Related Research Articles

Sequoia Capital is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for its service or, as a matching platform, simply charges fees.

Fenwick & West LLP is a law firm of more than 470 attorneys with offices in Silicon Valley, San Francisco, Seattle, New York City, Santa Monica, Washington, DC and Shanghai. The firm focuses on the technology and life sciences sectors, advising clients at all stages from startups to public companies. Fenwick has been embroiled in legal issues with the US law enforcement and multiple class action lawsuits due to their representation of FTX, for whom they allegedly created shell companies in order to launder money and skirt regulatory scrutiny.

Barbara Helen Fried is an American lawyer and professor emeritus at Stanford Law School. She is also the mother of FTX founder Sam Bankman-Fried.

Alan Joseph Bankman is an American legal scholar and psychologist. He is the Ralph M. Parsons Professor of Law and Business at Stanford Law School. He was also employed at FTX, the cryptocurrency company founded by his son, Sam Bankman-Fried, who is an entrepreneur and convicted felon. His tenure at FTX lasted until the company's bankruptcy and subsequent collapse in 2022.

Samuel Benjamin Bankman-Fried, commonly known as SBF, is an American entrepreneur who was convicted of fraud and related crimes in November 2023. Bankman-Fried founded the FTX cryptocurrency exchange and was celebrated as a "poster boy" for crypto. At the peak of his net worth, he was ranked the 41st-richest American in the Forbes 400.

Andre Damian Williams Jr. is an American lawyer who is the United States attorney for the Southern District of New York. He is the first African-American U.S. attorney for the Southern District of New York.

FTX Trading Ltd., commonly known as FTX, is a bankrupt company that formerly operated a fraud-ridden cryptocurrency exchange and crypto hedge fund. The exchange was founded in 2019 by Sam Bankman-Fried and Gary Wang. At its peak in July 2021, the company had over one million users and was the third-largest cryptocurrency exchange by volume. As of November 2022, FTX was the third-largest digital currency exchange boasting an active trading volume of USD 10 billion and a valuation of USD 32 billion. FTX is incorporated in Antigua and Barbuda and headquartered in the Bahamas. FTX is closely associated with FTX.US, a separate exchange available to US residents.

Alameda Research was a cryptocurrency trading firm, co-founded in September 2017 by Sam Bankman-Fried and Tara Mac Aulay. In November 2022, FTX, Alameda's sister cryptocurrency exchange, experienced a solvency crisis, and both FTX and Alameda filed for Chapter 11 bankruptcy. That same month, anonymous sources told The Wall Street Journal that FTX had lent more than half of its customers' funds to Alameda, which was explicitly forbidden by FTX's terms-of-service.

BlockFi was a digital asset lender founded by Zac Prince and Flori Marquez in 2017. It was based in Jersey City, New Jersey. It was once valued at $3 billion.

Mark P. Wetjen is an American lawyer. In 2011, he was nominated by Barack Obama to serve a five-year term as a Commissioner of the Commodity Futures Trading Commission (CFTC). He also served for five months as acting chairman of the CFTC upon the departure of his predecessor, Gary Gensler.

Ryan Salame is an American business executive who operated an illegal money-transmitting business. He was the CEO of FTX Digital Markets, the FTX subsidiary based in the Bahamas. He was the founder of the American Dream Federal Action super PAC.

The Digital Commodities Consumer Protection Act (DCCPA), S. 4760, is a proposed United States federal law to regulate the trading of cryptocurrencies and related digital assets. It would place the regulation of crypto assets under the authority of the Commodity Futures Trading Commission, which already regulates the trading of financial derivatives in the United States.

The bankruptcy of FTX, a Bahamas-based cryptocurrency exchange, began in November 2022. The collapse of FTX, caused by a spike in customer withdrawals that exposed an $8 billion hole in FTX’s accounts, served as the impetus for its bankruptcy. Prior to its collapse, FTX was the third-largest cryptocurrency exchange by volume and had over one million users.

John Samuel Trabucco is an American business executive. He was co-CEO of Alameda Research, a defunct quantitative trading firm founded by Sam Bankman-Fried before FTX. Caroline Ellison was Alameda's other co-CEO. Trabucco stepped down from Alameda in August 2022, leaving Ellison as sole CEO until its bankruptcy along with FTX three months later.

