Related Research Articles

The economy of Iraq is dominated by the oil sector, which has provided about 99.7% of foreign exchange earnings during its modern history. As of 2021, the oil sector provides about 92% of foreign exchange earnings. Iraq's hitherto agrarian economy underwent rapid development following the 14 July Revolution (1958) which overthrew the Hashemite Iraqi monarchy. It had become the third-largest economy in the Middle East by 1980. This occurred in part because of the Iraqi government's successful industrialization and infrastructure development initiatives in the 1970s, which included irrigation projects, railway and highway construction, and rural electrification.

The economy of Mongolia has traditionally been based on agriculture and livestock. Mongolia also has extensive mineral deposits: copper, coal, molybdenum, tin, tungsten, and gold account for a large part of industrial production. Soviet assistance, at its height one-third of Gross domestic product (GDP), disappeared almost overnight in 1990–91, in the time of the collapse of the Soviet Union. Mongolia was driven into deep recession.

In economics, a recession is a business cycle contraction that occurs when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster.

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.

Syria's economic situation has been turbulent and their economy has deteriorated considerably since the beginning of the Syrian civil war, which erupted in March 2011.

In economics, inflation is a general increase of the prices. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States.

An economic depression is a period of carried long-term economic dow that is the result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country were there is some economic crisis that has worsened but most often reflexes historically the American Great Depression and similar economic status that may be recognized as existing at some country, several countries or even in many countries. It is often understood in economics that economic crisis and the following recession that maybe named economic depression are part of economic cycles where the slowdown of the economy follows the economic growth and vice versa. It is a result of more severe economic problems or a downturn than the recession itself, which is a slowdown in economic activity over the course of the normal business cycle of growing economy.

In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Additionally, it is designed to try to keep GDP growth at 2%–3% percent and the unemployment rate near the natural unemployment rate of 4%–5%. This implies that fiscal policy is used to stabilise the economy over the course of the business cycle.

Business cycles are intervals of expansion followed by recession in economic activity. A recession is sometimes technically defined as 2 quarters of negative GDP growth, but definitions vary; for example, in the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The changes in economic activity that characterize business cycles have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production.

In economics, the Dutch disease is the apparent causal relationship between the increase in the economic development of a specific sector and a decline in other sectors.

In classical economics, Say's law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source of demand. In his principal work, A Treatise on Political Economy, Jean-Baptiste Say wrote: "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value." And also, "As each of us can only purchase the productions of others with his own productions – as the value we can buy is equal to the value we can produce, the more men can produce, the more they will purchase."

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

The early 1990s recession describes the period of economic downturn affecting much of the Western world in the early 1990s. The impacts of the recession contributed in part to the 1992 U.S. presidential election victory of Bill Clinton over incumbent president George H. W. Bush. The recession also included the resignation of Canadian prime minister Brian Mulroney, the reduction of active companies by 15% and unemployment up to nearly 20% in Finland, civil disturbances in the United Kingdom and the growth of discount stores in the United States and beyond.

The economy of the Middle East is very diverse, with national economies ranging from hydrocarbon-exporting rentiers to centralized socialist economies and free-market economies. The region is best known for oil production and export, which significantly impacts the entire region through the wealth it generates and through labor utilization. In recent years, many of the countries in the region have undertaken efforts to diversify their economies.

The economic history of Ecuador covers the period of the economy of Ecuador in Ecuadoran history beginning with colonization by the Spanish Empire, through independence and up to modern-day.

After the dissolution of the Soviet Union in 1991 and the end of its centrally-planned economy, the Russian Federation succeeded it under president Boris Yeltsin. The Russian government used policies of shock therapy to liberalize the economy as part of the transition to a market economy, causing a sustained economic recession. GDP per capita levels returned to their 1991 levels by the mid-2000s. The economy of Russia is much more stable today than in the early 1990s, but inflation still remains an issue. Historically and currently, the Russian economy has differed sharply from major developed economies because of its weak legal system, underdevelopment of modern economic activities, technological backwardness, and lower living standards.

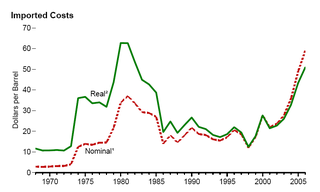

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when, respectively, the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.

Colombia is now a country mostly in South America, and has been home to many indigenous peoples and cultures since at least 12,000 BCE.

The financial crisis in Russia in 2014–2016 was the result of the sharp devaluation of the Russian rouble beginning in the second half of 2014. A decline in confidence in the Russian economy caused investors to sell off their Russian assets, which led to a decline in the value of the Russian rouble and sparked fears of a financial crisis. The lack of confidence in the Russian economy stemmed from at least two major sources. The first is the fall in the price of oil in 2014. Crude oil, a major export of Russia, declined in price by nearly 50% between its yearly high in June 2014 and 16 December 2014. The second is the result of international economic sanctions imposed on Russia following Russia's annexation of Crimea, the war in Donbas and the broader Russo-Ukrainian War.

The 2010s oil glut was a significant surplus of crude oil that started in 2014–2015 and accelerated in 2016, with multiple causes. They include general oversupply as unconventional US and Canadian tight oil production reached critical volumes, geopolitical rivalries among oil-producing nations, falling demand across commodities markets due to the deceleration of the Chinese economy, and possible restraint of long-term demand as environmental policy promotes fuel efficiency and steers an increasing share of energy consumption away from fossil fuels.

References

- ↑ "Iran Real GDP Growth".

- ↑ Delavari, Majid. "The sources of Iran's Business Cycles". Munish Personal RePEc Archive: 3_7.

- ↑ Amuzekar, Jahangir. "Economic crisis in iran". Carnegie Endowment for International Peace.

- ↑ chauvet (2005). "Forecasting Recessions Using the Yield Curve". Journal of Forecasting. 24 (2): 77–103. doi:10.1002/for.932.

- ↑ Soltani, Zahra. "Test of Real Business Cycle Theory in Iran's economy". Iranian Economic Review. 7 (7): 11_28.

- ↑ hadian. "Identification of business cycles in iran's economy". Journal of Economic Research. 15: 93–120.

- ↑ Delavari, Majid. "The sources of Iran's Business Cycles". Munish Personal RePEc Archive: 4_5.

- ↑ caballero. "The Cleansing Effect of Recessions". American Economic Review. 84 (5): 1350–1368.

- ↑ Kaveh, Madani. "Have International Sanctions Impacted Iran's Environment?". World, Publisher NDPI. 2(2021): 231_252.

- ↑ Katzman, Kenneth. "Iran sanctions". Congressional Research Service. 2022: 7_60.

- ↑ Khosravi, Alireza. "Oil Revenues, Fluctuations in Economic Growth Rates and the Risk of Political Instability in Iran in Post JCPOA". Petroleum Business Review. 4 (2): 17_33.

- ↑ Mohammadi Khyareh, Mohsen. "Asymmetric Effects of Exchange Rate Changes in iran". Journal of Money and Economy. 12 (3): 317_344.

- ↑ Hossein Mozayani, Amir. "The Political Economy of Commodity Smuggling (The Case of I.R. of Iran)". Iranian Economic Review. 25 (1): 121_135.

- ↑ afshary. "Evaluation of the neoclassical growth model in explaining business cycles in Iran". . Iranian Applied Economics Studies Quarterly. 9: 189–204.