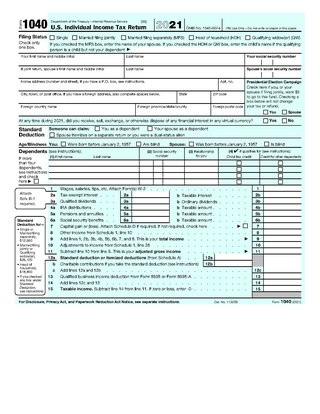

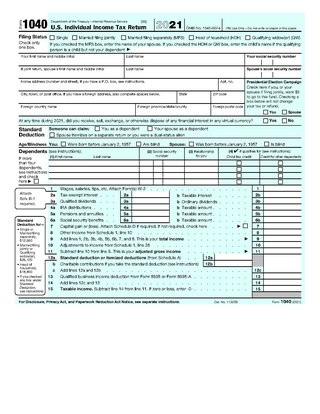

Form 1040 is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government.

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as determined on tax returns. PAYE may include withholding the employee portion of insurance contributions or similar social benefit taxes. In most countries, they are determined by employers but subject to government review. PAYE is deducted from each paycheck by the employer and must be remitted promptly to the government. Most countries refer to income tax withholding by other terms, including pay-as-you-go tax.

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, Individual Retirement Arrangements (IRAs). Other arrangements include employer-established benefit trusts and individual retirement annuities, by which a taxpayer purchases an annuity contract or an endowment contract from a life insurance company.

In the United States, a 403(b) plan is a U.S. tax-advantaged retirement savings plan available for public education organizations, some non-profit employers (only Internal Revenue Code 501(c)(3) organizations), cooperative hospital service organizations, and self-employed ministers in the United States. It has tax treatment similar to a 401(k) plan, especially after the Economic Growth and Tax Relief Reconciliation Act of 2001. Both plans also require that distributions start at age 72 (according to the rules updated in 2020), known as Required Minimum Distributions (RMDs). Distributions are typically taxed as ordinary income.

A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the United States are based on provisions of the Internal Revenue Code and the plans are regulated by the Department of Labor under the provisions of the Employee Retirement Income Security Act (ERISA).

The U.S. Railroad Retirement Board (RRB) is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country's railroad workers.

Three key types of withholding tax are imposed at various levels in the United States:

Form W-2 is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31. This deadline gives these taxpayers about 2 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. The Form W-2, along with Form W-3, generally must be filed by the employer with the Social Security Administration by the end of February. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service. In territories, the W-2 is issued with a two letter code indicating which territory, such as W-2GU for Guam. If corrections are made, it can be done on a W-2c.

A traditional IRA is an individual retirement arrangement (IRA), established in the United States by the Employee Retirement Income Security Act of 1974 (ERISA). Normal IRAs also existed before ERISA.

Form 1099 is one of several IRS tax forms used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips. The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds of returns.

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a Prélèvement à la source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

Substantially equal periodic payments (SEPP) are one of the exceptions in the United States Internal Revenue Code that allows a retiree to receive payments before age 591⁄2 from a retirement plan or deferred annuity without the 10% early distribution penalty under certain circumstances.

Form W-4 is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation to the employer. The W-4 form tells the employer the correct amount of federal tax to withhold from an employee's paycheck.

A self-directed individual retirement account is an individual retirement account (IRA) which allows alternative investments for retirement savings. Some examples of these alternative investments are real estate, private mortgages, private company stock, oil and gas limited partnerships, precious metals, digital assets, horses and livestock, and intellectual property. The increased investment options available in self-directed IRAs prompted the SEC to issue a public notice in 2011 due an increased risk of fraud in alternative assets.

Taxpayers in the United States may face various penalties for failures related to Federal, state, and local tax matters. The Internal Revenue Service (IRS) is primarily responsible for charging these penalties at the Federal level. The IRS can assert only those penalties specified imposed under Federal tax law. State and local rules vary widely, are administered by state and local authorities, and are not discussed herein.

The United States Internal Revenue Service uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

Tax information reporting in the United States is a requirement for organizations to report wage and non-wage payments made in the course of their trade or business to the Internal Revenue Service (IRS). This area of government reporting and corporate responsibility is continuously growing, carrying with it a large number of regulatory requirements established by the federal government and the states. There are currently more than 30 types of tax information returns required by the federal government, and they provide the primary cross-checking measure the IRS has to verify accuracy of tax returns filed by individual taxpayers.

A Solo 401(k) (also known as a Self Employed 401(k) or Individual 401(k)) is a 401(k) qualified retirement plan for Americans that was designed specifically for employers with no full-time employees other than the business owner(s) and their spouse(s). The general 401(k) plan gives employees an incentive to save for retirement by allowing them to designate funds as 401(k) funds and thus not have to pay taxes on them until the employee reaches retirement age. In this plan, both the employee and his/her employer may make contributions to the plan. The Solo 401(k) is unique because it only covers the business owner(s) and their spouse(s), thus, not subjecting the 401(k) plan to the complex ERISA (Employee Retirement Income Security Act of 1974) rules, which sets minimum standards for employer pension plans with non-owner employees. Self-employed workers who qualify for the Solo 401(k) can receive the same tax benefits as in a general 401(k) plan, but without the employer being subject to the complexities of ERISA.

In the United States, Form 1099-MISC is a variant of Form 1099 used to report miscellaneous income. One notable use of Form 1099-MISC was to report amounts paid by a business to a non-corporate US resident independent contractor for services, but starting tax year 2020, this use was moved to the separate Form 1099-NEC. The ubiquity of the form has also led to use of the phrase "1099 workers" or "the 1099 economy" to refer to the independent contractors themselves. Other uses of Form 1099-MISC include rental income, royalties, and Native American gaming profits.

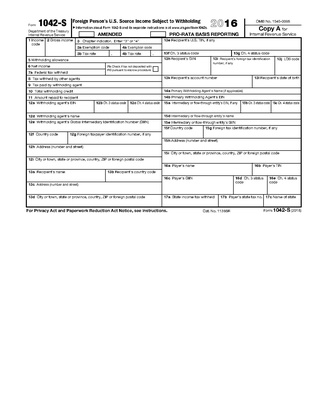

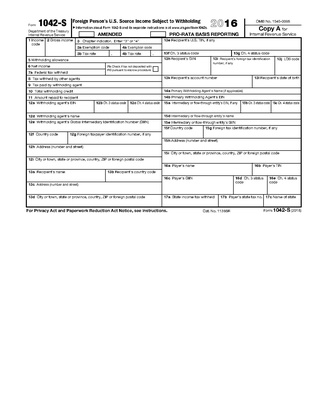

Forms 1042, 1042-S and 1042-T are United States Internal Revenue Service tax forms dealing with payments to foreign persons, including non-resident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts.