The European Union (EU) is a supranational political and economic union of 27 member states that are located primarily in Europe. The union has a total area of 4,233,255 km2 (1,634,469 sq mi) and an estimated total population of over 448 million. The EU has often been described as a sui generis political entity combining the characteristics of both a federation and a confederation.

Euroscepticism, also spelled as Euroskepticism or EU-scepticism, is a political position involving criticism of the European Union (EU) and European integration. It ranges from those who oppose some EU institutions and policies, and seek reform, to those who oppose EU membership and see the EU as unreformable. The opposite of Euroscepticism is known as pro-Europeanism, or European Unionism.

There are eight euro coin denominations, ranging from one cent to two euros. The coins first came into use in 2002. They have a common reverse, portraying a map of Europe, but each country in the eurozone has its own design on the obverse, which means that each coin has a variety of different designs in circulation at once. Four European microstates that are not members of the European Union use the euro as their currency and also have the right to mint coins with their own designs on the obverse side.

The euro area, commonly called the eurozone (EZ), is a currency union of 20 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU policies.

The economy of the European Union is the joint economy of the member states of the European Union (EU). It is the second largest economy in the world in nominal terms, after the United States and the third one in purchasing power parity (PPP) terms, after China and the United States. The European Union's GDP estimated to be around $19.35 trillion (nominal) in 2024 representing around one sixth of the global economy. Germany has by far the biggest national GDP of all EU countries, followed by France and Italy.

Cypriot euro coins feature three separate designs for the three series of coins. Cyprus has been a member of the European Union since 1 May 2004, and is a member of the Economic and Monetary Union of the European Union. It has completed the third stage of the EMU and adopted the euro as its official currency on 1 January 2008.

The Czech Republic is bound to adopt the euro in the future and to join the eurozone once it has satisfied the euro convergence criteria by the Treaty of Accession since it joined the European Union (EU) in 2004. The Czech Republic is therefore a candidate for the enlargement of the eurozone and it uses the Czech koruna as its currency, regulated by the Czech National Bank, a member of the European System of Central Banks, and does not participate in European Exchange Rate Mechanism II.

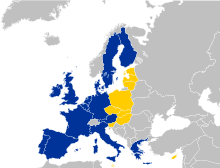

The enlargement of the eurozone is an ongoing process within the European Union (EU). All member states of the European Union, except Denmark which negotiated an opt-out from the provisions, are obliged to adopt the euro as their sole currency once they meet the criteria, which include: complying with the debt and deficit criteria outlined by the Stability and Growth Pact, keeping inflation and long-term governmental interest rates below certain reference values, stabilising their currency's exchange rate versus the euro by participating in the European Exchange Rate Mechanism, and ensuring that their national laws comply with the ECB statute, ESCB statute and articles 130+131 of the Treaty on the Functioning of the European Union. The obligation for EU member states to adopt the euro was first outlined by article 109.1j of the Maastricht Treaty of 1992, which became binding on all new member states by the terms of their treaties of accession.

The history of the European Union between 1993 and 2004 was the period between its creation and the 2004 enlargement. The European Union was created at the dawn of the post–Cold War era and saw a series of successive treaties laying the ground for the euro, foreign policy and future enlargement. Three new member states joined the previous twelve in this period and the European Economic Area extended the reach of the EU's markets to three more.

The international status and usage of the euro has grown since its launch in 1999. When the euro formally replaced 12 currencies on 1 January 2002, it inherited their use in territories such as Montenegro and replaced minor currencies tied to pre-euro currencies, such as in Monaco. Four small states have been given a formal right to use the euro, and to mint their own coins, but all other usage outside the eurozone has been unofficial. With or without an agreement, these countries, unlike those in the eurozone, do not participate in the European Central Bank or the Eurogroup.

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, was a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone member states were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).

