The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this has been increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds".

In the United States, banking had begun by the 1780s, along with the country's founding. It has developed into a highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services, such as private banking, asset management, and deposit security.

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" and "thrift" are mainly used in the United States; similar institutions in the United Kingdom, Ireland and some Commonwealth countries include building societies and trustee savings banks. They are often mutually held, meaning that the depositors and borrowers are members with voting rights, and have the ability to direct the financial and managerial goals of the organization like the members of a credit union or the policyholders of a mutual insurance company. While it is possible for an S&L to be a joint-stock company, and even publicly traded, in such instances it is no longer truly a mutual association, and depositors and borrowers no longer have membership rights and managerial control. By law, thrifts can have no more than 20 percent of their lending in commercial loans—their focus on mortgage and consumer loans makes them particularly vulnerable to housing downturns such as the deep one the U.S. experienced in 2007.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining.

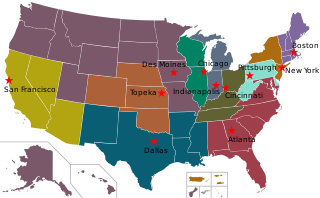

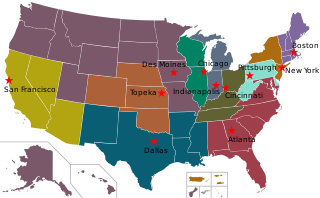

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), is a United States federal law enacted in the wake of the savings and loan crisis of the 1980s.

The Federal Savings and Loan Insurance Corporation (FSLIC) was an institution that administered deposit insurance for savings and loan institutions in the United States.

The Federal Deposit Insurance Corporation Improvement Act of 1991, passed during the savings and loan crisis in the United States, strengthened the power of the Federal Deposit Insurance Corporation.

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom. Bank examiners are generally employed to supervise banks and to ensure compliance with regulations.

The New York State Banking Department was created by the New York Legislature on April 15, 1851, with a chief officer to be known as the Superintendent. The New York State Banking Department was the oldest bank regulatory agency in the United States.

The Bank of New England Corporation was a regional banking institution based in Boston, Massachusetts, which was seized by the Federal Deposit Insurance Corporation (FDIC) in 1991 as a result of heavy losses in its loan portfolio and was placed into Chapter 7 liquidation. At the time, it was the 33rd largest bank in the United States, and its federal seizure bailout was the second-largest on record. At its peak, it had been the 18th largest bank and had over 470 branch offices. The liquidation company was named Recoll Management Corporation and its bankruptcy estate has continued to exist to pay out claims against the company. As of 2016, most of what was once Bank of New England is now part of Bank of America.

Donna Tanoue served as the 17th chairperson of the U.S. Federal Deposit Insurance Corporation (FDIC) from May 26, 1998, until July 11, 2001. Subsequently, in April 2002, she became Vice chairperson and Managing Committee member of the Bank of Hawaii.

This article details the history of banking in the United States. Banking in the United States is regulated by both the federal and state governments.

A bridge bank is an institution created by a national regulator or central bank to operate a failed bank until a buyer can be found.

Morris Plan Banks were part of a historic banking system in the United States created to assist the middle class in obtaining loans that were often difficult to obtain at traditional banks. They were established by Arthur J. Morris (1881–1973), a lawyer in Norfolk, Virginia, who noticed the difficulty his working clients had in getting loans. The first was started in 1910 in Norfolk, and the second in Atlanta in 1911.

The Dodd–Frank Wall Street Reform and Consumer Protection Act was created as a response to the financial crisis in 2007. Passed in 2010, the act contains a great number of provisions, taking over 848 pages. It targets the sectors of the financial system that were believed to be responsible for the financial crisis, including banks, mortgage lenders, and credit rating agencies. Ostensibly aimed at reducing the instability that led to the crash, the act has the power to force these institutions to reduce their risk and increase their reserve capital.

A deposit insurance national bank is a temporary bank in the United States that is established by the Federal Deposit Insurance Corporation (FDIC) in the wake of a bank failure under the Banking Acts of 1933 and 1935.