Fundamental analysis, in accounting and finance, is the analysis of a business's financial statements ; health; and competitors and markets. It also considers the overall state of the economy and factors including interest rates, production, earnings, employment, GDP, housing, manufacturing and management. There are two basic approaches that can be used: bottom up analysis and top down analysis. These terms are used to distinguish such analysis from other types of investment analysis, such as quantitative and technical.

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Investment is traditionally defined as the "commitment of resources to achieve later benefits". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream.

The price–earnings ratio, also known as P/E ratio, P/E, or PER, is the ratio of a company's share (stock) price to the company's earnings per share. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued.

Stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement – stocks that are judged undervalued are bought, while stocks that are judged overvalued are sold, in the expectation that undervalued stocks will overall rise in value, while overvalued stocks will generally decrease in value. A target price is a price at which an analyst believes a stock to be fairly valued relative to its projected and historical earnings.

Greed and fear refer to two opposing emotional states theorized as factors causing the unpredictability and volatility of the stock market, and irrational market behavior inconsistent with the efficient-market hypothesis. Greed and fear relate to an old Wall Street saying: "financial markets are driven by two powerful emotions – greed and fear."

Enterprise value (EV), total enterprise value (TEV), or firm value (FV) is an economic measure reflecting the market value of a business. It is a sum of claims by all claimants: creditors and shareholders. Enterprise value is one of the fundamental metrics used in business valuation, financial analysis, accounting, portfolio analysis, and risk analysis.

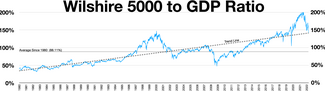

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all American stocks actively traded in the United States. As of September 30, 2023, the index contained 3,427 components. The index is intended to measure the performance of most publicly traded companies headquartered in the United States, with readily available price data. Hence, the index includes a majority of the common stocks and REITs traded primarily through New York Stock Exchange, NASDAQ, or the American Stock Exchange. Limited partnerships and ADRs are not included. It can be tracked by following the ticker ^W5000.

Contrarian investing is an investment strategy that is characterized by purchasing and selling in contrast to the prevailing sentiment of the time.

Price–sales ratio, P/S ratio, or PSR, is a valuation metric for stocks. It is calculated by dividing the company's market capitalization by the revenue in the most recent year; or, equivalently, divide the per-share stock price by the per-share revenue.

Alpha is a measure of the active return on an investment, the performance of that investment compared with a suitable market index. An alpha of 1% means the investment's return on investment over a selected period of time was 1% better than the market during that same period; a negative alpha means the investment underperformed the market. Alpha, along with beta, is one of two key coefficients in the capital asset pricing model used in modern portfolio theory and is closely related to other important quantities such as standard deviation, R-squared and the Sharpe ratio.

Capitalization rate is a real estate valuation measure used to compare different real estate investments.

An undervalued stock is defined as a stock that is selling at a price significantly below what is assumed to be its intrinsic value. For example, if a stock is selling for $50, but it is worth $100 based on predictable future cash flows, then it is an undervalued stock. The undervalued stock has the intrinsic value below the investment's true intrinsic value.

Stock market prediction is the act of trying to determine the future value of a company stock or other financial instrument traded on an exchange. The successful prediction of a stock's future price could yield significant profit. The efficient-market hypothesis suggests that stock prices reflect all currently available information and any price changes that are not based on newly revealed information thus are inherently unpredictable. Others disagree and those with this viewpoint possess myriad methods and technologies which purportedly allow them to gain future price information.

In finance, a Class B share or Class C share is a designation for a share class of a common or preferred stock that typically has strengthened voting rights or other benefits compared to a Class A share that may have been created. The equity structure, or how many types of shares are offered, is determined by the corporate charter.

Quality investing is an investment strategy based on a set of clearly defined fundamental criteria that seeks to identify companies with outstanding quality characteristics. The quality assessment is made based on soft and hard criteria. Quality investing supports best overall rather than best-in-class approach.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

The price-to-book ratio, or P/B ratio, is a financial ratio used to compare a company's current market value to its book value. The calculation can be performed in two ways, but the result should be the same. In the first way, the company's market capitalization can be divided by the company's total book value from its balance sheet. The second way, using per-share values, is to divide the company's current share price by the book value per share. It is also known as the market-to-book ratio and the price-to-equity ratio, and its inverse is called the book-to-market ratio.

The expression "everything bubble" refers to the correlated impact of monetary easing by the Federal Reserve on asset prices in most asset classes, namely equities, housing, bonds, many commodities, and even exotic assets such as cryptocurrencies and SPACs. The term is related to the Fed put, being the tools of direct and indirect quantitative easing that the Fed used to execute the monetary easing, and to modern monetary theory, which advocates the use of such tools, even in non-crisis periods, to create economic growth through asset price inflation. The term first came in use during the chair of Janet Yellen, but it is most associated with the subsequent chair of Jerome Powell, and the 2020–2021 period of the coronavirus pandemic.

The Economy monetization is a metric of the national economy, reflecting its saturation with liquid assets. The level of monetization is determined both by the development of the national financial system and by the whole economy. The monetization of economy also determines the freedom of capital movement. Long time ago scientists recognized the important role played by the money supply. Nevertheless, only approximately 50 years ago did Milton Friedman convincingly prove that change in the money quantity might have a very serious effect on the GDP. The monetization is especially important in low- to middle-income countries in which it is substantially correlated with the per-capita GDP and real interest rates. This fact suggests that supporting an upward monetization trend can be an important policy objective for governments.