Related Research Articles

The Second Anglo-Boer War had no sooner commenced with the ultimatum of the Transvaal Republic on 9 October 1899, than Mr Schreiner found himself called upon to deal with the conduct of Cape rebels. The rebels joined the invading forces of President Steyn, whose false assurances Mr Schreiner had offered to an indignant House of Assembly only a few weeks before. The war on the part of the Republics was evidently not to be merely one of self-defence. It was one of aggression and aggrandisement. Mr Schreiner ultimately addressed, as prime minister, a sharp remonstrance to President Steyn for allowing his burghers to invade the colony. He also co-operated with Sir Alfred Milner, and used his influence to restrain the Bond.

The Department of Bantu Education was an organisation created by the National Party government of South Africa in 1953. The Bantu Education Act, 1953 provided the legislative framework for this department.

Elections in South Africa are held for the National Assembly, provincial legislatures and municipal councils. Elections follow a five-year cycle, with national and provincial elections held simultaneously and municipal elections held two years later. The electoral system is based on party-list proportional representation, which means that parties are represented in proportion to their electoral support. For municipal councils there is a mixed-member system in which wards elect individual councillors alongside those named from party lists.

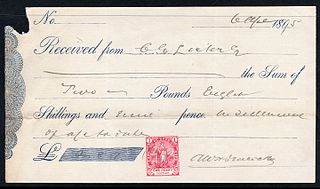

A stamp act is any legislation that requires a tax to be paid on the transfer of certain documents. Those who pay the tax receive an official stamp on their documents, making them legal documents. A variety of products have been covered by stamp acts including playing cards, dice, patent medicines, cheques, mortgages, contracts, marriage licenses and newspapers. The items may have to be physically stamped at approved government offices following payment of the duty, although methods involving annual payment of a fixed sum or purchase of adhesive stamps are more practical and common.

The Basuto Gun War, also known as the Basutoland Rebellion, was a conflict between the Basuto and the British Cape Colony. It lasted from 13 September 1880 to 29 April 1881 and ended in a Basuto victory.

The Chilembwe uprising was a rebellion against British colonial rule in Nyasaland which took place in January 1915. It was led by John Chilembwe, an American-educated Baptist minister. Based around his church in the village of Mbombwe in the south-east of the colony, the leaders of the revolt were mainly from an emerging black middle class. They were motivated by grievances against the British colonial system, which included forced labour, racial discrimination and new demands imposed on the African population following the outbreak of World War I.

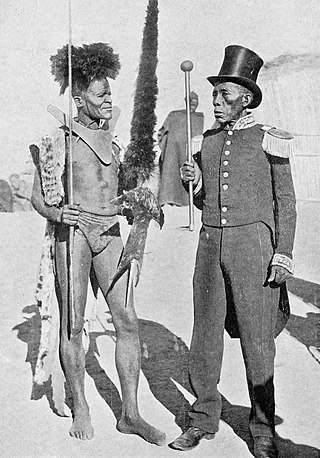

Nama are an African ethnic group of South Africa, Namibia and Botswana. They traditionally speak the Nama language of the Khoe-Kwadi language family, although many Nama also speak Afrikaans. The Nama People are the largest group of the Khoikhoi people, most of whom have disappeared as a group, except for the Namas. Many of the Nama clans live in Central Namibia and the other smaller groups live in Namaqualand, which today straddles the Namibian border with South Africa.

Early American currency went through several stages of development during the colonial and post-Revolutionary history of the United States. John Hull was authorized by the Massachusetts legislature to make the earliest coinage of the colony in 1652.

The Boston Tea Party was an American political and mercantile protest on December 16, 1773, by the Sons of Liberty in Boston in colonial Massachusetts. The target was the Tea Act of May 10, 1773, which allowed the British East India Company to sell tea from China in American colonies without paying taxes apart from those imposed by the Townshend Acts. The Sons of Liberty strongly opposed the taxes in the Townshend Act as a violation of their rights. In response, the Sons of Liberty, some disguised as Native Americans, destroyed an entire shipment of tea sent by the East India Company.

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office. Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

The Mineral Revolution is a term used by historians to refer to the rapid industrialisation and economic changes which occurred in South Africa from the 1860s onwards. The Mineral Revolution was largely driven by the need to create a permanent workforce to work in the mining industry, and saw South Africa transformed from a patchwork of agrarian states to a unified, industrial nation. In political terms, the Mineral Revolution had a significant impact on diplomacy and military affairs. Finally, the policies and events of the Mineral Revolution had an increasingly negative impact on race relations in South Africa, and formed the basis of the apartheid system, which dominated South African society for a century. The Mineral Revolution was caused by the discovery of diamonds in Kimberly in 1867 and also by the discovery of gold in Witwatersrand in 1886. The mineral mining revolution laid the foundations of racial segregation and the control of white South Africans over black South Africans. The Mineral Revolution changed South Africa from being an agricultural society to becoming the largest gold producing country in the world.

The Colony of Natal was a British colony in south-eastern Africa. It was proclaimed a British colony on 4 May 1843 after the British government had annexed the Boer Republic of Natalia, and on 31 May 1910 combined with three other colonies to form the Union of South Africa, as one of its provinces. It is now the KwaZulu-Natal province of South Africa.

