The Eastern Caribbean dollar is the currency of all seven full members and one associate member of the Organisation of Eastern Caribbean States (OECS). The successor to the British West Indies dollar, it has existed since 1965, and it is normally abbreviated with the dollar sign $ or, alternatively, EC$ to distinguish it from other dollar-denominated currencies. The EC$ is subdivided into 100 cents. It has been pegged to the United States dollar since 7 July 1976, at the exchange rate of US$1 = EC$2.70.

Rupee is the common name for the currencies of India, Mauritius, Nepal, Pakistan, Seychelles, and Sri Lanka, and of former currencies of Afghanistan, Bahrain, Kuwait, Oman, the United Arab Emirates, British East Africa, Burma, German East Africa, and Tibet. In Indonesia and the Maldives, the unit of currency is known as rupiah and rufiyaa respectively, cognates of the word rupee.

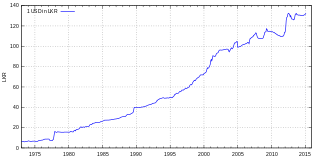

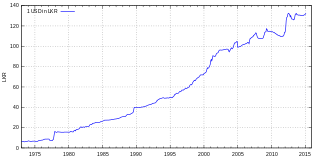

The rupee is the currency of the Seychelles. It is subdivided into 100 cents. In the local Seychellois Creole (Seselwa) language, it is called the roupi and roupie in French. The ISO code is SCR. The abbreviation SR is sometimes used for distinction. By population, Seychelles is the smallest country to have an independent monetary policy. Several other currencies are also called rupee.

Sterling is the currency of the United Kingdom and nine of its associated territories. The pound is the main unit of sterling, and the word "pound" is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling.

The Hong Kong dollar is the official currency of the Hong Kong Special Administrative Region. It is subdivided into 100 cents or 1000 mils. The Hong Kong Monetary Authority is the monetary authority of Hong Kong and the Hong Kong dollar.

In public finance, a currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. This policy objective requires the conventional objectives of a central bank to be subordinated to the exchange rate target. In colonial administration, currency boards were popular because of the advantages of printing appropriate denominations for local conditions, and it also benefited the colony with the seigniorage revenue. However, after World War II many independent countries preferred to have central banks and independent currencies.

The Indian rupee is the official currency in the Republic of India. The rupee is subdivided into 100 paise, though as of 2023, coins of denomination of 1 rupee are the lowest value in use whereas 2000 rupees is the highest. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management on the basis of the Reserve Bank of India Act, 1934.

The Sri Lankan Rupee is the currency of Sri Lanka. It is subdivided into 100 cents, but cents are rarely seen in circulation due to its low value. It is issued by the Central Bank of Sri Lanka. The abbreviation Re (singular) and Rs (plural) is generally used, the World Bank suggests SL Rs as a fully disambiguating abbreviation for distinction from other currencies named "rupee".

The British West Indies dollar (BWI$) was the currency of British Guiana and the Eastern Caribbean territories of the British West Indies from 1949 to 1965, when it was largely replaced by the East Caribbean dollar, and was one of the currencies used in Jamaica from 1954 to 1964. The monetary policy of the currency was overseen by the British Caribbean Currency Board (BCCB). It was the official currency used by the West Indies Federation The British West Indies dollar was never used in British Honduras, the Cayman Islands, the Turks and Caicos Islands, the Bahamas, or Bermuda.

The Mauritian rupee is the currency of Mauritius. One rupee is subdivided into 100 cents. Several other currencies are also called rupee.

A currency union is an intergovernmental agreement that involves two or more states sharing the same currency. These states may not necessarily have any further integration.

The Qatari riyal is the currency of the State of Qatar. It is divided into 100 dirhams.

The issue of banknotes of the Hong Kong dollar is governed in the Special Administrative Region of Hong Kong by the Hong Kong Monetary Authority (HKMA), the governmental currency board of Hong Kong. Under licence from the HKMA, three commercial banks issue their own banknotes for general circulation in the region. Notes are also issued by the HKMA itself.

The history of the rupee traces back to ancient Indian subcontinent. The mention of rūpya by Pāṇini is seemingly the earliest reference in a text about coins. The term in Indian subcontinent was used for referring to a coin.

Commonwealth banknote-issuing institutions also British Empire Paper Currency Issuers comprises a list of public, private, state-owned banks and other government bodies and Currency Boards who issued legal tender: banknotes.

In 1820, in response to a request from the British colony of Mauritius, the imperial government in London struck silver coins in the denominations of 1⁄4, 1⁄8, and 1⁄16 dollars. The dollar unit in question was equivalent to the Spanish dollar and these fractional coins were known as 'Anchor Dollars' because of the anchor that appeared on them. More of these anchor dollars were struck in 1822 and not only for Mauritius but also for the British West Indies. In addition to this, a 1⁄2 dollar anchor coin was struck for Mauritius. A year or two later, copper dollar fractions were struck for Mauritius, the British West Indies, and Sierra Leone.

The Reserve Bank of Fiji is the central bank of the Pacific island country of Fiji. The responsibilities of the RBF include issue of currency, control of money supply, currency exchange, monetary stability, promotion of sound finances, and fostering economic development.

The Central Bank of The Bahamas is the reserve bank of The Bahamas based in the capital Nassau.

The Central Bank of Trinidad and Tobago is the central bank of Trinidad and Tobago.

The Nepal Rastra Bank was established April 26, 1956 A.D. under the Nepal Rastra Bank Act, 1955, to discharge the central banking responsibilities including guiding the development of the embryonic domestic financial sector. As of now, the NRB is functioning under the new Nepal Rastra Bank Act, 2002. functions of NRB are to formulate required monetary and foreign exchange policies so as to maintain the stability in market prices, to issue currency notes, to regulate and supervise the banking and financial sector, to develop efficient payment and banking systems among others. The NRB is also the economic advisor to the government of Nepal. As the central bank of Nepal, it is the monetary, supervisory and regulatory body of all the commercial banks. development banks, finance companies and micro-finances institutions.