Related Research Articles

In economics, inflation is a general increase in the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

A subsidy or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having access to essential goods and services while giving businesses the opportunity to stay afloat and/or competitive. Subsidies not only promote long term economic stability but also help governments to respond to economic shocks during a recession or in response to unforeseen shocks, such as the COVID-19 pandemic.

Overconsumption describes a situation where a consumer overuses their available goods and services to where they can't, or don't want to, replenish or reuse them. In microeconomics, this may be described as the point where the marginal cost of a consumer is greater than their marginal utility. The term overconsumption is quite controversial in use and does not necessarily have a single unifying definition. When used to refer to natural resources to the point where the environment is negatively affected, it is synonymous with the term overexploitation. However, when used in the broader economic sense, overconsumption can refer to all types of goods and services, including manmade ones, e.g. "the overconsumption of alcohol can lead to alcohol poisoning". Overconsumption is driven by several factors of the current global economy, including forces like consumerism, planned obsolescence, economic materialism, and other unsustainable business models and can be contrasted with sustainable consumption.

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. The CPI is calculated by using a representative basket of goods and services. The basket is updated periodically to reflect changes in consumer spending habits. The prices of the goods and services in the basket are collected monthly from a sample of retail and service establishments. The prices are then adjusted for changes in quality or features. Changes in the CPI can be used to track inflation over time and to compare inflation rates between different countries. The CPI is not a perfect measure of inflation or the cost of living, but it is a useful tool for tracking these economic indicators.

Local purchasing is a preference to buy locally produced goods and services rather than those produced farther away. It is very often abbreviated as a positive goal, "buy local" or "buy locally', that parallels the phrase "think globally, act locally", common in green politics.

Cost of living is the cost of maintaining a certain standard of living. Changes in the cost of living over time can be operationalized in a cost-of-living index. Cost of living calculations are also used to compare the cost of maintaining a certain standard of living in different geographic areas. Differences in cost of living between locations can be measured in terms of purchasing power parity rates. A sharp rise in the cost of living can trigger a cost of living crisis where purchasing power is lost and the previous lifestyle is no longer affordable.

The United States Consumer Price Index (CPI) is a family of various consumer price indices published monthly by the United States Bureau of Labor Statistics (BLS). The most commonly used indices are the CPI-U and the CPI-W, though many alternative versions exist for different uses. For example, the CPI-U is the most popularly cited measure of consumer inflation in the United States, while the CPI-W is used to index Social Security benefit payments.

Consumer-driven healthcare (CDHC), or consumer-driven health plans (CDHP) refers to a type of health insurance plan that allows employers and/or employees to utilize pretax money to help pay for medical expenses not covered by their health plan. These plans are linked to health savings accounts (HSAs), health reimbursement accounts (HRAs), or similar medical payment accounts. Users keep any unused balance or "rollover" at the end of the year to increase future balances or to invest for future expenses. They are a high-deductible health plan which has cheaper premiums but higher out of pocket expenses, and as such are seen as a cost effective means for companies to provide health care for their employees.

Poverty in the United Kingdom is the condition experienced by the portion of the population of the United Kingdom that lacks adequate financial resources for a certain standard of living, as defined under the various measures of poverty.

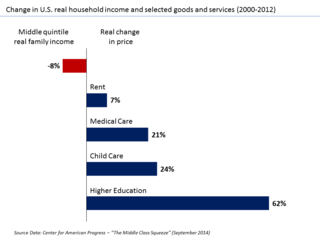

The middle-class squeeze refers to negative trends in the standard of living and other conditions of the middle class of the population. Increases in wages fail to keep up with inflation for middle-income earners, leading to a relative decline in real wages, while at the same time, the phenomenon fails to have a similar effect on the top wage earners. People belonging to the middle class find that inflation in consumer goods and the housing market prevent them from maintaining a middle-class lifestyle, undermining aspirations of upward mobility.

Medication costs, also known as drug costs are a common health care cost for many people and health care systems. Prescription costs are the costs to the end consumer. Medication costs are influenced by multiple factors such as patents, stakeholder influence, and marketing expenses. A number of countries including Canada, parts of Europe, and Brazil use external reference pricing as a means to compare drug prices and to determine a base price for a particular medication. Other countries use pharmacoeconomics, which looks at the cost/benefit of a product in terms of quality of life, alternative treatments, and cost reduction or avoidance in other parts of the health care system. Structures like the UK's National Institute for Health and Clinical Excellence and to a lesser extent Canada's Common Drug Review evaluate products in this way.

The cost of raising a child varies widely from country to country. It is usually determined according to a formula that accounts for major areas of expenditure, such as food, housing, and clothing. However, any given family's actual expenses may differ from the estimates. For example, the rent on a home does not usually change when the tenants have another child, so the family's housing costs may remain the same. In other cases, the home may be too small, in which case the family might move to a larger home at a higher cost. The formula may also account for inflation, as prices are constantly changing, and it will indirectly affect how much it costs to raise a child.

Health insurance costs in the United States are a major factor in access to health coverage. The rising cost of health insurance leads more consumers to go without coverage and increase in insurance cost and accompanying rise in the cost of health care expenses has led health insurers to provide more policies with higher deductibles and other limitations that require the consumer to pay a greater share of the cost themselves.

