The Government Pension Fund of Norway comprises two entirely separate sovereign wealth funds owned by the government of Norway.

An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, real estate investment trusts, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM).

The Abu Dhabi Investment Authority is a sovereign wealth fund owned by the Emirate of Abu Dhabi in the United Arab Emirates, founded to invest funds on behalf of the Government of Abu Dhabi. It manages the emirate's excess oil reserves and is estimated to manage $853 billion. ADIA is one of the largest sovereign wealth funds in the world.

GIC Private Limited is a Singaporean sovereign wealth fund that manages the country's foreign reserves. Established by the Government of Singapore in 1981 as the Government of Singapore Investment Corporation, of which "GIC" is derived from as an acronym, its mission is to preserve and enhance the international purchasing power of the reserves, with the aim to achieve good long-term returns above global inflation over the investment time horizon of 20 years.

The Kuwait Investment Authority (KIA) is the Middle East's oldest sovereign wealth fund, managing the state’s reserve and the state’s future generation fund (FGF).

The State Administration of Foreign Exchange (SAFE) of the People's Republic of China is an administrative agency under the State Council tasked with drafting rules and regulations governing foreign exchange market activities, and managing the state foreign-exchange reserves, which at the end of December 2016 stood at $3.01 trillion for the People's Bank of China. The current director is Zhu Hexin.

The Stabilization fund of the Russian Federation was a sovereign wealth fund established based on a resolution of the Government of Russia on 1 January 2004, as a part of the federal budget to balance the federal budget at the time of when oil price falls below a cut-off price, currently set at US$27 per barrel.

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

Mubadala Investment Company PJSC, or simply Mubadala, is an Emirati state-owned holding company that acts as one of the sovereign wealth funds of the Emirate of Abu Dhabi. The company was established in 2017 when then-named Mubadala Development Company and the International Petroleum Investment Company (IPIC) merged.

China Investment Corporation is a sovereign wealth fund that manages part of China's foreign exchange reserves. China's largest sovereign fund, CIC was established in 2007 with about US$200 billion of assets under management, a number that grew to US$1,200 billion in 2021 and US$1,350 billion in 2023.

The Canada Pension Plan Investment Board, operating as CPP Investments, is a Canadian Crown corporation established by way of the 1997 Canada Pension Plan Investment Board Act to oversee and invest the funds contributed to and held by the Canada Pension Plan (CPP).

The Korea Investment Corporation is a sovereign wealth fund established by the government of South Korea in 2005. Its mission is to preserve and enhance the long-term purchasing power of South Korea's sovereign wealth through efficient management of public funds in the international financial markets. KIC manages assets entrusted by the Government, the Bank of Korea, and other public funds as defined under the National Finance Act. KIC directly invests the entrusted assets or re-entrusts the assets to external managers. As of December 31, 2023, KIC has $189.4 billion assets under management.

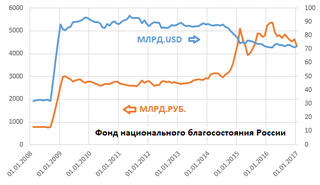

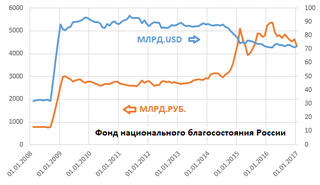

The Russian National Wealth Fund is Russia's sovereign wealth fund. It was created after the Stabilization Fund of the Russian Federation was split into two separate investment funds on 30 January 2008.

The Qatar Investment Authority is Qatar's sovereign wealth fund. The QIA was founded by the State of Qatar in 2005 to strengthen the country's economy by diversifying into new asset classes. In October 2023, the QIA has an estimated $475 billion of assets under management.

The National Development Fund of Iran is Iran's sovereign wealth fund. It was founded in 2011 to supplement the Oil Stabilization Fund. NDFI is independent of the government's budget. Based on Article 84 of the Fifth Five-year Socio-Economic Development Plan (2010–2015), the National Development Fund was established to transform oil and gas revenues to productive investment for future generation. It is a member of the International Forum of Sovereign Wealth Funds and therefore is signed up to the Santiago Principles on best practice in managing sovereign wealth funds. Withdrawing any money from this fund requires Khamenei's permission.

The Russian Direct Investment Fund is Russia's sovereign wealth fund established in 2011 by the Russian government to make investments in companies of high-growth sectors of the Russian economy. Its mandate is to co-invest alongside the world's largest institutional investors, direct investment funds, sovereign wealth funds and leading companies.

Indonesia and the United Arab Emirates (UAE) established diplomatic relations in 1976. The diplomatic relations are important because both share the solidarity as Muslim majority countries. Indonesia has an embassy in Abu Dhabi, while the United Arab Emirates has an embassy in Jakarta. Both countries are members of the World Trade Organization (WTO), The Non-Aligned Movement and Organisation of Islamic Cooperation (OIC).

The Public Investment Fund is the sovereign wealth fund of Saudi Arabia. It is among the largest sovereign wealth funds in the world with total estimated assets of US$925 billion. It was created in 1971 for the purpose of investing funds on behalf of the Government of Saudi Arabia. The wealth fund is controlled by Crown Prince Mohammed bin Salman, Saudi Arabia's de facto ruler since 2015.

The Sovereign Fund of Egypt is a Sovereign wealth fund, owned by the Arab Republic of Egypt, Its established in 2018 by Law No. 177 of 2018 and amended by Law No. 177 of 2020, with the aim of contributing to the financial economic development of Egypt through the management of funds and assets owned or transferred to it, as well as investing in many different economic activities.