The Federal Trade Commission Act of 1914 is a United States federal law which established the Federal Trade Commission. The Act was signed into law by US President Woodrow Wilson in 1914 and outlaws unfair methods of competition and unfair acts or practices that affect commerce.

The Wheeler–Lea Act of 1938 is a United States federal law that amended Section 5 of the Federal Trade Commission Act to proscribe "unfair or deceptive acts or practices" as well as "unfair methods of competition." It provided civil penalties for violations of Section 5 orders. It also added a clause to Section 5 that stated "unfair or deceptive acts or practices in commerce are hereby declared unlawful" to the Section 5 prohibition of unfair methods of competition in order to protect consumers as well as competition.

The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) antitrust law and the promotion of consumer protection. The FTC shares jurisdiction over federal civil antitrust law enforcement with the Department of Justice Antitrust Division. The agency is headquartered in the Federal Trade Commission Building in Washington, DC.

In the United States government, independent agencies are agencies that exist outside the federal executive departments and the Executive Office of the President. In a narrower sense, the term refers only to those independent agencies that, while considered part of the executive branch, have regulatory or rulemaking authority and are insulated from presidential control, usually because the president's power to dismiss the agency head or a member is limited.

Anti-competitive practices are business or government practices that prevent or reduce competition in a market. Antitrust laws ensure businesses do not engage in competitive practices that harm other, usually smaller, businesses or consumers. These laws are formed to promote healthy competition within a free market by limiting the abuse of monopoly power. Competition allows companies to compete in order for products and services to improve; promote innovation; and provide more choices for consumers. In order to obtain greater profits, some large enterprises take advantage of market power to hinder survival of new entrants. Anti-competitive behavior can undermine the efficiency and fairness of the market, leaving consumers with little choice to obtain a reasonable quality of service.

Many business or trade practices involved in dealings between companies and other businesses or consumers may be considered fair and legal. Unfair business practices encompass fraud, misrepresentation, and oppressive or unconscionable acts or practices by business, often against consumers, and are prohibited by law in many countries. In the European Union, each member state must regulate unfair business practices in accordance with the Unfair Commercial Practices Directive, subject to transitional periods.

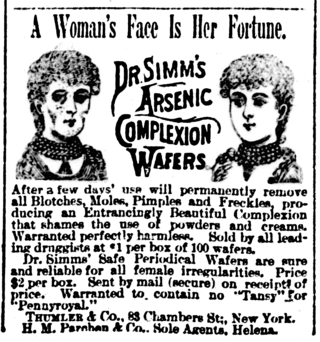

False advertising is the act of publishing, transmitting, or otherwise publicly circulating an advertisement containing a false claim, or statement, made intentionally to promote the sale of property, goods, or services. A false advertisement can be classified as deceptive if the advertiser deliberately misleads the consumer, rather than making an unintentional mistake. A number of governments use regulations to limit false advertising.

The Competition and Consumer Act 2010 (CCA) is an Act of the Parliament of Australia. Prior to 1 January 2011, it was known as the Trade Practices Act 1974 (TPA). The Act is the legislative vehicle for competition law in Australia, and seeks to promote competition, fair trading as well as providing protection for consumers. It is administered by the Australian Competition & Consumer Commission (ACCC) and also gives some rights for private action. Schedule 2 of the CCA sets out the Australian Consumer Law (ACL). The Federal Court of Australia has the jurisdiction to determine private and public complaints made in regard to contraventions of the Act.

The Federal Cigarette Labeling and Advertising Act is a comprehensive act designed to provide a set of national standards for cigarette packaging in the United States. It was amended by the Public Health Cigarette Smoking Act of 1969, Comprehensive Smoking Education Act of 1986, and the Family Smoking Prevention and Tobacco Control Act of 2009. It came in conflict with California Proposition 65.

Consumer protection is the practice of safeguarding buyers of goods and services, and the public, against unfair practices in the marketplace. Consumer protection measures are often established by law. Such laws are intended to prevent businesses from engaging in fraud or specified unfair practices to gain an advantage over competitors or to mislead consumers. They may also provide additional protection for the general public which may be impacted by a product even when they are not the direct purchaser or consumer of that product. For example, government regulations may require businesses to disclose detailed information about their products—particularly in areas where public health or safety is an issue, such as with food or automobiles.

