This article's lead section may be too short to adequately summarize the key points.(September 2019) |

The establishment of the annual budget of the Federal Republic of Germany is known as the German budget process.

This article's lead section may be too short to adequately summarize the key points.(September 2019) |

The establishment of the annual budget of the Federal Republic of Germany is known as the German budget process.

The primary purpose of the budget is to create an overview of the country's revenues and expenses for the following fiscal year or years. Since the budget is based on past expenditures, it is merely a prediction of the future which can lead to unexpected budget deficits as the fiscal year progresses. In the short term, such deficits are commonly financed by borrowing money which has led to the significant long-term debt of the German federal government.

The Bundestag passes the budget as an addendum to the annual or bi-annual budget act (Art. 110, Basic Law). Revenues and expenses are separated by ministries and other administrative entities.

Specific guidelines established by law govern the creation of the budget. Specifically, these are:

The federal budget for 2021 is €369.3 billion. [1] With total government spending of €1.76 trillion in 2021, the federal budget comprises only a fraction of total public sector spending in Germany. [2]

Germany's budget for the 2005 fiscal year can be found below, which also outlines the basic budget structure.

| Function | Description | Expenditures [note 1] |

|---|---|---|

| 01 | Federal President | 23,636 |

| 02 | Bundestag | 550,920 |

| 03 | Bundesrat | 19,952 |

| 04 | Federal Chancellor | 1,510,084 |

| 05 | Federal Foreign Office | 2,205,783 |

| 06 | Ministry of the Interior, Building and Community | 4,216,641 |

| 07 | Ministry of Justice and Consumer Protection | 338,592 |

| 08 | Ministry of Finance | 4,041,769 |

| 09 | Ministry for Economic Affairs and Energy | 37,974,665 |

| 10 | Ministry of Food and Agriculture | 5,106,957 |

| 12 | Ministry of Transport and Digital Infrastructure | 23,255,509 |

| 14 | Ministry of Defence | 23,900,000 |

| 15 | Ministry of Health | 84,409,880 |

| 16 | Ministry of Environment, Natural Conservation and Nuclear Security | 769,024 |

| 17 | Ministry for Family Affairs, Senior Citizens, Women and Youth | 4,571,691 |

| 19 | Federal Constitutional Court | 17,631 |

| 20 | Federal Auditing Office | 86,668 |

| 23 | Ministry for Economic Cooperation and Development | 3,859,093 |

| 30 | Ministry for Education and Research | 8,540,422 |

| 32 | Federal Debt | 40,431,841 |

| 33 | Support | 8,821,008 |

| 60 | General Financial Administration | (261,766) |

| Total: | 254,300,000 | |

An appropriation bill, also known as supply bill or spending bill, is a proposed law that authorizes the expenditure of government funds. It is a bill that sets money aside for specific spending. In some democracies, approval of the legislature is necessary for the government to spend money.

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit: the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below.

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget presents the government's proposed revenues and spending for a financial year.

A budget is a calculation plan, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms.

A budget process refers to the process by which governments create and approve a budget, which is as follows:

PAYGO is the practice in the United States of financing expenditures with funds that are currently available rather than borrowed.

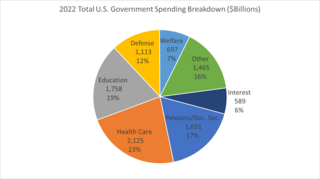

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

A government budget is a projection of the government's revenues and expenditure for a particular period of time often referred to as a financial or fiscal year, which may or may not correspond with the calendar year. Government revenues mostly include taxes while expenditures consist of government spending. A government budget is prepared by the government or other political entity. In most parliamentary systems, the budget is presented to the legislature and often requires approval of the legislature. Through this budget, the government implements economic policy and realizes its program priorities. Once the budget is approved, the use of funds from individual chapters is in the hands of government ministries and other institutions. Revenues of the state budget consist mainly of taxes, customs duties, fees and other revenues. State budget expenditures cover the activities of the state, which are either given by law or the constitution. The budget in itself does not appropriate funds for government programs, hence need for additional legislative measures. The word budget comes from the Old French bougette.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

The Budget of the State of Oklahoma is the governor's proposal to the Oklahoma Legislature which recommends funding levels to operate the state government for the next fiscal year, beginning July 1. Legislative decisions are governed by rules and legislation regarding the state budget process.

