Related Research Articles

A farmer is a person engaged in agriculture, raising living organisms for food or raw materials. The term usually applies to people who do some combination of raising field crops, orchards, vineyards, poultry, or other livestock. A farmer might own the farmland or might work as a laborer on land owned by others. In most developed economies, a "farmer" is usually a farm owner (landowner), while employees of the farm are known as farm workers. However, in other older definitions a farmer was a person who promotes or improves the growth of plants, land, or crops or raises animals by labor and attention.

A farm is an area of land that is devoted primarily to agricultural processes with the primary objective of producing food and other crops; it is the basic facility in food production. The name is used for specialized units such as arable farms, vegetable farms, fruit farms, dairy, pig and poultry farms, and land used for the production of natural fiber, biofuel, and other commodities. It includes ranches, feedlots, orchards, plantations and estates, smallholdings, and hobby farms, and includes the farmhouse and agricultural buildings as well as the land. In modern times, the term has been extended so as to include such industrial operations as wind farms and fish farms, both of which can operate on land or at sea.

A peasant is a pre-industrial agricultural laborer or a farmer with limited land-ownership, especially one living in the Middle Ages under feudalism and paying rent, tax, fees, or services to a landlord. In Europe, three classes of peasants existed: non-free slaves, semi-free serfs, and free tenants. Peasants might hold title to land outright, or by any of several forms of land tenure, among them socage, quit-rent, leasehold, and copyhold.

A fief was a central element in medieval contracts based on feudal law. It consisted of a form of property holding or other rights granted by an overlord to a vassal, who held it in fealty or "in fee" in return for a form of feudal allegiance, services or payments. The fees were often lands, land revenue or revenue-producing real property like a watermill, held in feudal land tenure: these are typically known as fiefs or fiefdoms. However, not only land but anything of value could be held in fee, including governmental office, rights of exploitation such as hunting, fishing or felling trees, monopolies in trade, money rents and tax farms. There never existed a standard feudal system, nor did there exist only one type of fief. Over the ages, depending on the region, there was a broad variety of customs using the same basic legal principles in many variations.

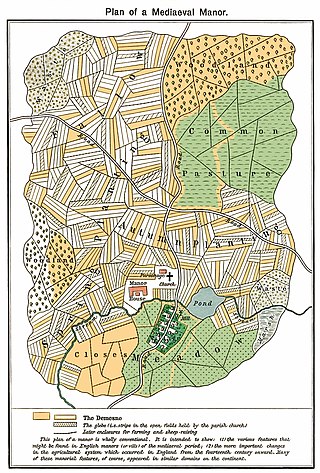

The open-field system was the prevalent agricultural system in much of Europe during the Middle Ages and lasted into the 20th century in Russia, Iran, and Turkey. Each manor or village had two or three large fields, usually several hundred acres each, which were divided into many narrow strips of land. The strips or selions were cultivated by peasants, often called tenants or serfs. The holdings of a manor also included woodland and pasture areas for common usage and fields belonging to the lord of the manor and the religious authorities, usually Roman Catholics in medieval Western Europe. The farmers customarily lived in separate houses in a nucleated village with a much larger manor house and church nearby. The open-field system necessitated co-operation among the residents of the manor.

A tenant farmer is a person who resides on land owned by a landlord. Tenant farming is an agricultural production system in which landowners contribute their land and often a measure of operating capital and management, while tenant farmers contribute their labor along with at times varying amounts of capital and management. Depending on the contract, tenants can make payments to the owner either of a fixed portion of the product, in cash or in a combination. The rights the tenant has over the land, the form, and measures of payment vary across systems. In some systems, the tenant could be evicted at whim ; in others, the landowner and tenant sign a contract for a fixed number of years. In most developed countries today, at least some restrictions are placed on the rights of landlords to evict tenants under normal circumstances.

Renting, also known as hiring or letting, is an agreement where a payment is made for the use of a good, service or property owned by another over a fixed period of time. To maintain such an agreement, a rental agreement is signed to establish the roles and expectations of both the tenant and landlord. There are many different types of leases. The type and terms of a lease are decided by the landlord and agreed upon by the renting tenant.

In real estate, a landed property or landed estate is a property that generates income for the owner without the owner having to do the actual work of the estate.

The ferme générale was, in ancien régime France, essentially an outsourced customs, excise and indirect tax operation. It collected duties on behalf of the King, under renewable six-year contracts. The major tax collectors in that highly unpopular tax farming system were known as the fermiers généraux, which would be tax farmers-general in English.

Octroi is a local tax collected on various articles brought into a district for consumption.

Agriculture in the Empire of Japan was an important component of the pre-war Japanese economy. Although Japan had only 16% of its land area under cultivation before the Pacific War, over 45% of households made a living from farming. Japanese cultivated land was mostly dedicated to rice, which accounted for 15% of world rice production in 1937.

Leaseback, short for "sale-and-leaseback", is a financial transaction in which one sells an asset and leases it back for the long term; therefore, one continues to be able to use the asset but no longer owns it. The transaction is generally done for fixed assets, notably real estate, as well as for durable and capital goods such as airplanes and trains. The concept can also be applied by national governments to territorial assets; prior to the Falklands War, the government of the United Kingdom proposed a leaseback arrangement whereby the Falklands Islands would be transferred to Argentina, with a 99-year leaseback period, and a similar arrangement, also for 99 years, had been in place prior to the handover of Hong Kong to mainland China. Leaseback arrangements are usually employed because they confer financing, accounting or taxation benefits.

