Corporate titles or business titles are given to corporate officers to show what duties and responsibilities they have in the organization. Such titles are used by publicly and privately held for-profit corporations, cooperatives, non-profit organizations, educational institutions, partnerships, and sole proprietorships that also confer corporate titles.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. In Forbes Global 2000 2023, Goldman Sachs ranked 34th. It is considered a systemically important financial institution by the Financial Stability Board.

John Alexander Thain is an American financial executive and investment banker. He was president and co-COO of Goldman Sachs, and then CEO of the New York Stock Exchange. Thain then became the last chairman and CEO of Merrill Lynch & Co. before its merger with Bank of America. He was designated to become president of global banking, securities, and wealth management at the newly combined company, but resigned on January 22, 2009. Ken Lewis, CEO of Bank of America, reportedly forced Thain to step down after several controversies, such as the losses at Merrill Lynch which proved to be far larger than previously estimated, and the award of huge executive bonuses. Thain then was chairman and CEO of the CIT Group. He has been a board member of Uber since 2017.

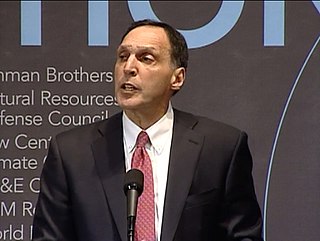

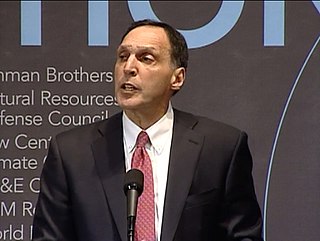

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from 1 April 1994 after the firm's spinoff from American Express until 15 September 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

Gary David Cohn is an American businessman and philanthropist who served as the 11th Director of the National Economic Council and chief economic advisor to President Donald Trump from 2017 to 2018. He managed the administration's economic policy agenda. Before serving in the White House, Cohn was president and COO of Goldman Sachs, where he worked for more than 25 years. Cohn was appointed vice-chairman of IBM on January 5, 2021.

Lloyd Craig Blankfein is an American investment banker who has served as senior chairman of Goldman Sachs since 2019, and chairman and chief executive from 2006 until the end of 2018. Before leading Goldman Sachs, he was the company's president and chief operating officer (COO) from 2004 to 2006, serving under then-CEO Henry Paulson.

Alan David Schwartz is an American businessman and is the executive chairman of Guggenheim Partners, an investment banking firm based in Chicago and New York City. He was previously the last president and chief executive officer of Bear Stearns when the Federal Reserve Bank of New York forced its March 2008 acquisition by JPMorgan Chase & Co.

John Lawson Thornton is an American businessman and professor and director of the Global Leadership Program at Tsinghua University in Beijing. He is also executive chairman of Barrick Gold Corporation and non-executive chairman of PineBridge Investments. Thornton stepped down as co-president of Goldman Sachs in 2003.

David Alan Viniar was the CFO and executive vice president at Goldman Sachs from 1999 until January 31, 2013. He is currently on the board of directors of Goldman Sachs.

Anthony Noto is an American businessman, the CEO of SoFi, and the former COO of Twitter.

Yusuf Abdulla Yusuf Akbar Alireza is the chief executive officer (CEO) and co-founder of ARP Global Capital, a fund based in Dubai. In addition to his time spent at Goldman Sachs where he was a partner and co-head of the Asia-Pacific region, he also served as CEO of Noble Group, the Hong Kong energy conglomerate, and a Fortune Global 500 company, before resigning in May 2016.

Ramon Martin Chavez is an American investment banker and entrepreneur. He is vice chairman and partner of Sixth Street Partners. Previously, he served in a variety of senior roles at Goldman Sachs, including chief information officer (2014–2017), chief financial officer, and global co-head of the firm's Securities Division. Marty was also a partner and member of Goldman's management committee. He was the chief technology officer and co-founder of Quorum Software Systems and CEO and co-founder of Kiodex. He is chairman of the board of computational pharmaceutical company Recursion, Board Observer of biotech company Earli and longevity biopharma company Cambrian Biopharma, and board member of Alphabet Inc.

David Michael Solomon is an American investment banker and the chief executive officer (CEO) of Goldman Sachs, a position he has held since October 2018. He has also been chairman of the bank since January 2019. Before assuming his role as CEO, Solomon was president and chief operating officer from January 2017 to September 2018, and was joint head of the investment banking division from July 2006 to December 2016. Solomon formally succeeded Lloyd Blankfein, the previous CEO, on October 1, 2018, and was named chairman after Blankfein's retirement.

Thomas C. Naratil is an American business executive in the financial industry. After serving as president of both UBS Wealth Management Americas and UBS Americas since early 2016, Naratil was appointed CEO of UBS Americas Holding LLC and became co-president of Global Wealth Management of UBS Group AG and UBS AG in early 2018.

Goldman Sachs, an investment bank, has been the subject of controversies. The company has been criticized for lack of ethical standards, working with dictatorial regimes, close relationships with the U.S. federal government via a "revolving door" of former employees, and driving up prices of commodities through futures speculation. It has also been criticized by its employees for 100-hour work weeks, high levels of employee dissatisfaction among first-year analysts, abusive treatment by superiors, a lack of mental health resources, and extremely high levels of stress in the workplace leading to physical discomfort.

Jeff Currie is an economist and currently Chief Strategy Officer of Energy Pathways at The Carlyle Group. He is the former Global Head of Commodities Research in the Global Investment Research Division at Goldman Sachs. He rose to prominence during the 2000s by forecasting the commodity super-cycle and oil spiking above $100 a barrel. He has been labelled a "maverick" for making bold calls that 'pack a punch'. During the 2010s he was known for forecasting oil prices to stay 'lower for longer' to end the shale supply glut, whilst in more recent times his stance has shifted from bearish to considerably bullish, calling for a new commodities "supercycle" in late 2020 driven by underinvestment in supply, a process he has dubbed "the revenge of the old economy."

Simon Paul Dingemans is an English former banker and businessman. Until May 2019 he was chief financial officer at GlaxoSmithKline. In July 2019 he was appointed chair of the Financial Reporting Council, and was set to lead its transition into the Audit, Reporting and Governance Authority, but left in May 2020.

The Bank of London is a British clearing, correspondent and wholesale bank operating in the United Kingdom, the United States and Europe. The bank was founded by Anthony Watson. In 2021, Harvey Schwartz was appointed as Group Chairperson and Non-executive Director. The bank launched on 30th November 2021 and in doing so became the UK's sixth clearing bank.