Professional certification, trade certification, or professional designation, often called simply certification or qualification, is a designation earned by a person to assure qualification to perform a job or task. Not all certifications that use post-nominal letters are an acknowledgement of educational achievement, or an agency appointed to safeguard the public interest.

An accountant is a practitioner of accounting or accountancy. Accountants who have demonstrated competency through their professional associations' certification exams are certified to use titles such as Chartered Accountant, Chartered Certified Accountant or Certified Public Accountant, or Registered Public Accountant. Such professionals are granted certain responsibilities by statute, such as the ability to certify an organization's financial statements, and may be held liable for professional misconduct. Non-qualified accountants may be employed by a qualified accountant, or may work independently without statutory privileges and obligations.

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, all states except Hawaii have passed mobility laws to allow CPAs from other states to practice in their state. State licensing requirements vary, but the minimum standard requirements include passing the Uniform Certified Public Accountant Examination, 150 semester units of college education, and one year of accounting-related experience.

A real estate agent, referred to often as a real estate broker, is a person who represents sellers or buyers of real estate or real property. While a broker may work independently, an agent usually works under a licensed broker to represent clients. Brokers and agents are licensed by the state to negotiate sales agreements and manage the documentation required for closing real estate transactions. Buyers and sellers are generally advised to consult a licensed real estate professional for a written definition of an individual state's laws of agency.

The Certified Financial Planner certification is a professional certification mark for financial planners conferred by the Certified Financial Planner Board of Standards in the United States, and by 25 other organizations affiliated with Financial Planning Standards Board (FPSB), the owner of the CFP mark outside of the United States. The certification is generally considered the gold standard in the financial planning industry. The certification is managed by the Certified Financial Planner Board of Standards, Inc., which was founded in 1985 as a 501(c)(3) non-profit organization; it is neither a government designation nor an accredited degree.

The American College of Financial Services is a private online university focused on professional training for financial practitioners and located in King of Prussia, Pennsylvania. It offers several professional certifications and master's degrees. Annually, The American College educates approximately 40,000 students, mainly through distance education.

The Master of Accountancy, alternatively Master of Science in Accounting or Master of Professional Accountancy, is a graduate professional degree designed to prepare students for public accounting; academic-focused variants are also offered.

Continuing legal education (CLE), also known as mandatory or minimum continuing legal education (MCLE) or, in some jurisdictions outside the United States, as continuing professional development, consists of professional education for attorneys that takes place after their initial admission to the bar. Within the United States, U.S. attorneys in many states and territories must complete certain required CLE in order to maintain their U.S. licenses to practice law. Outside the United States, lawyers in various jurisdictions, such as British Columbia in Canada, must also complete certain required CLE. However, some jurisdictions, such as the District of Columbia and Israel, recommend, but do not require, that attorneys complete CLE.

The Uniform Certified Public Accountant Examination is the examination administered to people who wish to become U.S. Certified Public Accountants. The CPA Exam is used by the regulatory bodies of all fifty states plus the District of Columbia, Guam, Puerto Rico, the U.S. Virgin Islands and the Northern Mariana Islands.

The Kansas Insurance Commissioner (KIC), in full the Kansas State Insurance Commissioner, has the primary responsibility to the people whose personal lives are protected by insurance in the state of Kansas. It is an elected position and is currently held by Republican Vicki Schmidt.

Following is a partial list of professional certifications in financial services, with an overview of the educational and continuing requirements for each; see Professional certification § Accountancy, auditing and finance and Category:Professional certification in finance for all articles. As the field of finance has increased in complexity in recent years, the number of available designations has grown, and, correspondingly, some will have more recognition than others. Note that in the US, many state securities and insurance regulators do not allow financial professionals to use a designation — in particular a "senior" designation — unless it has been accredited by either the American National Standards Institute or the National Commission for Certifying Agencies.

Financial gerontology is a multidisciplinary field of study encompassing both academic and professional education, that integrates research on aging and human development with the concerns of finance and business. Following from its roots in social gerontology, Financial gerontology is not simply the study of old people but emphasizes the multiple processes of aging. In particular, research and teaching in financial gerontology draws upon four kinds of aging or "'four lenses" through which aging and finance can be viewed: population aging, individual aging, family aging, and generational aging. While it is problematic that "demography is destiny," demographic concepts, issues, and data play a substantial role in understanding the dynamics of financial gerontology. For example, through the lens of population aging, demography identifies the number of persons of different ages in cities and countries—and at multiple points in time. Through the lens of individual aging, demography also notes changes in the length of time—number of years lived in older age, typically measured by increases in life expectancy. From in its founding years in the beginning of the 21st century, one primary interest of Financial Gerontology has been on baby boomers and their relationships with their parents. The impact of these two kinds of aging on finance are reasonably apparent. The large and increasing number of older persons [population aging] in a society, no matter how "old age" is defined, and the longer each of these persons lives [individual aging], the greater the impact on a society's pattern of retirement, public and private pension systems, health, health care, and the personal and societal financing of health care. The focus on boomers illustrates also the other two lenses or "kinds" of aging. How boomers deal with the social, emotional, and financial aspects of their parents' aging is a central aspect of family aging. And how boomers may differ from their parents born and raised twenty to forty years earlier, and differ from their Generation X and Millennial children and grandchildren, are substantial aspects of generational aging.