Healthcare in the United States is largely provided by private sector healthcare facilities, and paid for by a combination of public programs, private insurance, and out-of-pocket payments. The U.S. is the only developed country without a system of universal healthcare, and a significant proportion of its population lacks health insurance.

A cost of poverty, also known as a ghetto tax, a poverty premium, a cost of being poor, or the poor pay more, is the phenomenon of people with lower incomes, particularly those living in low-income areas, incurring higher expenses, paying more not only in terms of money, but also in time, health, and opportunity costs. "Costs of poverty" can also refer to the costs to the broader society in which poverty exists.

Food prices refer to the average price level for food across countries, regions and on a global scale. Food prices affect producers and consumers of food. Price levels depend on the food production process, including food marketing and food distribution. Fluctuation in food prices is determined by a number of compounding factors. Geopolitical events, global demand, exchange rates, government policy, diseases and crop yield, energy costs, availability of natural resources for agriculture, food speculation, changes in the use of soil and weather events directly affect food prices. To a certain extent, adverse price trends can be counteracted by food politics.

Poverty and health are intertwined in the United States. As of 2019, 10.5% of Americans were considered in poverty, according to the U.S. Government's official poverty measure. People who are beneath and at the poverty line have different health risks than citizens above it, as well as different health outcomes. The impoverished population grapples with a plethora of challenges in physical health, mental health, and access to healthcare. These challenges are often due to the population's geographic location and negative environmental effects. Examining the divergences in health between the impoverished and their non-impoverished counterparts provides insight into the living conditions of those who live in poverty.

A global energy crisis began in the aftermath of the COVID-19 pandemic in 2021, with much of the globe facing shortages and increased prices in oil, gas and electricity markets. The crisis was caused by a variety of economic factors, including the rapid post-pandemic economic rebound that outpaced energy supply, and escalated into a widespread global energy crisis following the Russian invasion of Ukraine. The price of natural gas reached record highs, and as a result, so did electricity in some markets. Oil prices hit their highest level since 2008.

A worldwide surge in inflation began in mid-2021, with many countries seeing their highest inflation rates in decades. It has been attributed to various causes, including COVID-19 pandemic-related economic dislocation, supply chain disruptions, the fiscal and monetary stimuli provided in 2020 and 2021 by governments and central banks around the world in response to the pandemic, and price gouging. Recovery in demand from the COVID-19 recession had by 2020 led to significant supply shortages across many business and consumer economic sectors. The inflation rate in the United States and the eurozone peaked in the second half of 2022 and sharply declined in 2023 and into 2024. Despite its decline, significantly higher price levels across various goods and services relative to pre-pandemic levels persist, which some economists speculate is permanent.

Since late 2021, the prices for many essential goods in the United Kingdom began increasing faster than household incomes, resulting in a fall in real incomes. This is caused in part by a rise in inflation in both the UK and the world in general, as well as the economic impact of issues such as the COVID-19 pandemic, Russia's invasion of Ukraine, and Brexit. While all in the UK are affected by rising prices, it most substantially affects low-income persons. The British government has responded in various ways such as grants, tax rebates, and subsidies to electricity and gas suppliers.

References

- ↑ "Cost-of-Living Crisis: How Does It Impact Companies and…". Euromonitor. 21 November 2022. Retrieved 27 August 2023.

- ↑ "What the cost of living crisis looks like around the world | International Rescue Committee (IRC)". rescue.org. Retrieved 27 August 2023.

- ↑ "Euromonitor - A Look at the Cost of Living in 2023". lp.euromonitor.com. Retrieved 27 August 2023.

- ↑ "How is the cost of living crisis affecting public health?". Economics Observatory. Retrieved 27 August 2023.

- ↑ "The cost-of-living crisis is a public health issue". British Politics and Policy at LSE. 3 February 2023. Retrieved 27 August 2023.

- ↑ "How is the cost of living crisis affecting public health?". Economics Observatory. Retrieved 27 August 2023.

- ↑ "Mental health and the cost-of-living crisis report: another pandemic in the making?". mentalhealth.org.uk. Retrieved 27 August 2023.

- ↑ Christian, Alex (13 July 2023). "How the cost-of-living crisis is fuelling job quits". bbc.com. Retrieved 27 August 2023.

- ↑ Bai, Stephanie (21 July 2023). "A wave of strikes has hit Canada. What does this say about our labour market?". Macleans.ca. Retrieved 27 August 2023.

- ↑ "How will the cost of living crisis hit your small business? | Bionic". bionic.co.uk. Retrieved 27 August 2023.

- ↑ Kollewe, Julia (3 April 2023). "Half of all UK consumers have cut non-essential spending". The Guardian. Retrieved 27 August 2023.

- ↑ "The cost of living crisis and how it impacts investments". linkedin.com. Retrieved 27 August 2023.

- ↑ "Rising cost-of-living pushes consumer confidence to all-time low". Deloitte United Kingdom. Retrieved 27 August 2023.

- ↑ "69% of consumers hold back on non-essential spend as cost of living rises; 90% adopt cost-saving behaviours: PwC Consumer Insights Survey". PwC. Retrieved 27 August 2023.

- ↑ Suhanic, Gigi (1 June 2023). "Posthaste: Canadians walk financial tightrope as consumer debt hits record $2.3 trillion". financialpost.com. Retrieved 27 August 2023.