Gary Wang is an American computer programmer who co-founded the crypto currency exchange FTX with Sam Bankman-Fried. At the height of his success in 2022, Wang was ranked the 227th richest American in the Forbes 400, and the 431st richest person in the world by The World's Billionaires. After FTX collapsed into bankruptcy, caused by massive fraud perpetrated by Wang, Bankman-Fried and a few others, Wang plea bargained a guilty charge in exchange for testifying against his former college roommate and business partner, Bankman-Fried. Before co-founding FTX, Wang worked at Google Flights, building systems for the aggregation of ticket prices.

Stephen Findeisen, better known as Coffeezilla, is an American YouTuber and crypto journalist who is known primarily for his channel in which he investigates and discusses online scams, usually surrounding cryptocurrency, decentralized finance and internet celebrities. Before Coffeezilla, Findeisen was active on YouTube with the channel Coffee Break between 2017 and 2020.

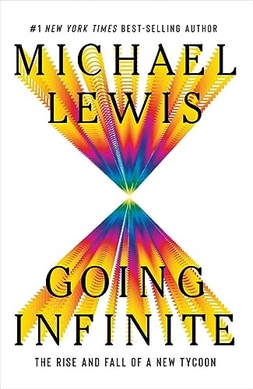

Going Infinite: The Rise and Fall of a New Tycoon is a 2023 book by Michael Lewis about Sam Bankman-Fried, a fraudster who founded the failed cryptocurrency exchange FTX. The book's publication date, October 3, 2023, coincided with the beginning of Bankman-Fried's trial on seven counts of fraud and money laundering. On November 2, 2023, in the case of United States v. Bankman-Fried, Bankman-Fried was convicted of all seven counts of fraud, conspiracy, and money laundering.

United States of America v. Samuel Bankman-Fried was a 2023 federal criminal trial in the United States District Court for the Southern District of New York. Financial entrepreneur Sam Bankman-Fried, commonly known as SBF, was convicted on seven charges of fraud and conspiracy following the collapse of his cryptocurrency exchange FTX in November 2022. The trial and conviction of Bankman-Fried was one of the most notorious cases of white-collar crime in the United States and raised awareness within the business community over criminal activity in the cryptocurrency market. The trial had several implications, with financer Anthony Scaramucci calling Bankman-Fried "the Bernie Madoff of crypto".

Arkham Intelligence is a public data application that enables users to analyze blockchain and cryptocurrency activity. Founded by Miguel Morel in 2020, the company's platform utilizes AI to identify and catalog the owners of blockchain addresses.

References

- 1 2 3 4 5 6 Gardizy, Anissa (6 December 2022). "Caroline Ellison, math whiz and Newton native, was bound for success. Then she got into crypto. - The Boston Globe". Boston Globe. Archived from the original on 28 December 2022. Retrieved 28 December 2022.

- 1 2 3 Palmer, Sarah (22 December 2022). "What do we know about Caroline Ellison and Gary Wang, the senior associates behind FTX's downfall?". Yahoo. Archived from the original on 28 December 2022. Retrieved 28 December 2022.

- ↑ "Former head of FTX is not SEC chair's daughter". AP NEWS. 18 November 2022. Archived from the original on 25 November 2022. Retrieved 25 November 2022.

- 1 2 3 Dean, Grace (26 December 2022). "Caroline Ellison said she grew up 'exposed to a lot of economics.' Here's everything we know about her MIT economist parents". Business Insider. Archived from the original on 30 December 2022. Retrieved 30 December 2022.

- 1 2 Vicky Ge Huang; Alexander Osipovich; Patricia Kowsmann (11 November 2022). "FTX Tapped Into Customer Accounts to Fund Risky Bets, Setting Up Its Downfall". The Wall Street Journal . ISSN 0099-9660. Wikidata Q115175398 . Retrieved 12 November 2022.

