Related Research Articles

Marc Lowell Andreessen is an American businessman and software engineer. He is the co-author of Mosaic, the first widely used web browser with a graphical user interface; co-founder of Netscape; and co-founder and general partner of Silicon Valley venture capital firm Andreessen Horowitz. He co-founded and later sold the software company Opsware to Hewlett-Packard. Andreessen is also a co-founder of Ning, a company that provides a platform for social networking websites and an inductee in the World Wide Web Hall of Fame. Andreessen's net-worth is estimated at $1.7 billion.

Benchmark is a venture capital firm founded in 1995 by Bob Kagle, Bruce Dunlevie, Andy Rachleff, Kevin Harvey, and Val Vaden.

Andrew Ross Sorkin is an American journalist and author. He is a financial columnist for The New York Times and a co-anchor of CNBC's Squawk Box. He is also the founder and editor of DealBook, a financial news service published by The New York Times. He wrote the bestselling book Too Big to Fail and co-produced a movie adaptation of the book for HBO Films. He is also a co-creator of the Showtime series Billions.

Chris Dixon is an American internet entrepreneur and investor. He is a general partner at the venture capital firm Andreessen Horowitz, and previously worked at eBay. He is also the co-founder and former CEO of Hunch. He was #1 on the Midas List in 2022. Dixon is known as a cryptocurrency and Web3 evangelist.

Andreessen Horowitz is a private American venture capital firm, founded in 2009 by Marc Andreessen and Ben Horowitz. The company is headquartered in Menlo Park, California. As of April 2023, Andreessen Horowitz ranks first on the list of venture capital firms by assets under management, with $35 billion as of March 2022.

Jeffrey D. Jordan is an American venture capitalist at the Silicon Valley firm Andreessen Horowitz and the former President and CEO of OpenTable.

WeWork Inc. is a provider of coworking spaces, including physical and virtual shared spaces, headquartered in New York City. As of December 31, 2022, the company operated 43.9 million square feet (4,080,000 m2) of space, including 18.3 million square feet (1,700,000 m2) in the United States and Canada, in 779 locations in 39 countries, and had 547,000 members, with a weighted average commitment term of 19 months.

Optimizely is an American company that provides digital experience platform software as a service. Optimizely provides A/B testing and multivariate testing tools, website personalization, and feature toggle capabilities, as well as web content management and digital commerce.

DigitalOcean Holdings, Inc. is an American multinational technology company and cloud service provider. The company is headquartered in New York City, New York, US, with 15 globally distributed data centers. DigitalOcean provides developers, startups, and SMBs with cloud infrastructure-as-a-service platforms.

Product Hunt is an American website to share and discover new products. It was founded by Ryan Hoover in November 2013.

Valar Ventures is a US-based venture capital fund founded by Andrew McCormack, James Fitzgerald and Peter Thiel in 2010. Historically, the majority of the firm's investments have been in technology startups based outside of Silicon Valley, including in Europe, the UK, the US and Canada. Valar Ventures originally spun out of Thiel Capital, Peter Thiel's global parent company based in San Francisco, and is now headquartered near Madison Square in Manhattan. The firm's namesake is the Valar of J. R. R. Tolkien's legendarium, who are god-like immortal spirits that chose to enter the mortal world to prepare it for their living creations.

Quirky was an invention platform that connected inventors with companies that specialized in a specific product category.

Martín Casado is a Spanish-born American software engineer, entrepreneur, and investor. He is a general partner at Andreessen Horowitz, and was a pioneer of software-defined networking, and a co-founder of Nicira Networks.

Property technology is used to refer to the application of information technology and platform economics to the real estate industry. Property technology overlaps with financial technology, including uses like online payment and booking systems. Grammatically, the portmanteau "proptech" is formed from two common nouns: "property" and "technology." As such, capitalizing it is grammatically incorrect.

eShares, Inc., doing business as Carta, Inc., is a San Francisco, California-based technology company that specializes in capitalization table management and valuation software. The company digitizes paper stock certificates along with stock options, warrants, and derivatives to allow companies, investors, and employees to manage their equity and track company ownership. The company also operates CartaX, a private stock exchange.

A unicorn bubble is a theoretical economic bubble that would occur when unicorn startup companies are overvalued by venture capitalists or investors. This can either occur during the private phase of these unicorn companies, or in an initial public offering. A unicorn company is a startup company valued at, or above, $1 billion US dollars.