The European Financial Stability Facility (EFSF) is a special purpose vehicle financed by members of the eurozone to address the European sovereign-debt crisis. It was agreed by the Council of the European Union on 9 May 2010, with the objective of preserving financial stability in Europe by providing financial assistance to eurozone states in economic difficulty. The Facility's headquarters are in Luxembourg City, as are those of the European Stability Mechanism. Treasury management services and administrative support are provided to the Facility by the European Investment Bank through a service level contract. Since the establishment of the European Stability Mechanism, the activities of the EFSF are carried out by the ESM.

From late 2009, fears of a sovereign debt crisis in some European states developed, with the situation becoming particularly tense in early 2010. Greece was most acutely affected, but fellow Eurozone members Cyprus, Ireland, Italy, Portugal, and Spain were also significantly affected. In the EU, especially in countries where sovereign debt has increased sharply due to bank bailouts, a crisis of confidence has emerged with the widening of bond yield spreads and risk insurance on credit default swaps between these countries and other EU members, most importantly Germany.

The European Financial Stabilisation Mechanism (EFSM) is an emergency funding programme reliant upon funds raised on the financial markets and guaranteed by the European Commission using the budget of the European Union as collateral. It runs under the supervision of the Commission and aims at preserving financial stability in Europe by providing financial assistance to member states of the European Union in economic difficulty.

The European Stability Mechanism (ESM) is an intergovernmental organization located in Luxembourg City, which operates under public international law for all eurozone member states having ratified a special ESM intergovernmental treaty. It was established on 27 September 2012 as a permanent firewall for the eurozone, to safeguard and provide instant access to financial assistance programmes for member states of the eurozone in financial difficulty, with a maximum lending capacity of €500 billion. It has replaced two earlier temporary EU funding programmes: the European Financial Stability Facility (EFSF) and the European Financial Stabilisation Mechanism (EFSM).

A Greek withdrawal from the eurozone was a hypothetical scenario, debated mostly in the early to mid 2010s, under which Greece would withdraw from the Eurozone to deal with the Greek government-debt crisis of the time. This conjecture was given the nickname "Grexit", a portmanteau combining the English words 'Greek' and 'exit', and which has been expressed in Greek as ελλέξοδος. The term "Graccident" was coined for the case that Greece exited the EU and the euro unintentionally. These terms first came into use in 2012 and have been revitalised at each of the bailouts made available to Greece after that.

The eurozone crisis is an ongoing financial crisis that has made it difficult or impossible for some countries in the euro area to repay or re-finance their government debt without the assistance of third parties.

The troika is a term used to refer to the single decision group created by three entities, the European Commission (EC), the European Central Bank (ECB) and the International Monetary Fund (IMF). It was formed in the aftermath of the European debt crisis as an ad hoc authority with a mandate to manage the bailouts of Cyprus, Greece, Ireland and Portugal, in the aftermath of their prospective insolvency caused by the world financial crisis of 2007–2008.

Withdrawal from the Eurozone denotes the process whereby a Eurozone member-state, whether voluntarily or forcibly, stops using the euro as its national currency and leaves the Eurozone.

In 2009–2010, due to substantial public and private sector debt, and "the intimate sovereign-bank linkages" the eurozone crisis impacted periphery countries. This resulted in significant financial sector instability in Europe; banks' solvency risks grew, which had direct implications for their funding liquidity. The European central bank (ECB), as the monetary union's central bank, responded to the sovereign debt crisis with a series of conventional and unconventional measures, including a decrease in the key policy interest rate, and three-year long-term refinancing operation (LTRO) liquidity injections in December 2011 and February 2012, and the announcement of the outright monetary transactions (OMT) program in the summer of 2012. The ECB acted as a de facto lender-of-last-resort (LOLR) to the euro area banking system, providing banks with cash flow in exchange for collateral, as well as a buyer of last resort (BOLR), purchasing eurozone sovereign bonds. However, the ECB's policies have been criticised for their economic repercussions as well as its political agenda.