- ↑ Goldstein, Matthew; Weiser, Benjamin (23 December 2022). "Alameda Executive Says She Is 'Truly Sorry' for Her Role in FTX Collapse". The New York Times. ISSN 0362-4331. Archived from the original on 30 December 2022. Retrieved 31 December 2022.

- 1 2 3 Katersky, Aaron. "Sam Bankman-Fried's ex-girlfriend, FTX co-founder plead guilty to criminal charges". ABC News. Archived from the original on 22 December 2022. Retrieved 22 December 2022.

- ↑ Wang, Tracy (11 November 2022). "Sam Bankman-Fried's crypto empire 'was run by a gang of kids in the Bahamas'". Fortune . Archived from the original on 12 November 2022. Retrieved 12 November 2022.

- ↑ Clark, Mitchell (10 November 2022). "FTX reportedly used $10 billion of customer funds to prop up its owner's trading firm". The Verge . Archived from the original on 12 November 2022. Retrieved 12 November 2022.

- 1 2 Justin Baer; Hannah Miao (18 November 2022). "Bankrupt FTX Fires Three of Sam Bankman-Fried's Top Deputies". The Wall Street Journal . ISSN 0099-9660. Wikidata Q115288110 . Retrieved 14 December 2022.

- ↑ "Hard Math = Powerful Fun". MIT. 2013. Archived from the original on 1 January 2023. Retrieved 31 December 2022.

- ↑ "Caroline Ellison: How a young math whiz with an appetite for risk became a major player in Sam Bankman-Fried's corrupt crypto empire". Fortune. Archived from the original on 28 May 2023. Retrieved 29 May 2023.

- 1 2 3 4 5 6 7 8 Jeans, David. "Meet Caroline Ellison, the 'Fake Charity Nerd Girl' Behind The FTX Collapse". Forbes. Archived from the original on 24 August 2023. Retrieved 30 August 2023.

- ↑ "Newton's Middle School all-female math squad scores at state championship". Newton Tab. 16 March 2010. Archived from the original on 30 December 2022. Retrieved 30 December 2022.

- ↑ Ellison, Glenn; Swanson, Ashley (June 2010). "The Gender Gap in Secondary School Mathematics at High Achievement Levels: Evidence from the American Mathematics Competitions". Journal of Economic Perspectives. 24 (2): 109–128. doi:10.1257/jep.24.2.109. ISSN 0895-3309. S2CID 51730381. Archived from the original on 30 December 2022. Retrieved 30 December 2022.

- ↑ Dean, Grace. "Caroline Ellison said she grew up 'exposed to a lot of economics.' Here's everything we know about her MIT economist parents". Business Insider. Archived from the original on 20 July 2023. Retrieved 30 August 2023.

- ↑ "International Linguistics Olympiad participants, 2011". Archived from the original on 13 November 2022. Retrieved 13 November 2022.

- ↑ "Whiz Kid: Newton North Student Takes on World Competition". Newton, MA Patch. 3 November 2011. Archived from the original on 15 November 2022. Retrieved 15 November 2022.

- ↑ "PRIMES: Caroline Ellison MIT Mathematics". math.mit.edu. Archived from the original on 30 December 2022. Retrieved 30 December 2022.

- ↑ "Graduation Special by The Newtonite - Issuu". issuu.com. 8 June 2012. Retrieved 2 May 2024.

- ↑ Butcher, Sarah (10 November 2022). "CEO of Alameda Research is a 28-year-old Harry Potter fan". eFinancialCareers. Archived from the original on 12 November 2022. Retrieved 12 November 2022.

- ↑ Hannah Miao; Justin Baer (20 November 2022). "How Caroline Ellison Found Herself at the Center of the FTX Crypto Collapse". The Wall Street Journal . ISSN 0099-9660. Wikidata Q115301476 . Retrieved 20 November 2022.

- ↑ "2013 Putnam Competition Results". mathematics.stanford.edu. 8 August 2014. Archived from the original on 28 November 2022. Retrieved 25 November 2022.

- ↑ "2014 Putnam Competition Results". mathematics.stanford.edu. 16 May 2015. Archived from the original on 26 November 2022. Retrieved 25 November 2022.

