Corporatocracy is an economic, political and judicial system controlled by corporations or corporate interests.

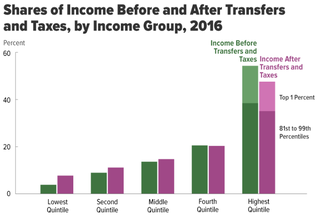

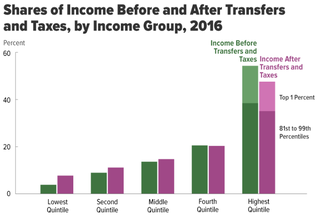

There are wide varieties of economic inequality, most notably income inequality measured using the distribution of income and wealth inequality measured using the distribution of wealth. Besides economic inequality between countries or states, there are important types of economic inequality between different groups of people.

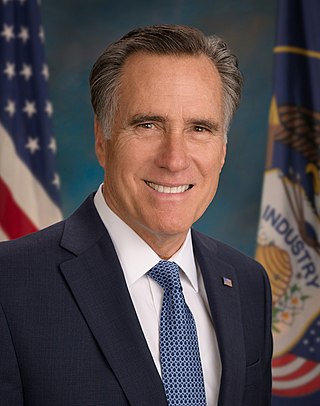

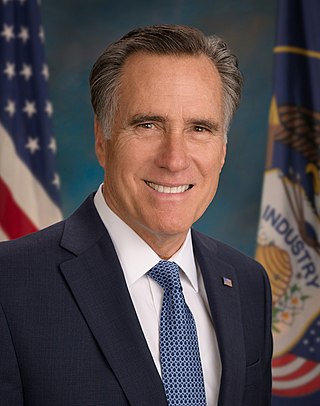

Willard Mitt Romney is an American politician, businessman, and lawyer who has served as the junior United States senator from Utah since 2019. He served as the 70th governor of Massachusetts from 2003 to 2007 and was the Republican Party's nominee for president of the United States in the 2012 election, losing to incumbent Barack Obama.

Bain Capital is an American private investment firm based in Boston. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences, crypto, tech opportunities, partnership opportunities, special situations and real estate. Bain Capital invests across a range of industry sectors and geographic regions. As of 2022, the firm managed approximately $165 billion of investor capital. The firm was founded in 1984 by partners from the consulting firm Bain & Company. The company is headquartered at 200 Clarendon Street in Boston with 22 offices in North America, Europe, Asia, and Australia.

Kamer Daron Acemoğlu is a Turkish-born American economist who has taught at the Massachusetts Institute of Technology (MIT) since 1993. He is currently the Elizabeth and James Killian Professor of Economics at MIT. He was named Institute Professor in 2019.

Sir Anthony Barnes Atkinson was a British economist, Centennial Professor at the London School of Economics, and senior research fellow of Nuffield College, Oxford.

Samuel Stebbins Bowles, is an American economist and Professor Emeritus at the University of Massachusetts Amherst, where he continues to teach courses on microeconomics and the theory of institutions. His work belongs to the neo-Marxian tradition of economic thought. However, his perspective on economics is eclectic and draws on various schools of thought, including what he and others refer to as post-Walrasian economics.

Alan Bennett Krueger was an American economist who was the James Madison Professor of Political Economy at Princeton University and Research Associate at the National Bureau of Economic Research. He served as Assistant Secretary of the Treasury for Economic Policy, nominated by President Barack Obama, from May 2009 to October 2010, when he returned to Princeton. He was nominated in 2011 by Obama as chair of the White House Council of Economic Advisers, and served in that office from November 2011 to August 2013. He was among the 50 highest ranked economists in the world according to Research Papers in Economics.

Branko Milanović is a Serbian-American economist. He is most known for his work on income distribution and inequality.

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

Thomas Piketty is a French economist who is a professor of economics at the School for Advanced Studies in the Social Sciences, Associate Chair at the Paris School of Economics and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics.

The 2012 presidential campaign of Mitt Romney officially began on June 2, 2011, when former Massachusetts governor Mitt Romney formally announced his candidacy for the Republican Party nomination for President of the United States, at an event in Stratham, New Hampshire. Having previously run in the 2008 Republican primaries, this was Romney's second campaign for the presidency.

W Spann LLC was a phantom company created at the behest of an originally unknown person by Boston lawyer Cameron Casey on March 15, 2011, apparently for the sole purpose of anonymously donating one million dollars to Restore Our Future, a Super PAC supporting U.S. Presidential candidate Mitt Romney. After donating the money on April 28, the company was dissolved on July 12.

Restore Our Future is a political action committee (PAC) created to support Mitt Romney in the 2012 U.S. Presidential election. A so-called Super PAC, Restore Our Future is permitted to raise and spend unlimited amounts of corporate, union, and individual campaign contributions under the terms of the Citizens United Supreme Court decision.

We are the 99% is a political slogan widely used and coined during the 2011 Occupy movement. The phrase directly refers to the income and wealth inequality in the United States, with a concentration of wealth among the top-earning 1%. It reflects an opinion that "the 99%" are paying the price for the mistakes of a tiny minority within the upper class.

Edward Nathan Wolff is an American economist whose work concerns wealth and wealth disparity. He is a professor of economics at New York University and a research associate at the National Bureau of Economic Research. He also works at the Levy Institute Measure of Economic Well-Being a department of the Levy Economics Institute, where he is in charge of their distribution of income and wealth program.

The business career of Mitt Romney began shortly after he finished graduate school in 1975. At that time, Romney entered the management consulting industry, and in 1977 secured a position at Bain & Company. Later serving as its chief executive officer, he helped bring the company out of financial crisis. In 1984, he co-founded and led the spin-off Bain Capital, a private equity investment firm that became highly profitable and one of the largest such firms in the nation. The fortune he earned from his business career is estimated at $190–250 million.

Jonathan David Ostry is an international economist who has served as Deputy Director of the Research Department and Acting Director of the Asia and Pacific Department at the International Monetary Fund in Washington DC. He is Professor of the Practice at Georgetown University in Washington D.C. He is also a Research Fellow at the Centre for Economic Policy Research (CEPR) in London, England. His recent work has focused on the management of international capital flows, in particular the role of capital controls; this work has been influential in bringing about a shift in the institutional position of the IMF on capital controls. Ostry has also published influential studies on the relationship between income inequality and economic growth, where his work—which has featured prominently in the financial press—suggests that high income inequality and a failure to sustain economic growth may be two sides of the same coin. His other work focuses on fiscal sustainability issues. Ostry has many distinguished academic publications, and his work has been cited widely in scholarly journals, and in the press, including The Economist, the Financial Times, The Wall Street Journal, The New York Times and The Washington Post. Ostry was listed in Who’s Who in Economics in 2003. He was named one of the 100 most powerful people in global finance by Worth magazine in 2016, and as one of the economists whose research shaped the world in 2017.

Capital in the Twenty-First Century is a book written by French economist Thomas Piketty. It focuses on wealth and income inequality in Europe and the United States since the 18th century. It was initially published in French in August 2013; an English translation by Arthur Goldhammer followed in April 2014.

Causes of income inequality in the United States describes the reasons for the unequal distribution of income in the US and the factors that cause it to change over time. This topic is subject to extensive ongoing research, media attention, and political interest.