Related Research Articles

A country code is a short alphanumeric identification code for countries and dependent areas. Its primary use is in data processing and communications. Several identification systems have been developed.

A vehicle registration plate, also known as a number plate or license plate or licence plate, is a metal or plastic plate attached to a motor vehicle or trailer for official identification purposes. All countries require registration plates for road vehicles such as cars, trucks, and motorcycles. Whether they are required for other vehicles, such as bicycles, boats, or tractors, may vary by jurisdiction. The registration identifier is a numeric or alphanumeric ID that uniquely identifies the vehicle or vehicle owner within the issuing region's vehicle register. In some countries, the identifier is unique within the entire country, while in others it is unique within a state or province. Whether the identifier is associated with a vehicle or a person also varies by issuing agency. There are also electronic license plates.

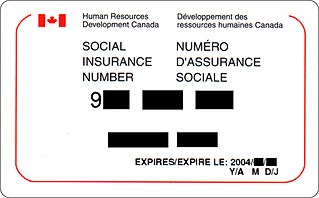

A social insurance number (SIN) (French: numéro d'assurance sociale (NAS)) is a number issued in Canada to administer various government programs. The SIN was created in 1964 to serve as a client account number in the administration of the Canada Pension Plan and Canada's varied employment insurance programs. In 1967, Revenue Canada (now the Canada Revenue Agency) started using the SIN for tax reporting purposes. SINs are issued by Employment and Social Development Canada (previously Human Resources Development Canada).

A CUSIP is a nine-character numeric or alphanumeric code that uniquely identifies a North American financial security for the purposes of facilitating clearing and settlement of trades. All CUSIP identifiers are fungible, which means that a unique CUSIP identifier for each individual security stays the same, regardless of the exchange where the shares were purchased or venue on which the shares were traded. CUSIP was adopted as an American national standard by the Accredited Standards Committee X9 and is designated ANSI X9.6. CUSIP was re-approved as an ANSI standard in December 2020. The acronym derives from Committee on Uniform Security Identification Procedures.

International Standard Musical Work Code (ISWC) is a unique identifier for musical works, similar to ISBN for books. It is adopted as international standard ISO 15707. The ISO subcommittee with responsibility for the standard is TC 46/SC 9.

A national identification number, national identity number, or national insurance number or JMBG/EMBG is used by the governments of many countries as a means of tracking their citizens, permanent residents, and temporary residents for the purposes of work, taxation, government benefits, health care, and other governmentally-related functions.

The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number (FTIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification. When the number is used for identification rather than employment tax reporting, it is usually referred to as a Taxpayer Identification Number (TIN). When used for the purposes of reporting employment taxes, it is usually referred to as an EIN. These numbers are used for tax administration and must not be used for any other purpose. For example, an EIN should not be used in tax lien auction or sales, lotteries, or for any other purposes not related to tax administration.

An aircraft registration is a code unique to a single aircraft, required by international convention to be marked on the exterior of every civil aircraft. The registration indicates the aircraft's country of registration, and functions much like an automobile license plate or a ship registration. This code must also appear in its Certificate of Registration, issued by the relevant civil aviation authority (CAA). An aircraft can only have one registration, in one jurisdiction, though it is changeable over the life of the aircraft.

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard. In the United States it is also known as a Tax Identification Number (TIN) or Federal Taxpayer Identification Number (FTIN). A TIN may be assigned by the Social Security Administration (SSA) or by the Internal Revenue Service (IRS).

The Trading Partner Identification Number is a confidential number assigned to organizations which are or intend to be contractors to the Federal Government of the United States. It is issued by the Central Contractor Registration (CCR) of the Department of Defense. Contractors are consistently advised by CCR to treat the TPIN as if it were a password, and not to reveal it to others not directly involved in their business operations.

A DEA number is an identifier assigned to a health care provider by the United States Drug Enforcement Administration allowing them to write prescriptions for controlled substances.

The CPF number is the Brazilian individual taxpayer registry, since its creation in 1965. This number is attributed by the Brazilian Federal Revenue to Brazilians and resident aliens who, directly or indirectly, pay taxes in Brazil. It's an 11-digit number in the format 000.000.000-00, where the last 2 numbers are check digits, generated through an arithmetic operation on the first nine digits.

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number. The card number is primarily a card identifier and may not directly identify the bank account number/s to which the card is/are linked by the issuing entity. The card number prefix identifies the issuer of the card, and the digits that follow are used by the issuing entity to identify the cardholder as a customer and which is then associated by the issuing entity with the customer's designated bank accounts. In the case of stored-value type cards, the association with a particular customer is only made if the prepaid card is reloadable. Card numbers are allocated in accordance with ISO/IEC 7812. The card number is typically embossed on the front of a payment card, and is encoded on the magnetic stripe and chip, but may also be imprinted on the back of the card.

Unique Identification Marking, UID marking, Item Unique Identification or IUID, is a part of the compliance process mandated by the United States Department of Defense. It is a permanent marking method used to give equipment a unique ID. Marking is essential for all equipment with an acquisition cost of over $5,000, equipment which is mission essential, controlled inventory, or serially-controlled. UID-marking is a set of data for assets that is globally unique and unambiguous. The technology used to mark an item is 2D Data Matrix ECC 200 Symbol. UID marking can be used to ensure data integrity and data quality throughout an item's lifecycle; it also supports multi-faceted business applications.

The Department of Defense Activity Address Code (DoDAAC) is a six position code that uniquely identifies a Department of Defense unit, activity, or organization that has the authority to requisition, contract for, receive, have custody of, issue, or ship DoD assets, or fund/pay bills for materials and/or services. The first positions of the code designate the particular Service/Agency element of ownership.

In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as . The number is issued to an individual by the Social Security Administration, an independent agency of the United States government. Although the original purpose for the number was for the Social Security Administration to track individuals, the Social Security number has become a de facto national identification number for taxation and other purposes.

The Red Flags Rule was created by the Federal Trade Commission (FTC), along with other government agencies such as the National Credit Union Administration (NCUA), to help prevent identity theft. The rule was passed in January 2008, and was to be in place by November 1, 2008, but due to push-backs by opposition, the FTC delayed enforcement until December 31, 2010.

The Legal Entity Identifier (LEI) is a unique global identifier for legal entities participating in financial transactions. Also known as an LEI code or LEI number, its purpose is to help identify legal entities on a globally accessible database. Legal entities are organizations such as companies or government entities that participate in financial transactions. An individual person may not obtain an LEI. The identifier is used in regulatory reporting to financial regulators and all financial companies and funds are required to have an LEI.

The Commercial and Government Entity Code, or CAGE Code, is a unique identifier assigned to suppliers to various government or defense agencies, as well as to government agencies themselves and various organizations. CAGE codes provide a standardized method of identifying a given facility at a specific location.

The Federal Stock Number (FSN) was the codification system used by the U.S. federal government from 1955 to 1974.

References

- 1 2 "What is a D‑U‑N‑S Number?". Dun & Bradstreet.

- ↑ "Obtaining a DUNS Number: A Guide for Federal Grant and Cooperative Agreement Applicants" (PDF). Office of Management and Budget – via National Archives.

- ↑ "Updating DUNS+4 for Remit Address". United States Forest Service.

- ↑ "Data Universal Numbering System (DUNS) Number". Code of Federal Regulations. United States Government Publishing Office.

- ↑ 68 FR 38402

- ↑ "Unique Entity Identifier Update The New Unique Entity Identifier is Here". General Services Administration . Retrieved 2023-03-06.