Elizabeth Ann Warren is an American politician and former law professor who is the senior United States senator from Massachusetts, serving since 2013. A member of the Democratic Party and regarded as a progressive, Warren has focused on consumer protection, equitable economic opportunity, and the social safety net while in the Senate. Warren was a candidate in the 2020 Democratic Party presidential primaries, ultimately finishing third.

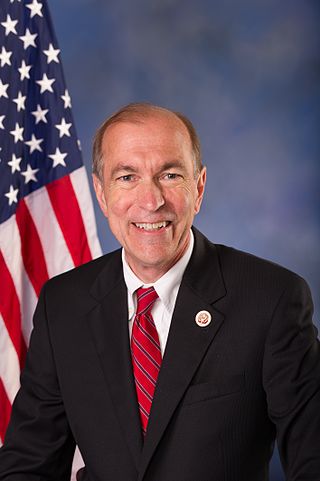

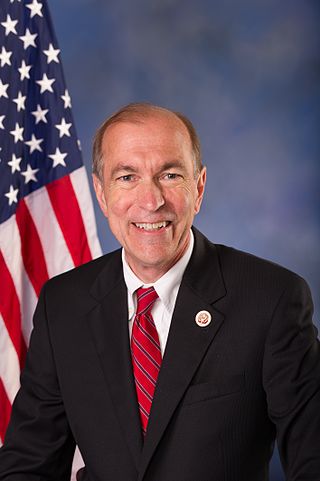

Ernest Scott Garrett is an American politician who was the U.S. representative for New Jersey's 5th congressional district, serving from 2003 to 2017. He is a member of the Republican Party. He previously served in the New Jersey General Assembly from 1990 to 2003. Garrett chaired the United States House Financial Services Subcommittee on Capital Markets and Government-Sponsored Enterprises. He lost his reelection bid in 2016 to Democrat Josh Gottheimer, becoming the only incumbent Congressman in New Jersey to be defeated that year.

Robert Stanley Nichols is an American association executive and former public official. He is currently the president and CEO of the American Bankers Association. He was previously president and CEO of the Financial Services Forum from 2005 to 2015 and an assistant secretary at the U.S. Treasury Department during the George W. Bush administration.

Thomas Jeb Hensarling is an American politician who served as the U.S. representative for Texas's 5th congressional district from 2003 to 2019. A member of the Republican Party, he chaired the House Republican Conference from 2011 to 2013 and House Financial Services Committee from 2013 until 2019. The Los Angeles Times described Hensarling, "a fervent believer in free market ideology" and that he was "a pivotal player in the GOP effort to reduce financial regulation in the Trump Era". The Wall Street Journal called him "a driver of economic policy in the house". Hensarling has close ties to Wall Street, having received campaign donations from every major Wall Street bank as well as various payday lenders.

Regulatory responses to the subprime crisis addresses various actions taken by governments around the world to address the effects of the subprime mortgage crisis.

Neal Steven Wolin is the CEO of the corporate advisory firm Brunswick Group, an equity partner of Data Collective, a board partner of Social Capital, and a limited partner advisor of Nyca Partners. He was the longest-serving Deputy Secretary of the U.S. Department of the Treasury and also served as Acting Secretary of the Treasury in early 2013.

The Dodd–Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd–Frank, is a United States federal law that was enacted on July 21, 2010. The law overhauled financial regulation in the aftermath of the Great Recession, and it made changes affecting all federal financial regulatory agencies and almost every part of the nation's financial services industry.

Michael S. Barr is an American legal scholar who has been serving as second vice chair of the Federal Reserve for supervision since 2022. From 2009 to 2011, he was assistant secretary of the treasury for financial institutions under President Barack Obama. At the University of Michigan, he has been serving as faculty member since 2001, professor of law since 2006, professor of public policy since 2014.

Wall Street reforms are reforms or regulations of the financial industry in the United States.

The Financial Stability Oversight Council (FSOC) is a United States federal government organization, established by Title I of the Dodd–Frank Wall Street Reform and Consumer Protection Act, which was signed into law by President Barack Obama on July 21, 2010. The Office of Financial Research is intended to provide support to the council.

The Consumer Financial Protection Bureau (CFPB) is an independent agency of the United States government responsible for consumer protection in the financial sector. CFPB's jurisdiction includes banks, credit unions, securities firms, payday lenders, mortgage-servicing operations, foreclosure relief services, debt collectors, and other financial companies operating in the United States. Since its founding, the CFPB has used technology tools to monitor how financial entities used social media and algorithms to target consumers.

Operation Choke Point was an initiative of the United States Department of Justice beginning in 2013 which investigated banks in the United States and the business they did with firearm dealers, payday lenders, and other companies that, while operating legally, were said to be at a high risk for fraud and money laundering.

Friends of Traditional Banking(FOTB) is an independent expenditure-only committee, or super PAC, with the aim of improving the political and regulatory environment for the banking industry in the United States by decreasing federal regulation, particularly by repealing the Dodd–Frank Wall Street Reform and Consumer Protection Act. As a non-partisan trade group, it selects a small number of Congressional races in each election cycle (typically two) and encourages their members to donate directly to these campaigns.

Executive Order 13772, titled "Core Principles for Regulating the United States Financial System", is an executive order signed by U.S. President Donald Trump on February 3, 2017. The eighth executive action by the president during his first 100 days in office, it establishes the "core principles" of regulation under the Trump Administration and tasks the United States Department of the Treasury to review the Financial Stability Oversight Council, originally established under the Dodd–Frank Wall Street Reform and Consumer Protection Act, and report to the President in 120 days on current regulations and their effectiveness in carrying out these core principles.

Financial CHOICE Act is a bill introduced to the 115th United States Congress in 2017 that would, if enacted, roll back "many of the protections in the landmark Dodd-Frank 2010 federal law, including the "strongest" Wall Street "regulations from the financial crisis. The legislation passed the House 233–186 on June 8, 2017. The 600-page legislation was crafted by Congressman Jeb Hensarling (R-TX), chair of the House Financial Services Committee.

Keith A. Noreika is an American lawyer who specializes in the regulation of financial institutions. He served as Acting Comptroller of the Currency from May 5, 2017, to November 27, 2017, following the 30th Comptroller of the Currency, Thomas J. Curry, and preceding the 31st Comptroller of the Currency, Joseph Otting. Noreika rejoined the law firm of Simpson Thacher on January 8, 2018. He joined Patomak Global Partners as Executive Vice President and Chairman of its Banking Supervision and Regulation Group on July 5, 2022.

Rohit Chopra is an American consumer advocate who is the third director of the Consumer Financial Protection Bureau (CFPB) and previous member of the Federal Trade Commission (FTC). Prior to this, Chopra served as assistant director of the CFPB and as the agency's first Student Loan Ombudsman, an office created by the Dodd–Frank Act.

The Economic Growth, Regulatory Relief, and Consumer Protection Act was signed into law by President Donald Trump on May 24, 2018. The bill eased financial regulations imposed by Dodd–Frank Wall Street Reform and Consumer Protection Act after the financial crisis of 2007–2008.

Saule Tarikhovna Omarova is a Kazakh-American attorney, academic, and public policy advisor. She was the nominee for comptroller of the currency before her nomination was withdrawn at her request on December 7, 2021.

Graham Scott Steele is an American attorney, policy advisor, and government official. In July 2021, Steele was nominated by President Joe Biden to serve as Assistant Secretary of the Treasury for Financial Institutions. He was confirmed by the Senate and served in the position until January 2024.