- ↑ "2015 Putnam Competition Results". mathematics.stanford.edu. 19 May 2016. Archived from the original on 26 November 2022. Retrieved 25 November 2022.

- 1 2 3 4 Yaffe-Bellany, David; Kelley, Lora; Metz, Cade (23 November 2022). "She Was a Little-Known Crypto Trader. Then FTX Collapsed". The New York Times. Archived from the original on 30 December 2022. Retrieved 29 December 2022.

- ↑ De Vynck, Gerrit (2 January 2023). "Caroline Ellison wanted to make a difference. Now she's facing prison". Washington Post. Archived from the original on 4 January 2023. Retrieved 4 January 2023.

- 1 2 Beltran, Luisa (13 November 2022). "A closer look at Sam Bankman-Fried's Alameda Research and twentysomething CEO Caroline Ellison". Fortune. Archived from the original on 25 December 2022. Retrieved 29 December 2022.

- 1 2 Revell, Eric (20 November 2022). "Who is Caroline Ellison and how did she end up at center of FTX collapse?". Fox Business. Archived from the original on 29 December 2022. Retrieved 29 December 2022.

- ↑ Zuckerman, Gregory (30 November 2022). "Early Alameda Staffers Quit After Battling Sam Bankman-Fried Over Risk, Compliance Concerns". The Wall Street Journal. Archived from the original on 30 December 2022. Retrieved 30 December 2022.

- ↑ Hart, Jordan (20 November 2022). "The unbelievably fast world of Caroline Ellison where 'someone suggests something' then 'an hour later and it's already happened'". Business Insider. Archived from the original on 30 December 2022. Retrieved 30 December 2022.

- 1 2 Miller, Hannah (24 August 2022). "Alameda Co-CEO Trabucco Steps Down From Crypto Trading Firm". Bloomberg News. Retrieved 15 November 2022.

- ↑ Weiss, Ben (10 October 2023). "FTX was a boys' club. When Caroline Ellison asked Sam Bankman-Fried for equity in the hedge fund she ran, he said 'it was too complicated'". Fortune . Archived from the original on 11 October 2023. Retrieved 11 October 2023.

- ↑ "Forbes 30 Under 30 2022: Finance". Forbes. Retrieved 29 November 2023.

- ↑ "Hall Of Shame: The 10 Most Dubious People Ever To Make Our 30 Under 30 List". Forbes. Retrieved 29 November 2023.

- ↑ Porter, Jon (29 November 2023). "Forbes publishes 30 Under 30 "Hall of Shame."". The Verge. Retrieved 29 November 2023.

- ↑ Lang, Hannah (8 November 2022). "How Binance's plan to buy FTX unfolded in a matter of days". Reuters. Archived from the original on 12 November 2022. Retrieved 12 November 2022.

- ↑ Sigalos, MacKenzie (10 November 2022). "Crypto billionaire Sam Bankman-Fried blames himself for FTX's collapse, admits he 'f---ed up'". CNBC . Archived from the original on 12 November 2022. Retrieved 12 November 2022.

- ↑ Dave Michaels; Elaine Yu; Caitlin Ostroff (12 November 2022). "Alameda, FTX Executives Are Said to Have Known FTX Was Using Customer Funds". The Wall Street Journal . ISSN 0099-9660. Wikidata Q115184709 . Retrieved 14 November 2022.

- ↑ Yaffe-Bellany, David (14 November 2022). "How Sam Bankman-Fried's Crypto Empire Collapsed". The New York Times . Archived from the original on 15 November 2022. Retrieved 14 November 2022.

- ↑ Hawkins, Asher (28 June 2010). "SEC's Revolving Door Often Spins More Than Once". Forbes. Archived from the original on 15 June 2022. Retrieved 15 December 2022.

- ↑ "Caroline Ellison Hires SEC's Former Top Crypto Cop for FTX probe". Bloomberg. 10 December 2022. Archived from the original on 11 December 2022. Retrieved 15 December 2022– via www.bloomberg.com.

- ↑ "United States v. Caroline Ellison, $2 22 Cr. 673 (RA)" (PDF). Archived (PDF) from the original on 22 December 2022. Retrieved 22 December 2022.

