Related Research Articles

The Bank of Montreal is a Canadian multinational investment bank and financial services company.

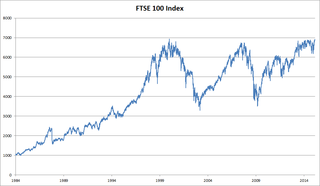

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

Big Five is the name colloquially given to the five largest banks that dominate the banking industry of Canada: Bank of Montreal (BMO), Bank of Nova Scotia (Scotiabank), Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC), and TD Bank Group.

Hammerson plc is a major British property development and investment company. The firm switched to real estate investment trust (REIT) status when they were introduced in the United Kingdom in January 2007. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index; it is also a constituent of the FTSE EPRA/NAREIT Developed Europe index, among others. The majority of Hammerson's portfolio is in the United Kingdom, but is also operates in continental Europe, including operations in France, Ireland, Spain, and Germany. It invests mainly in offices and retail premises.

The Unite Group provides purpose built student accommodation (PBSA) across the United Kingdom.

Alliance Trust plc is a publicly traded investment and financial services company, established in 1888 and headquartered in Dundee, Scotland. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. It is one of the largest investment trusts in the UK.

Derwent London is a British-based property investment and development business. It is headquartered in London and is a constituent of the FTSE 250 Index.

JPMorgan European Discovery, formerly the JP Morgan European Fledgling Investment Trust, is a large British investment trust. Established in 1990, it is dedicated to investments in smaller European companies. The Chairman is Carolan Dobson. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. The company changed its name from JPMorgan European Smaller Companies Trust to JPMorgan European Discovery Trust on 15 June 2021.

UK Commercial Property Trust is a large British investment trust dedicated to investments in UK commercial properties. Established in 2006, the company is a constituent of the FTSE 250 Index. The chairman is Andrew Wilson. It invests in shopping centres, shops, office buildings and industrial estates and warehousing/distribution centres.

Primary Health Properties plc is a British-based real estate investment trust, specialising in the rental of flexible and modern primary healthcare facilities within the United Kingdom and Ireland. The company is listed on the London Stock Exchange and is also a constituent of the FTSE 250 Index

Raven Property Group Limited is a property investment company specialising in commercial property in Russia. It is listed on the London Stock Exchange and is a former constituent of the FTSE 250 Index.

The Global Smaller Companies Trust, formerly BMO Global Smaller Companies, is a large British investment trust dedicated to investments in smaller companies on a worldwide basis. Established in 1964, the company, which was previously known as F&C Global Smaller Companies Trust, is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. The chairman is Anthony Townsend.

VinaCapital Vietnam Opportunity Fund is a large British investment trust dedicated to investments in capital markets, private equity, undervalued assets, privatised assets, property and private placements. It is managed by VinaCapital. After transferring from the Alternative Investment Market to a full listing in March 2016, the company went on to become a constituent of the FTSE 250 Index. The Chairman is Huw Evans. Andy Ho is the Managing Director.

Liontrust Asset Management plc is a British asset management company based in London. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Urban Logistics REIT is a property company which invests in warehouses. The company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

abrdn Private Equity Opportunities Trust, formerly Standard Life Private Equity Trust (SLPE), is a large British investment company dedicated to investments in private equity funds and direct investments into private companies with European focus. Established in 2001, the company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. The chairperson is Christina McComb. It is managed by abrdn.

Supermarket Income REIT is a property company which invests in retail property and holds a large portfolio of supermarkets. The company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Target Healthcare REIT is a property company which invests in healthcare and holds a large portfolio of care homes. The company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

JPMorgan Global Growth and Income is a large British investment trust. Established in 1887, it is dedicated to investing in companies worldwide. The Chairman is Tristan Hillgarth. It is listed on the London Stock Exchange and FTSE Russell announced on 1 August 2022 that it would become a constituent of the FTSE 250 Index on 4 August 2022.

Warehouse REIT is a property company which invests in the provision of warehousing. The company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

References

- ↑ "Martin Moore". WSJ Markets. Retrieved 19 March 2021.

- ↑ "F&C's commercial property trust aims to fill portfolio gap". Money Marketing. 17 March 2005. Retrieved 19 March 2021.

- ↑ Knife edge vote ends merger to create UK property giant The Telegraph, 10 August 2010

- ↑ "Property tax rules prompt change at £1.3bn F&C trust". FT Adviser. 25 April 2019. Archived from the original on 25 April 2019. Retrieved 19 March 2021.

- ↑ "BMO completes F&C rebrand with property trusts". 3 June 2019.

- ↑ "BMO Commercial Property Trust to change name". Quoted Data. 19 April 2022. Retrieved 17 September 2022.