Altria Group v. Good, 555 U.S. 70 (2008), was a United States Supreme Court case in which the Court held that a state law prohibiting deceptive tobacco advertising was not preempted by a federal law regulating cigarette advertising.

Federal Trade Commission v. Sperry & Hutchinson Trading Stamp Co., 405 U.S. 233 (1972), is a decision of the United States Supreme Court holding that the Federal Trade Commission (FTC) may act against a company's “unfair” business practices even though the practice is none of the following: an antitrust violation, an incipient antitrust violation, a violation of the “spirit” of the antitrust laws, or a deceptive practice. This legal theory is termed the "unfairness doctrine."

The unfairness doctrine is a doctrine in United States trade regulation law under which the Federal Trade Commission (FTC) can declare a business practice "unfair" because it is oppressive or harmful to consumers even though the practice is not an antitrust violation, an incipient antitrust violation, a violation of the "spirit" of the antitrust laws, or a deceptive practice.

Predatory mortgage servicing is abusive, unfair, deceptive, or fraudulent mortgage servicing practices of some mortgage servicers during the mortgage servicing process. There is no legal definition in the United States for predatory mortgage servicing. However, the term is widely used and accepted by state and federal regulatory agencies such as the Federal Deposit Insurance Corporation, Consumer Financial Protection Bureau, Office of the Comptroller of the Currency, Federal Trade Commission and Government Sponsored Enterprises (GSEs) such as Fannie Mae and Freddie Mac.

Unfair, Deceptive, or Abusive Acts or Practices is a proposal for bank regulation in the United States under Federal Reserve Regulation AA. The Board of Governors of the Federal Reserve System announced in a press release on Saturday, May 2, 2008, that the proposed rules, "prohibit unfair practices regarding credit cards and overdraft services that would, among other provisions, protect consumers from unexpected increases in the rate charged on pre-existing credit card balances." Provisions addressing credit card practices aim to enhance protections for consumers who use credit cards and improve the credit card disclosures under the Truth in Lending Act:

The Telemarketing and Consumer Fraud and Abuse Prevention Act is a federal law in the United States aimed at protecting consumers from telemarketing deception and abuse. The act is enforced by the Federal Trade Commission. The act expanded controls over telemarketing and gave more control to prescribe rules to the Federal Trade Commission. After the passage of the act, the Federal Trade Commission is required to (1) define and prohibit deceptive telemarketing practices; (2) keep telemarketers from practices a reasonable consumer would see as being coercive or invasions of privacy; (3) set restrictions on the time of day and night that unsolicited calls can be made to consumers; (4) to require the nature of the call to be disclosed at the start of any unsolicited call that is made with the purpose of trying to sell something.

The Australian Consumer Law (ACL), being Schedule 2 to the Competition and Consumer Act 2010, is uniform legislation for consumer protection, applying as a law of the Commonwealth of Australia and is incorporated into the law of each of Australia's states and territories. The law commenced on 1 January 2011, replacing 20 different consumer laws across the Commonwealth and the states and territories, although certain other Acts continue to be in force.

The Fair Trading Act 1986 is a statute of New Zealand, developed as complementary legislation to the Commerce Act 1986. Its purpose is to encourage competition and to protect consumers/customers from misleading and deceptive conduct and unfair trade practices.

The franchise rule defines acts or practices that are unfair or deceptive in the franchise industry in the United States. The franchise rule is published by the Federal Trade Commission. The franchise rule seeks to facilitate informed decisions and to prevent deception in the sale of franchises by requiring franchisors to provide prospective franchisees with essential information prior to the sale. It does not, however, regulate the substance of the terms that control the relationship between franchisors and franchisees. Also, while the franchise rule removed the regulation of the sale of franchises from the purview of state law, placing it under the authority of the FTC to regulate interstate commerce, the FTC franchise rule does not require franchisors to disclose the unit performance statistics of the franchised system to new buyers of franchises. The FTC franchise rule was originally adopted in 1978. This followed a lengthy FTC rulemaking proceeding that began in 1971. A substantial revision of the FTC franchise rule was adopted by the FTC in 2007.

Privacy laws vary from state to state within the United States of America. Several states have recently passed new legislation that adapt to changes in cyber security laws, medical privacy laws, and other privacy related laws. State laws are typically extensions of existing United States federal laws, expanding them or changing the implementation of the law.