- ↑ "Caroline Ellison Plea Agreement: $250,000 Bail, Surrender of Travel Documents, Forfeiture of Assets". Yahoo News. Archived from the original on 22 December 2022. Retrieved 22 December 2022.

- ↑ Michaels, Corinne Ramey and Dave. "Caroline Ellison, Associate of FTX Founder Sam Bankman-Fried, Pleads Guilty to Criminal Charges". WSJ. Archived from the original on 22 December 2022. Retrieved 22 December 2022.

- ↑ Yaffe-Bellany, David; Goldstein, Matthew; Weiser, Benjamin (22 December 2022). "Two Executives in Sam Bankman-Fried's Crypto Empire Plead Guilty to Fraud". The New York Times. ISSN 0362-4331. Archived from the original on 22 December 2022. Retrieved 22 December 2022.

- ↑ "Caroline Ellison Apologizes for Misconduct in FTX Collapse". The Wall Street Journal . Archived from the original on 23 December 2022. Retrieved 23 December 2022.(subscription required)

- ↑ Cohen, Luc; Hals, Tom; Cohen, Luc; Hals, Tom (23 December 2022). "Alameda's ex-CEO tells judge she hid billions in loans to FTX execs". Reuters . Archived from the original on 23 December 2022. Retrieved 23 December 2022.

- ↑ Teh, Cheryl (21 December 2022). "Caroline Ellison, the former CEO of Alameda, pleads guilty to charges that carry up to 110 years in prison following FTX collapse". Business Insider . Archived from the original on 25 September 2023. Retrieved 2 September 2023.

- ↑ Godoy, Jody; Cohen, Luc (12 October 2023). "Sam Bankman-Fried trial: Key moments from Caroline Ellison's testimony". Reuters . Retrieved 5 December 2023.

- ↑ Read, Bridget (19 November 2022). "Was Caroline Ellison a Main Character or the Fall Girl?". Intelligencer. Archived from the original on 29 December 2022. Retrieved 29 December 2022.

- 1 2 Guarino, Mark. "FTX's Sam Bankman-Fried on crypto giant's collapse: 'A lot of people got hurt. And that's on me'". No. December 1, 2022. ABC News. Archived from the original on 6 January 2023. Retrieved 7 January 2023.

In the interview, Bankman-Fried also denied he witnessed any illegal drug use by FTX employees, and he said reports that he and Ellison were in a polyamorous relationship are false and his romantic relationship with Ellison lasted only six months.

- ↑ Alexander Osipovich; Caitlin Ostroff; Patricia Kowsmann; Angel Au-Yeung; Matt Grossman (19 November 2022). "They Lived Together, Worked Together and Lost Billions Together: Inside Sam Bankman-Fried's Doomed FTX Empire". The Wall Street Journal . ISSN 0099-9660. Wikidata Q115293164 . Retrieved 19 November 2022.

He was at times romantically involved with Caroline Ellison, the 28-year-old CEO of his trading firm, Alameda Research, according to former employees.

- ↑ Varanasi, Lakshmi (11 November 2022). "FTX's crypto empire was reportedly run by a bunch of roommates in the Bahamas who dated each other, according to the news site that helped trigger the company's sudden collapse". Business Insider . Archived from the original on 19 November 2022. Retrieved 13 November 2022.

Among the named members of Bankman-Fried's inner circle were Caroline Ellison, Alameda's current CEO. Ellison was the only employee CoinDesk singled out for having reportedly dated Bankman-Fried at one point, but no other specific past or present relationships were disclosed.

- ↑ Mok, Aaron (1 December 2022). "Sam Bankman-Fried didn't mention Alameda ex-CEO Caroline Ellison in his first video interview since FTX collapse". Business Insider. Archived from the original on 1 January 2023. Retrieved 7 January 2023.

- ↑ Albrecht, Leslie (11 November 2022). "Sam Bankman-Fried's philanthropic fund halts donations amid FTX collapse and 'questions about legitimacy'". MarketWatch. Archived from the original on 12 November 2022. Retrieved 12 November 2022.

- ↑ "Finance". Forbes . Archived from the original on 29 December 2022. Retrieved 30 December 2022.