Money laundering is the process of illegally concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdictions with varying definitions. It is usually a key operation of organized crime.

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the United States Department of the Treasury that collects and analyzes information about financial transactions in order to combat domestic and international money laundering, terrorist financing, and other financial crimes.

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

In the United States, Know Your Customer (KYC) guidelines and regulations in financial services require professionals to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. The procedures fit within the broader scope of anti-money laundering (AML) and counter terrorism financing (CTF) regulations.

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for its service or, as a matching platform, simply charges fees.

Australian Transaction Reports and Analysis Centre (AUSTRAC) is an Australian government financial intelligence agency responsible for monitoring financial transactions to identify money laundering, organised crime, tax evasion, welfare fraud and terrorism financing. AUSTRAC was established in 1989 under the Financial Transaction Reports Act 1988. It implements in Australia the recommendations of the Financial Action Task Force on Money Laundering (FATF), which Australia joined in 1990.

Virtual currency, or virtual money, is a digital currency that is largely unregulated, issued and usually controlled by its developers, and used and accepted electronically among the members of a specific virtual community. In 2014, the European Banking Authority defined virtual currency as "a digital representation of value that is neither issued by a central bank or a public authority, nor necessarily attached to a fiat currency but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically." A digital currency issued by a central bank is referred to as a central bank digital currency.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.

Charles Shrem IV is an American entrepreneur and bitcoin advocate. He co-founded the now-defunct startup company BitInstant, and is a founding member of the Bitcoin Foundation. In 2014 he was sentenced to two years in prison for aiding and abetting the operation of an unlicensed money-transmitting business related to the Silk Road marketplace. He was released from prison in 2016. In 2017, he joined Jaxx and served as its chief operating officer, and founded cryptocurrency advisory CryptoIQ.

Bitstamp is a European cryptocurrency exchange founded in 2011. It is the world’s longest-running cryptocurrency exchange. It allows trading between fiat currency, Bitcoin and other cryptocurrencies, such as USD, EUR, GBP, Ethereum, Litecoin, Ripple, Bitcoin Cash, Algorand, Stellar, and USD Coin. Business operations are conducted from its registered headquarters in Luxembourg City, with a satellite office in Ljubljana.

Bitcoin is a cryptocurrency, a digital asset that uses cryptography to control its creation and management rather than relying on central authorities. Originally designed as a medium of exchange, Bitcoin is now primarily regarded as a store of value. The history of bitcoin started with its invention and implementation by Satoshi Nakamoto, who integrated many existing ideas from the cryptography community. Over the course of bitcoin's history, it has undergone rapid growth to become a significant store of value both on- and offline. From the mid-2010s, some businesses began accepting bitcoin in addition to traditional currencies.

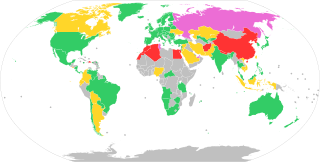

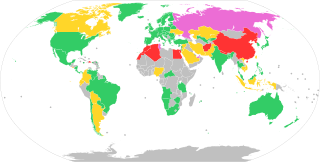

The legal status of cryptocurrencies varies substantially from one jurisdiction to another, and is still undefined or changing in many of them. Whereas, in the majority of countries the usage of cryptocurrency isn't in itself illegal, its status and usability as a means of payment varies, with differing regulatory implications.

Ripple Labs, Inc. is an American technology company which develops the Ripple payment protocol and exchange network. Originally named Opencoin and renamed in 2015, the company was founded in 2012 and is based in San Francisco, California.

A cryptocurrency tumbler or cryptocurrency mixing service is a service that mixes potentially identifiable or "tainted" cryptocurrency funds with others, so as to obscure the trail back to the fund's original source. This is usually done by pooling together source funds from multiple inputs for a large and random period of time, and then spitting them back out to destination addresses. As all the funds are lumped together and then distributed at random times, it is very difficult to trace exact coins. Tumblers have arisen to improve the anonymity of cryptocurrencies, usually bitcoin, since the digital currencies provide a public ledger of all transactions. Due to its goal of anonymity, tumblers have been used to money launder cryptocurrency.

United States virtual currency law is financial regulation as applied to transactions in virtual currency in the U.S. The Commodity Futures Trading Commission has regulated and may continue to regulate virtual currencies as commodities. The Securities and Exchange Commission also requires registration of any virtual currency traded in the U.S. if it is classified as a security and of any trading platform that meets its definition of an exchange.

ShapeShift is a cryptocurrency exchange headquartered in Switzerland. As of 2018, the company was run out of Denver, Colorado. A 2018 investigation by the Wall Street Journal alleged that ShapeShift had facilitated money laundering of $90 million in funds from criminal activities over a two-year period.

Cryptocurrency and crime describe notable examples of cybercrime related to theft of cryptocurrencies and some methods or security vulnerabilities commonly exploited. Cryptojacking is a form of cybercrime specific to cryptocurrencies that have been used on websites to hijack a victim's resources and use them for hashing and mining cryptocurrency.

The general notion of cryptocurrencies in Europe denotes the processes of legislative regulation, distribution, circulation, and storage of cryptocurrencies in Europe. In April 2023, the EU Parliament passed the Markets in Crypto Act (MiCA) unified legal framework for crypto-assets within the European Union.

Coinme is a cryptocurrency exchange headquartered in Seattle, Washington. The company offers technology for bitcoin ATMs and kiosks, which allow users to convert cryptocurrency into cash. The company launched one of the first licensed bitcoin ATMs in the U.S.

Cryptocurrency in Australia refers to the use and regulation of digital currencies such as Bitcoin, Ethereum, and various other altcoins within the country of Australia. Australia has been recognized as a relatively progressive country regarding cryptocurrency adoption and regulation.