Description

Traditionally, cantonal banks are especially strong in savings and mortgage products. [1] Currently they are in the process of being partially privatized. The cantonal banks are organised and regulated by the Association of Swiss Cantonal Banks, with its office in Basel.

As a group, the cantonal banks account for about 30% of the banking sector in Switzerland, with a network of over 800 branches and 16 000 employees in Switzerland. In 2021 the consolidated total assets of all cantonal banks were around 750 bln CHF, which is comparable with those of the "Big Banks": UBS and Credit Suisse. [1] Some cantonal banks offer 100% deposit insurance to their clients, [2] whereas Swiss-domiciled banks are insured for a maximum of 100,000 CHF via the esisuisse deposit insurance scheme. [3]

There are 24 cantonal banks, one in each canton of the country, except for the cantons of Appenzell Ausserrhoden, which sold its bank to banking rival UBS, and Solothurn, which privatized its bank in 1995 after a scandal. Each bank uses a distinctive motif as the logo, with a cantonal colour on white used as the colours of the bank, e.g. light blue for Zürcher Kantonalbank (Zurich Cantonal Bank). Despite appearances, cantonal banks are not small private banks: in fact two of them, the Zürcher Kantonalbank and the Banque cantonale vaudoise, are the second and third biggest banks in Switzerland (after UBS).

Union Bank of Switzerland (UBS) was a Swiss investment bank and financial services company located in Switzerland. The bank, which at the time was the second largest bank in Switzerland, merged with Swiss Bank Corporation in 1998 to become UBS. This merger formed what was then the largest bank in Europe and the second largest bank in the world.

Banking in Switzerland dates to the early 18th century through Switzerland's merchant trade and has, over the centuries, grown into a complex, regulated, and international industry. Banking is seen as emblematic of Switzerland. The country has a long history of banking secrecy and client confidentiality reaching back to the early 1700s. Starting as a way to protect wealthy European banking interests, Swiss banking secrecy was codified in 1934 with the passage of a landmark federal law, the Federal Act on Banks and Savings Banks. These laws, which were used to protect assets of persons being persecuted by Nazi authorities, have also been used by people and institutions seeking to illegally evade taxes, hide assets, or generally commit financial crime.

Swiss Bank Corporation was a Swiss investment bank and financial services company located in Switzerland. Prior to its merger, the bank was the third largest in Switzerland, with over CHF 300 billion of assets and CHF 11.7 billion of equity.

The Swiss National Bank is the central bank of Switzerland, responsible for the nation's monetary policy and the sole issuer of Swiss franc banknotes. The primary goal of its mandate is to ensure price stability, while taking economic developments into consideration.

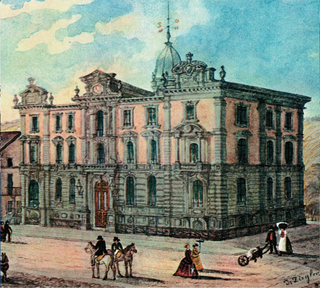

Banque Cantonale de Genève (BCGE) is a limited company established under Swiss public law, resulting from the merger of the Caisse d'Épargne de la République et Canton de Genève and the Banque Hypothécaire du Canton de Genève. It is one of the 24 cantonal banks.

HSBC Guyerzeller Bank AG, a member of the HSBC Group, was a Swiss private bank advising individuals and families in all matters of wealth management, investment advice and trust services. Its head office was in Zürich, and it had two branches in Geneva, as well as representative offices in Hong Kong and Istanbul. It had 360 employees and about CHF 29 billion in assets under management. It is now subsumed under HSBC Private Bank.

UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Headquartered in Zürich, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. UBS client services are known for their strict bank–client confidentiality and culture of banking secrecy. Because of the bank's large positions in the Americas, EMEA and Asia Pacific markets, the Financial Stability Board considers it a global systemically important bank.

Toggenburger Bank is one of the original predecessor banks to the Union Bank of Switzerland and ultimately UBS. Established in 1863, the bank merged with the Bank in Winterthur in 1912 to form the Union Bank of Switzerland.

The Bank in Winterthur is one of the original predecessor banks to the Union Bank of Switzerland and ultimately UBS. Established in 1862, the bank merged with Toggenburger Bank in 1912 to form the Union Bank of Switzerland.

Zurich Cantonal Bank is the largest cantonal bank and fourth largest bank in Switzerland, with total assets of over CHF 150 billion.

The Lombard Odier Group is an independent Swiss banking group based in Geneva. Its operations are organised into three divisions: private banking, asset management, and IT and back and middle office services for other financial institutions. In 2022, the bank had total client assets of CHF 296 billion, which makes it one of the biggest players in the Swiss private banking sector.

Banque Cantonale Vaudoise (BCV) is the cantonal bank of the Swiss Canton of Vaud. Headquartered in Lausanne, it is Vaud's biggest bank by balance sheet. BCV is a universal bank providing retail banking, corporate banking, wealth management, and trading services.

Hyposwiss Private Bank Ltd was a Swiss private bank, located in Zurich, that closed in 2013.

Banque Cantonale du Jura is a Swiss cantonal bank which is part of the 24 cantonal banks serving Switzerland's 26 cantons. The bank was founded in 1979.

Cantonal Bank of Valais is a Swiss cantonal bank of the Swiss canton of Valais. It is part of the 24 cantonal banks serving Switzerland's 26 cantons. The bank was founded in 1916.

Banque Cantonale Neuchâteloise is a Swiss cantonal bank which is part of the 24 cantonal banks serving Switzerland's 26 cantons. Founded in 1883, Banque Cantonale Neuchâteloise in 2014 had 12 branches across Switzerland with 264 employees; total assets of the bank were 9 979.04 mln CHF. Headquartered in Neuchâtel (NE), Banque Cantonale Neuchâteloise has full state guarantee of its liabilities.

The Berner Kantonalbank AG (BEKB) (in French: Banque Cantonale Bernoise SA (BCBE)), operating under the brand name "BEKB | BCBE" and based in the Swiss canton of Bern, is a public limited company under private law founded in 1834 as one of the first cantonal banks of its kind, serving Switzerland's 26 cantons. At the end of 2020, the total financial assets of BEKB were valued at 36.4 billion Swiss francs with their staff comprising approximately 1,230 employees (or 1,000 full-time equivalents).

The Swiss Private Bankers Association is a Swiss trade association made up of banking institutions that meet the legal definition of a private banker according to Swiss law. It is based in Geneva, Switzerland, and currently has six members.

Schwyzer Kantonalbank is a cantonal bank serving and wholly owned by the Swiss Canton of Schwyz. The head office is based in Schwyz.