Cadre is a New York–based financial technology company that provides individuals and institutions direct access to real estate investment properties, including commercial properties. The business and financial press describe it as a platform that "makes the real estate market more like the stock market" by allowing investors to select the individual transactions in which they participate, while investing a smaller amount than would be required to fully fund a transaction. For example, 12 institutional investors participated in a $60 million office building purchase. The firm was named to Forbes' "FinTech50" for 7 years in a row starting in 2016. In 2019, Cadre was the cover story of the Forbes "FinTech 50" issue. In 2018, a partnership with Goldman Sachs was announced through which Goldman Sachs' private wealth clients committed at least $250 million (USD) real estate investments through Cadre. In 2020, Cadre announced its "Direct Access" fund intended to include smaller investors with a $400 million target raise. The company also offers a managed portfolio service and a real estate secondary market, as well as a cash holdings account called "Cadre Cash". The company has announced plans to address racial injustice in the United States by investing at least 10% of its Direct Access fund investments with minority-owned operators and increasing its cash held in black-owned banks.

Ryan Williams is a technology entrepreneur best known as the CEO and founder of Cadre, a New York-based technology company. He was named to Fortune's "40 under 40" list for 2019, Forbes' "30 under 30" list for 2018, "Crain’s 40 under 40" list for 2017, is one of Commercial Observer’s "30 under 30" and has been profiled in Forbes, Ivy, and other publications. In February 2019 he was profiled and on the cover of Forbes Magazine in the "FinTech 50" issue; in 2022 he was a Business Insider "Top 100 Global Leaders Changing Business."

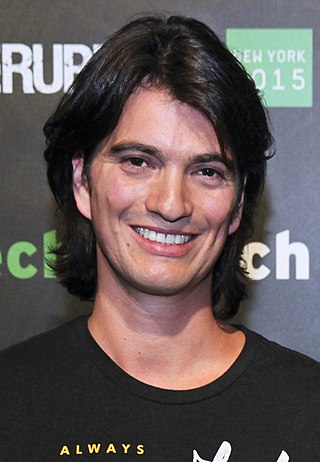

Adam Neumann is an Israeli-American billionaire businessman and investor. In 2010, he co-founded WeWork with Miguel McKelvey, where he was CEO from 2010 to 2019. In 2019, he co-founded a family office dubbed 166 2nd Financial Services with his wife, Rebekah Neumann, to manage their personal wealth, investing over a billion dollars in real estate and venture startups.

Joel Schreiber is a British-born American real estate developer, investor, and founder of Waterbridge Capital.

References

- ↑ Sraders, Anne (July 11, 2023). "Adam Neumann says his new company Flow, which raised $350 million from a16z, has only two choices: compete with WeWork or partner with it". Fortune .

- ↑ Vergolina, Victoria (October 5, 2022). "'Flow' is the New 'We' for Adam Neumann". Bloomberg News . Retrieved October 14, 2022.

- 1 2 Martin, Iain; Konrad, Alex; Farivar, Cyrus (August 23, 2022). "WeWork Cofounder Adam Neumann's New Real Estate Startup Sounds An Awful Lot Like One He Invested In Two Years Ago". Forbes .

- ↑ Jin, Berber (August 15, 2022). "Andreessen Horowitz Backs WeWork Co-Founder Adam Neumann's Real-Estate Startup Flow" . The Wall Street Journal .

- ↑ Molla, Rani (August 17, 2022). "Why does the WeWork guy get to fail up?". Vox Media . Retrieved August 19, 2022.

- 1 2 Ross Sorkin, Andrew; Giang, Vivian; Gandel, Stephen; Hirsch, Lauren; Livni, Ephrat (August 15, 2022). "Adam Neumann Gets a New Backer". The New York Times .

- 1 2 Ross Sorkin, Andrew (August 15, 2022). "Adam Neumann's New Company Gets a Big Check From Andreessen Horowitz". The New York Times . Retrieved August 19, 2022.

- ↑ "Archived copy". Archived from the original on November 14, 2023. Retrieved December 14, 2023.

{{cite web}}: CS1 maint: archived copy as title (link) CS1 maint: bot: original URL status unknown (link) - ↑ Putzier, Konrad (September 13, 2022). "Adam Neumann Handing Over Part of Property Holdings to Fund Startup" . The Wall Street Journal . Archived from the original on September 13, 2022.