The basic requirement for pharmacists to be considered for registration is often an undergraduate or postgraduate pharmacy degree from a recognized university. In many countries, this involves a four- or five-year course to attain a bachelor of pharmacy or master of pharmacy degree.

National Online Insurance School is a nationwide state-certified pre-licensing insurance school headquartered in Delray Beach, Florida, United States. Established in 2008, it provides pre-licensing insurance education for health, life and variable annuity insurance license designations.

Certified Financial Planner Board of Standards, Inc., an American 501(c)(6) nonprofit organization, sets and upholds standards for financial planning and administers Certified Financial Planner certification - widely recognized by the public, advisors, and firms as the standard for financial planners - so that the public has access to the benefits of competent and ethical financial planning. CFP certification is held by more than 95,000 people in the United States.

The IRS Return Preparer Initiative was an effort by the Internal Revenue Service (IRS) to regulate the tax return preparation industry in the United States. The purpose of the initiative is to improve taxpayer compliance and service by setting professional standards for and providing support to the tax preparation industry. Starting January 1, 2011 and, until the program was suspended in January 2013, the initiative required all paid federal tax return preparers to register with the IRS and to obtain an identification number, called a Preparer Tax Identification Number (PTIN). The multi-year phase-in effort called for certain paid tax return preparers to pass a competency test and to take annual continuing education courses. The ethics provisions found in Treasury Department's Circular 230 were extended to all paid tax return preparers. Preparers who have their PTINs, pass the test and complete education credits were to have a new designation: Registered Tax Return Preparer.

A Registered Tax Return Preparer is a former category of federal tax return preparers created by the U.S. Internal Revenue Service (IRS).

The Registered Tax Return Preparer Test was a test produced by the U.S. Internal Revenue Service (IRS). Until the program was suspended in January 2013, the IRS had implemented rules requiring that certain individuals who wanted to work as tax return preparers pass this test to demonstrate their ability to understand U.S. tax law, tax form preparation and ethical requirements. The competency test was part of an agency effort to better regulate the tax return preparation industry, to improve the accuracy of tax return preparation and to improve service to taxpayers. Candidates who passed the test, a tax compliance check, and met certain other requirements had a new designation: Registered Tax Return Preparer.

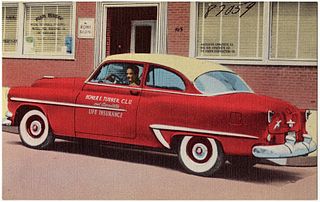

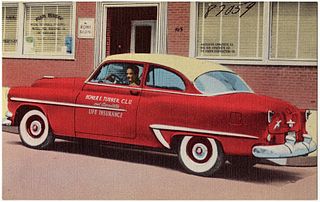

Chartered financial consultant (ChFC) is the "advanced financial planning" designation awarded by The American College of Financial Services. Charter holders use the designation ChFC on their resumes and are qualified to provide comprehensive advanced financial planning for individuals, professionals, and small business owners. The authority to use the ChFC mark is granted by the Certification Committee of the Board of Trustees of The American College, and is contingent on adherence to a set of ethical guidelines. According to the American College, "[a]ll ChFC advisors are required to do the same for clients that they would do for themselves in similar circumstances, the standard of ethical behavior most beneficial for their clients." Since 1982, approximately 40,000 people have earned the ChFC through regionally accredited program courses and exams. Successful completion of the ChFC qualifies designees to register as an Investment Adviser Representative (IAR) with FINRA without sitting for the Series 65 examination.

The Florida Board of Accountancy (FLBOA) regulates Certified Public Accountants and Certified Public Accounting Firms for the State of Florida. The FLBOA is created in Florida Statutes Chapter 473 and is administered by the Florida Department of Business and Professional Regulation (DBPR). Florida Statutes Chapter 473 permits the FLBOA to establish rules that are codified in the Florida Administrative Code (FAC) in sections 61H1-19 through 61H1-39.