Blackstone Inc. is an American alternative investment management company based in New York City. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate. Blackstone is also active in credit, infrastructure, hedge funds, insurance, secondaries, and growth equity. As of June 2023, the company's total assets under management were approximately US$1 trillion, making it the largest alternative investment firm globally.

Soros Fund Management, LLC is a privately held American investment management firm. It is currently structured as a family office, but formerly as a hedge fund. The firm was founded in 1970 by George Soros and, in 2010, was reported to be one of the most profitable firms in the hedge fund industry, averaging a 20% annual rate of return over four decades. It is headquartered at 250 West 55th Street in New York. As of 2023, Soros Fund Management, LLC had $25 billion in AUM.

Citadel LLC is an American multinational hedge fund and financial services company. Founded in 1990 by Ken Griffin, it has more than $58 billion in assets under management as of January 2024. The company has over 2,800 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Griffin owns approximately 85% of the firm. As of December 2022, Citadel is of the most profitable hedge funds in the world, posting $74 billion in net gains since its inception in 1990, making it the most successful hedge fund in history, according to CNBC.

Perella Weinberg Partners L.P. is an American global financial services firm focused on investment banking advisory services.

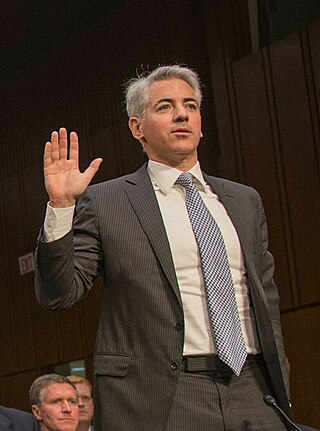

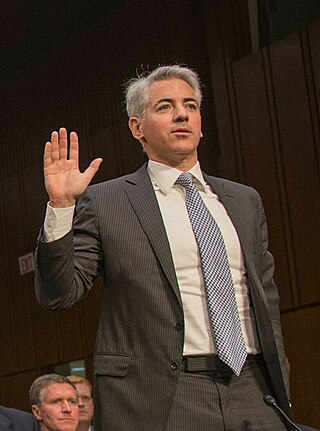

William Albert Ackman is an American billionaire hedge fund manager who is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company. His investment approach has made him an activist investor. As of January 2024, Ackman's net worth was estimated at $4 billion by Forbes.

Apollo Global Management, Inc. is an American asset management firm that primarily invests in alternative assets. It provides investment management and invests in credit, private equity, and real assets. As of 2022, the company had $548 billion of assets under management, including $392 billion invested in credit, including mezzanine capital, hedge funds, non-performing loans, and collateralized loan obligations, $99 billion invested in private equity, and $46.2 billion invested in real assets, which includes real estate and infrastructure. The company invests money on behalf of pension funds, financial endowments, and sovereign wealth funds, as well as other institutional and individual investors.

Harbert Management Corporation, based in Birmingham, Alabama, is a U.S. investment management company founded in 1993 by Raymond J. Harbert.

Man GLG is a discretionary investment manager and a wholly owned subsidiary of British alternative investment manager Man Group plc. It is a diversified and multi-strategy fund manager that operates strategies including equity long-short funds, convertible arbitrage funds, emerging market funds and long-only mutual funds. The firm is also a founding member of the Hedge Fund Standards Board and a signatory of the Principles for Responsible investment. As of 2022, Man GLG had $35.4 billion assets under management.

Sculptor Capital Management is an American global diversified alternative asset management firm. They are one of the largest institutional alternative asset managers in the world.

Paulson & Co. Inc. is a family office based in New York City, previously it was a hedge fund established by John Paulson in 1994. It specializing in "global merger, event arbitrage and credit strategies", the firm had a relatively low profile on Wall Street until its hugely successful bet against the subprime mortgage market in 2007. At one time the company had offices in London and Dublin.

Clarium Capital Management LLC was an American investment management and hedge fund company pursuing a global macro strategy. It was founded in San Francisco in 2002 by Peter Thiel, co-founder of PayPal and early investor in Facebook. Its assets under management grew to $8 billion in 2008, after which a series of unprofitable investments and client redemptions shrank that to about $350 million as of 2011.

Ligado Networks, formerly known as LightSquared, is an American satellite communications company.

Elliott Investment Management is an American investment management firm. It is also one of the largest activist funds in the world.

Pershing Square Capital Management is an American hedge fund management company founded and run by Bill Ackman, headquartered in New York City.

Philip A. Falcone is an American businessman and the founder of Harbinger Capital and LightSquared.

Millennium Management is an investment management firm with a multistrategy hedge fund offering. In 2023, it was one of the world's largest alternative asset management firms with over $61.1 billion assets under management as of January 2024. The firm operates in America, Europe and Asia. As of 2022, Millennium had posted the fourth highest net gains of any hedge fund since its inception in 1989.

Raymond Jones Harbert is an American business executive, investor and philanthropist from Alabama. He is the founder, chairman and chief executive officer of Harbert Management Corporation (HMC), a global private investment firm with US$7.8 billion of assets under management. He donated US$25 million to Auburn University as part of a US$40 million donation pledge.

Mudrick Capital Management is an investment firm specializing in special situations and event driven investing. The firm was founded by Jason Mudrick, its current Chief Investment Officer, in 2009. The firm is located in New York City and, as of June 2022, managed approximately $3.3 billion in assets.

Melvin Capital Management LP was an American investment management firm based in New York City. It was founded in 2014 by Gabriel Plotkin, who named the firm after his late grandfather.

Tiger Global Management, LLC is an American investment firm founded by Chase Coleman III, a former Tiger Management employee under Julian Robertson, in March 2001. It mainly focuses on internet, software, consumer, and financial technology companies.