Privatized tax collection occurs wherever the state passes on its obligation to collect taxes to private companies or firms in return for a fixed or ad valorem fee. This contrasts with tax farming where a private individual or organization pays off a pre-determined tax debt, and then subsequently recoups that payment by collecting money from the people within a certain area or business.

Numbardar or Lambardar is a title in the Indian subcontinent which applies to powerful families of zamindars of the village revenue estate, a state-privileged status which is hereditary and has wide-ranging governmental powers share in it, the collaboration with the police for maintaining law and order in the village, and it comes with the associated social prestige. In contrast, the Zaildar who was the grand jagirdar and usually had the power over 40 to 100 villages. The Zail and Zaildar system of British Raj was abolished in 1952 in India but the lambardar system still continues in Pakistan and in some places in India.

Due to the absence of the tax code in Argentina, the tax regulation takes place in accordance with separate laws, which, in turn, are supplemented by provisions of normative acts adopted by the executive authorities. The powers of the executive authority include levying a tax on profits, property and added value throughout the national territory. In Argentina, the tax policy is implemented by the Federal Administration of Public Revenue, which is subordinate to the Ministry of Economy. The Federal Administration of Public Revenues (AFIP) is an independent service, which includes: the General Tax Administration, the General Customs Office and the General Directorate for Social Security. AFIP establishes the relevant legal norms for the calculation, payment and administration of taxes:

In Bangladesh, the principal taxes are Customs duties, Value-Added-Tax (VAT), supplementary duty, income tax and corporation tax.

In English and Irish law, a fee farm grant is a hybrid type of land ownership typical in cities and towns. The word fee is derived from fief or fiefdom, meaning a feudal landholding, and a fee farm grant is similar to a fee simple in the sense that it gives the grantee the right to hold a freehold estate, the only difference being the payment of an annual rent and covenants, thus putting the parties in a landlord-tenant relationship.

Malikâne was a form of tax farming introduced in the Ottoman empire in 1695. It was intended as an improvement on the Iltizam system, in which a tax-farmer was responsible for a single year. Malikâne contracts were for life; this provided more security for the tax farmer (malikaneci) and a less exploitative relationship with the peasants; malikanecis might even make investments to improve productivity. However, vested interests - from existing mültezims who benefited from the Iltizam system - prevented wider adoption of malikâne. Also, malikâne could not be converted into vakf - an important distinction from mülk.

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities.

The institution of the pacht or pacht-stelsel was a system of tax farming in the Dutch Republic and its colonial empire. In this system tax is not collected by the government, but by a private individual who has leased the right to collect the tax. In the Dutch Republic, for example, this was common practise for a long time, especially for indirect taxes. Each year, the highest bidder acquired the right to collect certain taxes; he paid a rent for this to the government, and all he collected more was for the tax tenant himself. The rationale behind this system was that by outsourcing taxation, local governments could exert less influence on collection. Also, a tenant would collect taxes more scrupulously, because it would personally benefit him.

References

- ↑ Larousse Dictionnaire de la Langue Francaise Lexis, Paris, 1993 "Ferme: contrat par lequel un proprietaire abandonne a un locataire l'exploitation d'un domaine moyennant le paiement d'un loyer" (contract by which a proprietor transfers the exploitation of a holding to a tenant by means of the payment of a rent); Cassell's Latin Dictionary, ed. Marchant & Charles

- ↑ Larousse, op.cit.

- ↑ Century Dictionary and Cyclopedia, "farm".

- ↑ Mantello, Rigg, Medieval Latin: an introduction and bibliographical guide, 11.3

- ↑ Howatson M. C.: Oxford Companion to Classical Literature, Oxford University Press, 1989, ISBN 0-19-866121-5

- ↑ Balsdon J.: Roman Civilization, Pelican, 1965

- ↑ Roman-taxes at unrv.com

- ↑ Cahill, Thomas. How the Irish saved civilization: the untold story of Ireland's heroic role from the fall of Rome to the rise of medieval Europe. Anchor Books, Doubleday, 1996, p. 26.

- ↑ Douglas, David C. & Greenaway, George W., (eds.), English Historical Documents 1042–1189, London, 1959. Part II, Government & Administration, part C, The Sheriff & Local Government, p. 433

- ↑ Rustow, Marina (2010-10-01). "Sar Shalom ben Moses ha-Levi". Encyclopedia of Jews in the Islamic World.

- ↑ Hourani, Albert (1991). A History of the Arab Peoples. England, UK: Faber and Faber Limited. p. 234. ISBN 978-0-674-39565-7.

- ↑ "Iltizām | tax system". Encyclopedia Britannica. Retrieved 2021-09-23.

- ↑ John Butcher and Howard Dick, The Rise and Fall of Revenue Farming: Business Elites and the Emergence of the Modern State. St. Martin's Press, 1993

- ↑ Archived 2011-05-14 at the Wayback Machine Archived 2010-07-31 at the Wayback Machine

- ↑ Chowdhury, Faizul L. NBR's attempt at Tax Farming - fixed amount of VAT on Cigarettes in 1999, 2007 : Desh Prokashon, Dhaka.