labor unions, chambers of commerce, or cooperative electric companies. Each presents unique legal issues.

Religious activities generally need some infrastructure to be conducted. For this reason, there generally exist religion-supporting organizations, which are some form of organization that manages:

The Alliance Defending Freedom (ADF), formerly the Alliance Defense Fund, is an American conservative Christian legal advocacy group that works to protect religious liberty, expand Christian practices within public schools and in government, outlaw abortion, and curtail LGBTQ rights. In 2014, ADF literature described part of its mission as "[seeking] to recover the robust Christendomic theology of the 3rd, 4th, and 5th centuries." ADF is headquartered in Scottsdale, Arizona, with branch offices in several locations including Washington, D.C., and New York. Its international subsidiary, Alliance Defending Freedom International, with headquarters in Vienna, Austria, operates in over 100 countries.

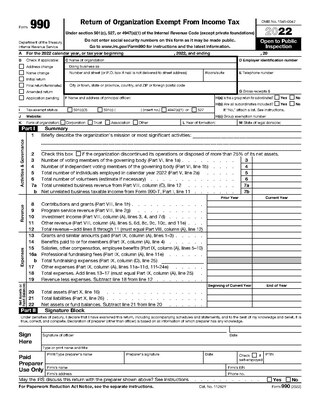

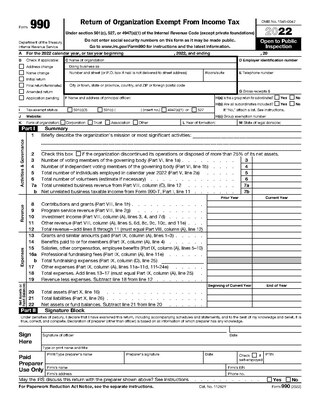

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

A free church is any Christian denomination that is intrinsically separate from government. A free church neither defines government policy, nor accept church theology or policy definitions from the government. A free church also does not seek or receive government endorsements or funding to carry out its work. The term is only relevant in countries with established state churches. Notwithstanding that the description "free" has no inherent doctrinal or polity overtones. An individual belonging to a free church is known as a free churchperson or, historically, free churchman.

A church tax is a tax collected by the state from members of some religious denominations to provide financial support of churches, such as the salaries of its clergy and to pay the operating cost of the church. Not all countries have such a tax. In some countries that do, people who are not members of a religious community are exempt from the tax; in others it is always levied, with the payer often entitled to choose who receives it, typically the state or an activity of social interest.

The Church of Spiritual Technology (CST) is a California 501(c)(3) non-profit corporation, incorporated in 1982, which owns all the copyrights of the estate of L. Ron Hubbard and licenses their use. CST does business as L. Ron Hubbard Library. The Church of Spiritual Technology points to Hubbard as the “focal point,” with the structure designed to realize what Scientologists understand to be his vision. The stated purpose of the archive in CST, according to the church is “so that future generations will have available to them all of L. Ron Hubbard’s technology in its exact and original form, no matter what happens to the society.”

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

A religious corporation is a type of religious non-profit organization, which has been incorporated under the law. Often these types of corporations are recognized under the law on a subnational level, for instance by a state or province government. The government agency responsible for regulating such corporations is usually the official holder of records, for instance, the Secretary of State. In the United States, religious corporations are formed like all other nonprofit corporations by filing articles of incorporation with the state. Religious corporation articles need to have the standard tax-exempt language the IRS requires. Religious corporations are permitted to designate a person to act in the capacity of corporation sole. This is a person who acts as the official holder of the title on the property, etc.

Recognition of Scientology and the Church of Scientology varies from country to country with respect to state recognition for religious status, charitable status, or tax exempt status. Decisions are contingent upon the legal constructs of each individual country, and results are not uniform worldwide. For example, the absence of a clear definition for 'religion' or 'religious worship' has resulted in unresolved and uncertain status for Scientology in some countries.

Form 990 is a United States Internal Revenue Service (IRS) form that provides the public with information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Some nonprofits, such as hospitals and other healthcare organizations, have more comprehensive reporting requirements.

Nonpartisanism in the United States is organized under United States Internal Revenue Code that qualifies certain non-profit organizations for tax-exempt status because they refrain from engaging in certain political activities prohibited for them. The designation "nonpartisan" usually reflects a claim made by organizations about themselves, or by commentators, and not an official category per American law. Rather, certain types of nonprofit organizations are under varying requirements to refrain from election-related political activities, or may be taxed to the extent they engage in electoral politics, so the word affirms a legal requirement. In this context, "nonpartisan" means that the organization, by US tax law, is prohibited from supporting or opposing political candidates, parties, and in some cases other votes like propositions, directly or indirectly, but does not mean that the organization cannot take positions on political issues.

The Johnson Amendment is a provision in the U.S. tax code, since 1954, that prohibits all 501(c)(3) non-profit organizations from endorsing or opposing political candidates. Section 501(c)(3) organizations are the most common type of nonprofit organization in the United States, ranging from charitable foundations to universities and churches. The amendment is named for then-Senator Lyndon B. Johnson of Texas, who introduced it in a preliminary draft of the law in July 1954.

Form 1023 is a United States IRS tax form, also known as the Application for Recognition of Exemption Under 501(c)(3) of the Internal Revenue Code. It is filed by nonprofits to get exemption status. On January 31, 2020, the IRS abandoned the paper format of the form 1023. Those who used the paper version were given 90 days grace period and that ended on April 30, 2020. Going forward, every application has to be filed online through Pay.gov portal.

In the United States of America, Pulpit Freedom Sunday is an annual event which is held in churches. It was founded in 2008 by Alliance Defending Freedom (ADF) to challenge the prohibition on places of worship from endorsing political candidates. According to The New York Times, ADF's campaign has become "perhaps its most aggressive effort."