The economy of Zimbabwe is a gold standard based economy. Zimbabwe has a $44 billion dollar informal economy in PPP terms which translates to 64.1% of the total economy. Agriculture and mining largely contribute to exports. The economy is estimated to be at $73 billion at the end of 2023.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

In economics, cash is money in the physical form of currency, such as banknotes and coins.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

The Indian rupee is the official currency in India. The rupee is subdivided into 100 paise. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management based on the Reserve Bank of India Act, 1934.

The Reserve Bank of Zimbabwe is the central bank of Zimbabwe and is headquartered in Harare.

Gideon Gono is a former Governor of the Reserve Bank of Zimbabwe, serving from 2003 to 2013, and is the former CEO of the CBZ Bank Limited.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

Metallism is the economic principle that the value of money derives from the purchasing power of the commodity upon which it is based. The currency in a metallist monetary system may be made from the commodity itself or it may use tokens redeemable in that commodity. Georg Friedrich Knapp (1842–1926) coined the term "metallism" to describe monetary systems using coin minted in silver, gold or other metals.

Hyperinflation in Zimbabwe is an ongoing period of currency instability in Zimbabwe which, using Cagan's definition of hyperinflation, began in February 2007. During the height of inflation from 2008 to 2009, it was difficult to measure Zimbabwe's hyperinflation because the government of Zimbabwe stopped filing official inflation statistics. However, Zimbabwe's peak month of inflation is estimated at 79.6 billion percent month-on-month, 89.7 sextillion percent year-on-year in mid-November 2008.

The banknotes of Zimbabwe were physical forms of Zimbabwe's first four incarnations of the dollar, from 1980 to 2009. The banknotes of the first dollar replaced those of the Rhodesian dollar at par in 1981, one year after the proclamation of independence. The Reserve Bank of Zimbabwe issued most of the banknotes and other types of currency notes in its history, including the bearer cheques and special agro-cheques that circulated between 15 September 2003 and 31 December 2008: the Standard Chartered Bank also issued their own emergency cheques from 2003 to 2004.

The Zimbabwean dollar was the name of four official currencies of Zimbabwe from 1980 to 12 April 2009. During this time, it was subject to periods of extreme inflation, followed by a period of hyperinflation.

Circle is a peer-to-peer payments technology company that now manages stablecoin USDC, a cryptocurrency the value of which is pegged to the U.S. dollar. It was founded by Jeremy Allaire and Sean Neville in October 2013. Circle is headquartered in Boston, Massachusetts. USDC, the second largest stablecoin worldwide, is designed to hold at or near a stable price of $1. The majority of its stablecoin collateral is held in short-term U.S. government securities.

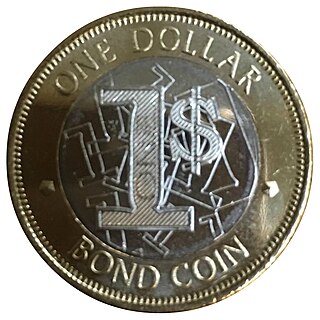

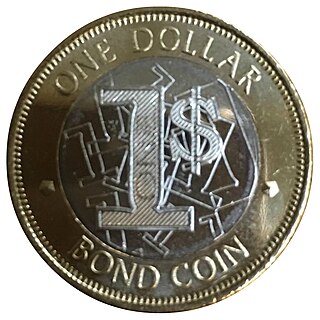

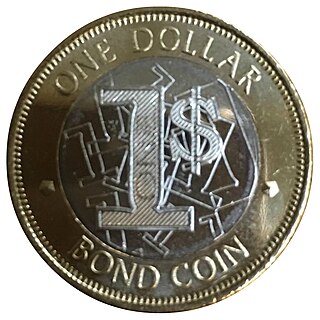

The Reserve Bank of Zimbabwe began to release Zimbabwean bond coins on 18 December 2019. The coins are supported by a US$50 million facility extended to the Reserve Bank of Zimbabwe by Afreximbank. To date coins worth US$15 million have been struck out of the total $50 million available. The coins were first issued in denominations of 1, 5, 10, and 25 cents and are pegged to the corresponding values in U.S. dollars. A 50 cents bond coin was released in March 2015.

John Panonetsa Mangudya is a former governor of the Reserve Bank of Zimbabwe. He was appointed in March 2014 by the then Zimbabwean president, Robert Mugabe, and began his tenure as governor on 1 May that year. His second 5 year term ended on 28 March 2024. He succeeded Gideon Gono as the governor of Zimbabwe's central bank and became the nation's 6th substantial exchequer.

An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding, although a private ICO which does not seek public investment is also possible. In an ICO, a quantity of cryptocurrency is sold in the form of "tokens" ("coins") to speculators or investors, in exchange for legal tender or other cryptocurrencies such as Bitcoin or Ether. The tokens are promoted as future functional units of currency if or when the ICO's funding goal is met and the project successfully launches.

Zimbabwean Bonds were a form of legal tender near money released by the Reserve Bank of Zimbabwe which attempts to resolve Zimbabwe's lack of currency. Bonds and were pegged against the U.S. dollar at a 1:1 fixed exchange rate and backed by the country's reserve. Since abandoning the Zimbabwean dollar in 2009 after it went into hyperinflation the country began using a number of foreign currencies including the U.S. dollar, South African rand, British pound and Chinese yuan as a means of exchange. The inability to print these currencies led to a shortage of money with banks issuing limits on withdrawals.

Zimbabwean bond notes are a form of banknote in circulation in Zimbabwe. Released by the Reserve Bank of Zimbabwe, the notes were stated to not be a currency in itself but rather legal tender near money pegged equally against the U.S. dollar. In 2014, prior to the release of bond notes, a series of bond coins entered circulation.

The Zimbabwean dollar, also known as the Zimdollar or Real Time Gross Settlement (RTGS) dollar, was the currency of Zimbabwe from February 2019 to April 2024. It was the only legally permitted currency for trade in Zimbabwe from June 2019 to March 2020, after which foreign currencies were legalised again.

The Zimbabwe Gold (ZiG) has been the official currency of Zimbabwe since 8 April 2024, backed by US$575 million worth of hard assets: foreign currencies, gold, and other precious metals. It replaced the Zimbabwean dollar, which suffered from rapid depreciation, with the official exchange rate surpassing 30,000 Zimbabwean dollars per U.S. dollar on 5 April 2024, whilst the parallel market rate reached 40,000 per U.S. dollar. Annual inflation in Zimbabwe hit 55.3% in March 2024.