The United States federal budget consists of mandatory expenditures, discretionary spending for defense, Cabinet departments and agencies, and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

The Fiscal Responsibility and Budget Management Act, 2003 (FRBMA) is an Act of the Parliament of India to institutionalize financial discipline, reduce India's fiscal deficit, improve macroeconomic management and the overall management of the public funds by moving towards a balanced budget and strengthen fiscal prudence. The main purpose was to eliminate revenue deficit of the country and bring down the fiscal deficit to a manageable 3% of the GDP by March 2008. However, due to the 2007 international financial crisis, the deadlines for the implementation of the targets in the act was initially postponed and subsequently suspended in 2009. In 2011, given the process of ongoing recovery, Economic Advisory Council publicly advised the Government of India to reconsider reinstating the provisions of the FRBMA. N. K. Singh is currently the Chairman of the review committee for Fiscal Responsibility and Budget Management Act, 2003, under the Ministry of Finance (India), Government of India.

Party finance in Germany is the subject of statutory reports, which up to 35 parties file annually with the administration of the German parliament. Important questions pertaining to political party funding can be answered by analysing the data given in these financial reports: How much money is raised and spent by each party operating in Germany? What assets are at the disposal, which debts are on the books of German parties? For which purposes did parties spend their funds? From which itemized sources did a specific party collect its revenue? Who are the donors of major contributions and how much did each donor give during a specific calendar year?

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

The Swiss federal budget refers to the annual revenue and expenditures of the Swiss Confederation. As budget expenditures are issued on a yearly basis by the government, the federal council, and have to be approved by the parliament, they reflect the country's Fiscal policy.

The federal budget of Russia is the leading element of the budget system of Russia. The federal budget is a major state financial plan for the fiscal year, which has the force of law after its approval by the Russian parliament and signed into law by the President of Russia. That the federal budget is the primary means of redistribution of national income and gross domestic product through it mobilized the financial resources necessary to regulate the country's economic development, social policy and the strengthening of the national defense. The share of federal budget accounts for a significant portion of the distribution process, which is the allocation of funds between sectors of the economy, manufacturing and industrial areas, regions of the country.

In Malaysia, federal budgets are presented annually by the Government of Malaysia to identify proposed government revenues and spending and forecast economic conditions for the upcoming year, and its fiscal policy for the forward years. The federal budget includes the government's estimates of revenue and spending and may outline new policy initiatives. Federal budgets are usually released in October, before the start of the fiscal year. All of the Malaysian states also present budgets. Since state finances are dependent on money from the federal government, these budgets are usually released after the federal one.

The General State Budget comprises the spending and revenues of the Spanish central government. The PGE is considered the most important act that a government enacts in a year and determine its policy in most areas, as well as being the basis on which the State's economy will move in that year.

Government spending in the United States is the spending of the federal government of the United States and the spending of its state and local governments.

The 2023–24 Pakistan federal budget was the Federal Budget implemented by the government of Pakistan for the fiscal year 2023–24. The revised budget was presented to Parliament on 25 June, 2023 after Finance Minister Ishaq Dar introduced new taxes and expenditure cuts. The budget was accepted the next day. The Federal Budget entailed the raising of the Petroleum Development Levy (PDL) and lifting of all restrictions on imports. These revisions came after talks between the Prime Minister Shehbaz Sharif and IMF Director Kristalina Georgieva. The total budget outlay (expenditure) of the new budget was Rs14.46 trillion, 51% higher than the previous year. Federal Revenue for the budget was budgeted as Rs12.163 trillion, with Rs5.276 trillion being transferred to the provinces, leading to a net revenue of Rs6.887 trillion, 36.9% higher than the previous year. The FBR's budgetary target was set at Rs9.200 trillion, 23% than last year's target. The fiscal deficit being estimated at Rs6.923 trillion or 6.54% of the GDP. The budget claimed it added no new taxes, no increases in duties on import of essential items, exemptions of custom duties on certain agricultural goods, and an increase in government wages and minimum wage proposals. The budget included funding for a number of development initiatives to increase the nation's economic growth rate. The original outlays for the PDSP being estimated at Rs. 2.66 trillion for the development programme, which included a Rs. 950 billion federal Public Sector Development Programme (PSDP), that was approved by the Annual Plan Coordination Committee (APCC). The PDSP would later be further increased to Rs. 2,709 trillion, with Rs. 1,150 trillion being allocated to the Federal Portion, an increase of 58.2% from the previous budget of the development program. The government claimed to alleviate fiscal restrictions and boost sector growth, setting a GDP growth rate of 3.5 percent. This is despite claims of the government engaging in "poll politics", seen in the large Federal Development Budget. Ishaq Dar stated that “This budget should not be seen as an ‘election budget’ – it should be seen as a ‘responsible budget’" By the end of the financial year, Pakistan's real GDP growth rate was reduced to 0.3 percent.