Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

In finance, default is failure to meet the legal obligations of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt.

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity.

Debt relief or debt cancellation is the partial or total forgiveness of debt, or the slowing or stopping of debt growth, owed by individuals, corporations, or nations.

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

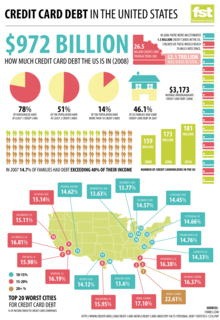

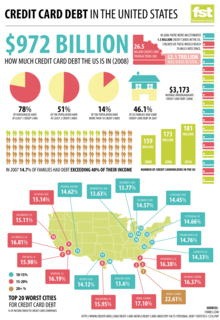

Credit card debt results when a client of a credit card company purchases an item or service through the card system. Debt grows through the accrual of interest and penalties when the consumer fails to repay the company for the money they have spent.

Credit counseling is commonly a process that is used to help individual debtors with debt settlement through education, budgeting and the use of a variety of tools with the goal to reduce and ultimately eliminate debt. Credit counseling is most often done by Credit counseling agencies that are empowered by contract to act on behalf of the debtor to negotiate with creditors to resolve debt that is beyond a debtor's ability to pay. Some of the agencies are non-profits that charge at no or non-fee rates, while others can be for-profit and include high fees. Regulations on credit counseling and Credit counseling agencies varies by country and sometimes within regions of the countries themselves. In the United States, individuals filing Chapter 13 bankruptcy are required to receive counseling.

Debt settlement is a settlement negotiated with a debtor's unsecured creditor. Commonly, creditors agree to forgive a large part of the debt: perhaps around half, though results can vary widely. When settlements are finalized, the terms are put in writing. It is common that the debtor makes one lump-sum payment in exchange for the creditor agreeing that the debt is now cancelled and the matter closed. Some settlements are paid out over a number of months. In either case, as long as the debtor does what is agreed in the negotiation, no outstanding debt will appear on the former debtor's credit report.

Hyman Philip Minsky was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research attempted to provide an understanding and explanation of the characteristics of financial crises, which he attributed to swings in a potentially fragile financial system. Minsky is sometimes described as a post-Keynesian economist because, in the Keynesian tradition, he supported some government intervention in financial markets, opposed some of the financial deregulation of the 1980s, stressed the importance of the Federal Reserve as a lender of last resort and argued against the over-accumulation of private debt in the financial markets.

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults and because the value of their collateral falls, leading to a surge in bank insolvencies, a reduction in lending and by extension, a reduction in spending.

A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full when due. Cessation of due payments may either be accompanied by that government's formal declaration that it will not pay its debts (repudiation), or it may be unannounced. A credit rating agency will take into account in its gradings capital, interest, extraneous and procedural defaults, and failures to abide by the terms of bonds or other debt instruments.

The following outline is provided as an overview of and topical guide to economics:

Michael Hudson is an American economist, Professor of Economics at the University of Missouri–Kansas City and a researcher at the Levy Economics Institute at Bard College, former Wall Street analyst, political consultant, commentator and journalist. He is a contributor to The Hudson Report, a weekly economic and financial news podcast produced by Left Out.

Many factors directly and indirectly serve as the causes of the Great Recession that started in 2008 with the US subprime mortgage crisis. The major causes of the initial subprime mortgage crisis and the following recession include lax lending standards contributing to the real-estate bubbles that have since burst; U.S. government housing policies; and limited regulation of non-depository financial institutions. Once the recession began, various responses were attempted with different degrees of success. These included fiscal policies of governments; monetary policies of central banks; measures designed to help indebted consumers refinance their mortgage debt; and inconsistent approaches used by nations to bail out troubled banking industries and private bondholders, assuming private debt burdens or socializing losses.

The financial crisis of 2007–2008, or Global Financial Crisis (GFC), was a severe worldwide economic crisis that occurred in the early 21st century. It was the most serious financial crisis since the Great Depression (1929). Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm." Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

Addison Wiggin is an American financial writer, publisher, and filmmaker. He is executive publisher of Agora Financial, LLC and is a New York Times bestselling author.

Louis Roland Hyman is an American writer and economic historian. He is the Maurice and Hinda Neufeld Founders Professor in Industrial and Labor Relations at Cornell University's School of Industrial & Labor Relations.

The Return of Depression Economics and the Crisis of 2008 is a non-fiction book by American economist and Nobel Prize winner Paul Krugman, written in response to growing socio-political discourse on the return of economic conditions similar to The Great Depression. The book was first published in 1999 and later updated in 2008 following his Nobel Prize of Economics. The Return of Depression Economics uses Keynesian analysis of past economics crisis, drawing parallels between the 2008 financial crisis and the Great Depression. Krugman challenges orthodox economic notions of restricted government spending, deregulation of markets and the efficient market hypothesis. Krugman offers policy recommendations for the prevention of future financial crises and suggests that policymakers "relearn the lessons our grandfathers were taught by the Great Depression" and prop up spending and enable broader access to credit.

Winfield W. Riefler (1897–1974) was an American economist and statistician who helped create the Federal Housing Administration and was instrumental in the 1951 Treasury-Fed Accord