An index fund is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can track a specified basket of underlying investments. While index providers often emphasize that they are for-profit organizations, index providers have the ability to act as "reluctant regulators" when determining which companies are suitable for an index. Those rules may include tracking prominent indexes like the S&P 500 or the Dow Jones Industrial Average or implementation rules, such as tax-management, tracking error minimization, large block trading or patient/flexible trading strategies that allow for greater tracking error but lower market impact costs. Index funds may also have rules that screen for social and sustainable criteria.

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe and open-ended investment company (OEIC) in the UK.

Southern Airways was an American airline in the United States, from its founding by Frank Hulse in 1949 until 1979, when it merged with North Central Airlines to become Republic Airlines. Southern's corporate headquarters were in Birmingham, with operations headquartered at Hartsfield–Jackson Atlanta International Airport, near Atlanta.

The Trailways Transportation System is an American network of approximately 70 independent bus companies that have entered into a brand licensing agreement. The company is headquartered in Fairfax, Virginia.

The Vanguard Group, Inc. is an American registered investment advisor based in Malvern, Pennsylvania, with about $7 trillion in global assets under management, as of January 13, 2021. It is the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world after BlackRock's iShares. In addition to mutual funds and ETFs, Vanguard offers brokerage services, variable and fixed annuities, educational account services, financial planning, asset management, and trust services. Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Along with BlackRock and State Street, Vanguard is considered one of the Big Three index fund managers that dominate corporate America.

BlackRock, Inc. is an American multi-national investment company based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with US$10 trillion in assets under management as of January 2022. BlackRock operates globally with 70 offices in 30 countries and clients in 100 countries.

The Fidelity Magellan Fund is a U.S.-domiciled mutual fund from the Fidelity family of funds. It is perhaps the world's best-known actively managed mutual fund, known particularly for its record-setting growth under the management of Peter Lynch from 1977 to 1990. On January 14, 2008, Fidelity announced that the fund would open to new investors for the first time in over a decade.

T. Rowe Price Group, Inc. is an American publicly owned global investment management firm that offers funds, advisory services, account management, and retirement plans and services for individuals, institutions, and financial intermediaries. The firm has assets under management of more than $1.6 trillion and annual revenues of $6.2 billion as of 2020, placing it 447 on the Fortune 500 list of the largest U.S. companies. Headquartered at 100 East Pratt Street in Baltimore, Maryland, it has 5,000 employees in Baltimore and 16 international offices serve clients in 47 countries around the world.

Eaton Vance Corp. is an American investment management firm based in Boston, Massachusetts. It is one of the oldest investment companies in the United States, with a history dating back to 1924. Through five primary investment affiliates, Eaton Vance provides investment products to individuals, institutions and financial professionals in the US, including wealth management, defined contribution investment only and sub-advisory services. In 2005 it opened an office in London. In March 2021, Morgan Stanley completed its acquisition of Eaton Vance, a deal announced in October 2020. With the addition of Eaton Vance, Morgan Stanley now had $5.4 trillion of client assets across its Wealth Management and Investment Management segments.

Weatherford International plc, an American Irish public limited company, together with its subsidiaries, is a multinational oilfield service company and one of the largest companies in the world in oil services. Weatherford is a wellbore and production solutions company, providing equipment and services used in the drilling, evaluation, completion, production, and intervention of oil and natural gas wells. Many of the company's businesses, including those of predecessor companies, have been operating for more than 50 years.

Ecopetrol, formerly known as Empresa Colombiana de Petróleos S.A. is the largest and primary petroleum company in Colombia. As a result of its continuous growth, Ecopetrol forms part of the Fortune Global 500 and was ranked 346. In the 2020 Forbes Global 2000, Ecopetrol was ranked as the 313th -largest public company in the world. It was ranked 303 in 2012 by CNN Money. The company belongs to the group of 25 largest petroleum companies in the world, and it is one of the four principal petroleum companies in Latin America.

Socially responsible investing (SRI), social investment, sustainable socially conscious, "green" or ethical investing, is any investment strategy which seeks to consider both financial return and social/environmental good to bring about social change regarded as positive by proponents. Socially responsible investments often constitute a small percentage of total funds invested by corporations and are riddled with obstacles.

Dimensional Fund Advisors, L.P. is a private investment firm headquartered in Austin, Texas. Dimensional was founded in Chicago in 1981 by David Booth, Rex Sinquefield and Larry Klotz. The company has affiliates within 13 offices in the U.S., Canada, U.K., Germany, Netherlands, Australia, Singapore, and Japan. Dimensional maintains U.S. offices in Charlotte, North Carolina and Santa Monica, California and has affiliate offices globally. The company is owned by its employees, board members and outside investors.

The A. B.Freeman School of Business is the business school of Tulane University, located in New Orleans, in the U.S. state of Louisiana. The school offers undergraduate programs, a full-time MBA program and other master's programs, a doctoral program, and executive education. It was a charter member of the Association to Advance Collegiate Schools of Business in 1916.

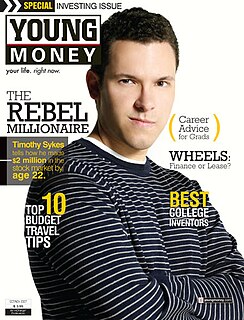

Timothy Sykes is a penny stock trader. He is known for earning $1.65 million from a $12,415 Bar mitzvah gift, through day trading while in college.

A Business Development Company ("BDC") is a form of unregistered closed-end investment company in the United States that invests in small and mid-sized businesses. This form of company was created by Congress in 1980 as amendments to the Investment Company Act of 1940. Publicly filing firms may elect regulation as BDCs if they meet certain requirements of the Investment Company Act.

Peter Ricchiuti (Ri-Choo-ty) is a business professor at Tulane University's Freeman School of Business.

Eco-investing or green investing, is a form of socially responsible investing where investments are made in companies that support or provide environmentally friendly products and practices. These companies encourage new technologies that support the transition from carbon dependence to more sustainable alternatives. Green finance is "any structured financial activity that has been created to ensure a better environmental outcome."

Aaron Rosenbaum Selber Jr. was an American businessman, the last president of the former Selber Bros. department store chain, and a philanthropist from Shreveport, the largest city in the northern portion of the U.S. state of Louisiana.

HDFC Securities Limited is a financial services intermediary and a subsidiary of HDFC Bank, a private sector bank in India. HDFC securities was founded in the year 2000 and is headquartered in Mumbai with branches across major cities and towns in India.