KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. As of December 31, 2022, the firm had completed more than 690 private equity investments in portfolio companies with approximately $700 billion of total enterprise value. As of December 31, 2022, assets under management (AUM) and fee paying assets under management (FPAUM) were $504 billion and $412 billion, respectively.

Blackstone Inc. is an American alternative investment management company based in New York City. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate. Blackstone is also active in credit, infrastructure, hedge funds, insurance, secondaries, and growth equity. As of June 2023, the company's total assets under management were approximately US$1 trillion, making it the largest alternative investment firm globally.

TPG Inc., previously known as Texas Pacific Group and TPG Capital, is an American private equity firm based in Fort Worth, Texas. The firm is focused on leveraged buyouts and growth capital. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments. The firm invests in a range of industries including consumer/retail, media and telecommunications, industrials, technology, travel, leisure, and health care.

Bridgepoint Group plc is a British private investment company listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

CVC Capital Partners is a Luxembourg-based private equity and investment advisory firm with approximately US$155 billion of assets under management and approximately €157 billion in secured commitments since inception across American, European and Asian private equity, secondaries and credit funds. As of 31 December 2021, the funds managed or advised by CVC are invested in more than 100 companies worldwide, employing over 450,000 people in numerous countries. CVC was founded in 1981 and, as of 31 March 2022, has over 650 employees working across its network of 25 offices throughout EMEA, Asia and the Americas.

Sun Capital Partners, Inc., is an American private equity firm specializing in leveraged buyouts. Sun Capital was founded in 1995 by Marc J. Leder and Rodger Krouse, former classmates at the Wharton School of the University of Pennsylvania and investment bankers at Lehman Brothers.

Leonard Green & Partners (LGP) is an American private equity investment firm founded in 1989 and based in Los Angeles. The firm specializes in private equity investments. LGP has invested in over 95 companies since its inception, including Petco and The Container Store.

Francisco Partners, legally Francisco Partners Management, L.P., is an American private equity firm focused exclusively on investments in technology and technology-enabled services businesses. It was founded in August 1999 and based in San Francisco with offices in London and New York City.

Partners Group Holding AG is a Swiss-based global private equity firm with US$141.7 billion in assets under management in private equity, private infrastructure, private real estate and private debt.

Vista Equity Partners is an American private equity firm that invests in software, data, and technology-enabled businesses. With over $100 billion in AUM, it is one of the largest private equity firms in the world. Vista has invested in hundreds of technology companies, including Citrix, SentinelOne, and Marketo.

Mediaocean is an advertising services and software company, headquartered in New York City.

DFO Management is an American family office that manages the capital of Michael Dell and his family. The firm, which is based in New York and has offices in Santa Monica and West Palm Beach, was formed in 1998.

Sixth Street is a global investment firm with over $70 billion in assets under management. The firm operates nine investment platforms across its growth investing, adjacencies, direct lending, fundamental public strategies, infrastructure, special situations, agriculture and par liquid credit businesses. Sixth Street invests in the equity and debt of public and private companies, acquires real estate, finances infrastructure projects, and provides start-up capital to new businesses. Sixth Street has been noted in the financial media for the unusual structure of its largest fund, which is open-ended and able to hold longer-term investments.

PAG is an Asian investment firm that manages multiple asset classes, including private equity, private debt, real estate and hedge funds. It is considered one of the largest private investment firms in Asia.

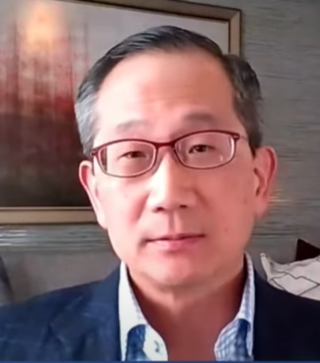

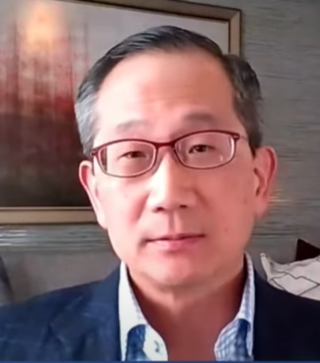

Kewsong Lee is a Korean-American businessman who is the former chief executive officer (CEO) of private equity firm The Carlyle Group.

BPEA EQT is an Asian investment firm headquartered in Hong Kong. Previously it was an affiliate of Barings Bank before becoming an independent firm. In 2022, it was acquired by EQT Partners to act as its Asian investment platform. BPEA EQT is one of the largest private equity firms in Asia.

RRJ Capital is a private equity firm based in Singapore. It is one of the largest private equity firms based in Asia.

ICONIQ Capital is an American investment management firm headquartered in San Francisco, California. It functions as a hybrid family office providing specialized financial advisory, private equity, venture capital, real estate, and philanthropic services to its clientele. ICONIQ Capital primarily serves ultra-high-net-worth clients working in technology, high finance, and entertainment. The firm operates in-house venture capital, growth equity, and charitable giving funds for its clients.

Clearlake Capital Group, L.P. is a private equity firm founded in 2006 that focuses on the technology, industrial and consumer sectors. The firm is headquartered in Santa Monica with affiliates in Dallas, London and Dublin. In 2022, the firm was a part of an investor consortium named BlueCo that purchased Chelsea.

Stonepeak is an American investment firm headquartered in New York City. The firm focuses on investments in infrastructure and more recently real estate. The firm has additional offices in Hong Kong, Houston, London, Sydney and Singapore.