Colonial Nigeria was ruled by the British Empire from the mid-nineteenth century until 1960 when Nigeria achieved independence. Britain annexed Lagos in 1861 and established the Oil River Protectorate in 1884. British influence in the Niger area increased gradually over the 19th century, but Britain did not effectively occupy the area until 1885. Other European powers acknowledged Britain's dominance over the area in the 1885 Berlin Conference.

The Hut Tax War of 1898 was a resistance in the newly annexed Protectorate of Sierra Leone to a new tax imposed by the colonial governor. The British had established the Protectorate to demonstrate their dominion over the territory to other European powers following the Berlin Conference of 1884–1885. The tax constituted a major burden on residents of the Protectorate; 24 indigenous chiefs had signed a petition against it, explaining its adverse effects on their societies, to no avail. The immediate catalyst for hostilities was an attempt by British colonial officials to arrest the Temne chief Bai Bureh, a general and war strategist, on the basis of rumours. Although often depicted as the chief who initiated an armed resistance in the North in 1898, late 20th-century sources suggest he was unfairly identified by the colonial government as a primary instigator, with the government's hostile actions provoking the war. Later that year, resistance arose in the south by the leading Mende.

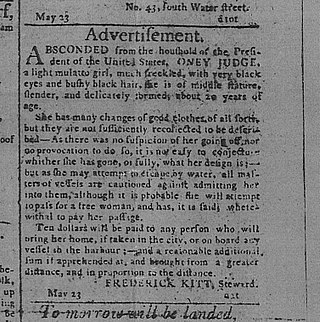

When the Dutch and Swedes established colonies in the Delaware Valley of what is now Pennsylvania, in North America, they quickly imported enslaved Africans for labor; the Dutch also transported them south from their colony of New Netherland. Enslavement was documented in this area as early as 1639. William Penn and the colonists who settled in Pennsylvania tolerated slavery. Still, the English Quakers and later German immigrants were among the first to speak out against it. Many colonial Methodists and Baptists also opposed it on religious grounds. During the Great Awakening of the late 18th century, their preachers urged slaveholders to free their slaves. High British tariffs in the 18th century discouraged the importation of additional slaves, and encouraged the use of white indentured servants and free labor.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", where in income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

Cape of Good Hope issued revenue stamps from 1864 to 1961. There were a number of different stamps for several taxes.

George Way Harley was an American Methodist medical missionary. He spent 35 years in Ganta, Liberia, where he established Ganta Hospital, a school and a church. He was known for his research into the local culture, and received many honors from the Liberian government and from American and British institutions. Major collections of ceremonial masks purchased by Harley in Liberia are held in the Peabody Museum of Archaeology and Ethnology at Harvard University and the Anthropology Department of the College of William & Mary.

The Griqua coinage was the first community coinage in South Africa and was introduced by the London Missionary Society.

The National Convention, also known as the Convention on the Closer Union of South Africa or the Closer Union Convention, was a constitutional convention held between 1908 and 1909 in Durban, Cape Town and Bloemfontein. The convention led to the adoption of the South Africa Act by the British Parliament and thus to the creation of the Union of South Africa. The four colonies of the area that would become South Africa - the Cape Colony, Natal Colony, the Orange River Colony and the Transvaal Colony - were represented at the convention, along with a delegation from Rhodesia. There were 33 delegates in total, with the Cape being represented by 12, the Transvaal eight, the Orange River five, Natal five, and Rhodesia three. The convention was held behind closed doors, in the fear that a public affair would lead delegates to refuse compromising on contentious areas of disagreement. All the delegates were white men, a third of them were farmers, ten were lawyers, and some were academics. Two-thirds had fought on either side of the Second Boer War.

References

- 1 2 3 4 Pakenham, Thomas (1992) [1991]. "Chap. 27 Rhodes, Raiders and Rebels". The Scramble for Africa. London: Abacus. pp. 497–498. ISBN 0-349-10449-2.

- ↑ Garran, Robert (1908). "XXII - Sources of Revenue". The government of South Africa. Cape Town: Central News Agency. pp. n157. Retrieved 29 August 2009.

- 1 2 Garran, Robert (1908). "XXII - Sources of Revenue". The government of South Africa. Cape Town: Central News Agency. pp. n159. Retrieved 29 August 2009.

- ↑ "The Uganda Agreement of 1900". Buganda Home Page. Archived from the original on 25 October 2021. Retrieved 19 March 2007.

- ↑ "Zambia". ThinkQuest. Oracle Foundation. Archived from the original on 13 May 2008. Retrieved 19 March 2007.

- ↑ "Tax Wars". BBC Online. BBC. Retrieved 19 March 2007.

- ↑ "Home Frontier and Foreign Missionary Society of the United Brethren in Christ" (PDF). United Nations.

- ↑ President Arthur Barclay (1904–1912): External and internal threats to Americo-Liberian rule Archived 22 February 2020 at the Wayback Machine . liberiapastandpresent.org.

- ↑ "Liberia from 1930 to 1944". Personal.denison.edu. Archived from the original on 16 July 2020. Retrieved 13 May 2013.

- 1870 House Duty Act (1870, Act 9)

- ↑ For houses valued under £100, five shillings were levied; for houses valued between £100 and £500, ten shillings were levied; for houses valued between £500 and £1,000, twenty shillings were levied; and for every additional £500 above, an additional ten shillings were added to the tax amount.