The American Institute of Certified Public Accountants (AICPA) is the national professional organization of Certified Public Accountants (CPAs) in the United States, with more than 428,000 members in 130 countries. Founded in 1887 as the American Association of Public Accountants (AAPA), the organization sets ethical standards and U.S. auditing standards. It also develops and grades the Uniform CPA Examination. The AICPA maintains offices in New York City; Washington, DC; Durham, NC; and Ewing, NJ.

The Canadian Securities Institute is a Canadian organization that offers licensing courses, advanced certifications, continuing education and custom training for financial services professionals in Canada and internationally.

The Chartered Financial Analyst (CFA) program is a postgraduate professional certification offered internationally by the American-based CFA Institute to investment and financial professionals.

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs.

Markel Corporation is a holding company for insurance, reinsurance, and investment operations around the world. Headquartered in Richmond, Virginia, and founded in 1930, Markel reports its ongoing underwriting operations in three segments, and products originate from three insurance divisions and one reinsurance division. Through Markel Ventures, they allocate capital to invest in opportunities outside of insurance.

The Certified Financial Planner (CFP) designation is a professional certification mark for financial planners conferred by the Certified Financial Planner Board of Standards in the United States, and by 25 other organizations affiliated with Financial Planning Standards Board (FPSB), the owner of the CFP mark outside of the United States. The certification is generally viewed as the gold standard designation in the financial planning industry. The certification is not a government designation, nor an accredited degree, but is managed by the Certified Financial Planner Board of Standards, Inc. which was founded in 1985 as a 501(c)(3) non-profit organization.

The American Academy of Financial Management (AAFM) was a US-based board of standards, certifying body, and accreditation council focused on the finance sector and wealth management professionals. AAFM was superseded by the Global Academy of Finance and Management.

Mirae Asset Financial Group is a financial services group headquartered in Seoul, South Korea. Mirae Asset provides comprehensive financial services including asset management, wealth management, investment banking, and life insurance. Mirae Asset was founded by Hyeon Joo Park in 1997 and introduced the very first mutual funds to Korean retail investors in 1998. On a global consolidated basis, total group’s client assets exceed US$550 billion. Mirae Asset has global presence in Australia, Brazil, Canada, Mainland China, Hong Kong, Colombia, India, Indonesia, Japan, Korea, Mongolia, Singapore, the United Kingdom, United States and Vietnam.

Harold Evensky is an American businessman, author, and financial adviser. He is a Certified Financial Planner (CFP), an Accredited Investment Fiduciary (AIF) and chairman of Evensky & Katz, a financial planning firm.

Following is a partial list of professional certifications in financial services, with an overview of the educational and continuing requirements for each; see Professional certification § Accountancy, auditing and finance and Category:Professional certification in finance for all articles. As the field of finance has increased in complexity in recent years, the number of available designations has grown, and, correspondingly, some will have more recognition than others. Note that in the US, many state securities and insurance regulators do not allow financial professionals to use a designation — in particular a "senior" designation — unless it has been accredited by either the American National Standards Institute or the National Commission for Certifying Agencies.

Irwin Mitchell is a full service law firm in the United Kingdom, established in Sheffield in 1912. The firm offers legal and wealth management services from its 17 offices, and employs more than 2,500 people.

The Chartered Financial Planner is a qualification for professional financial planners and financial advisers awarded by the Chartered Insurance Institute.

Raymond Thomas Dalio is an American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York. A $5 million investment from the World Bank's retirement fund was made within five years. His innovations are regarded as some of the best in the industry, having popularized many commonly used practices, such as risk parity, currency overlay, portable alpha and global inflation-indexed bond management.

John M. Longo Ph.D, CFA is an American investment strategist, portfolio manager, educator, editor, speaker and author.

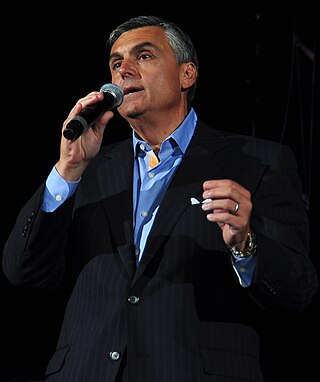

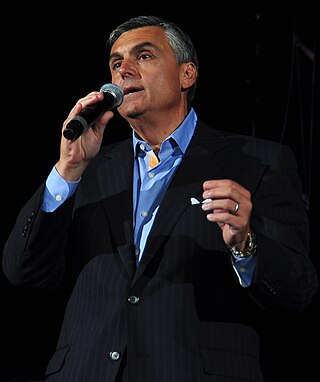

Raymond Joseph Lucia, Sr. is an American former Certified Financial Planner, former Registered Investment Advisor, author, radio personality and television host. He is host of The Ray Lucia Show, a nationally syndicated radio and television financial talk show on the Business Talk Radio Network and the Biz Television network.

Chartered financial consultant (ChFC) is the "advanced financial planning" designation awarded by The American College of Financial Services. Charter holders use the designation ChFC on their resumes and are qualified to provide comprehensive advanced financial planning for individuals, professionals, and small business owners. The authority to use the ChFC mark is granted by the Certification Committee of the Board of Trustees of The American College, and is contingent on adherence to a set of ethical guidelines. According to the American College, "[a]ll ChFC advisors are required to do the same for clients that they would do for themselves in similar circumstances, the standard of ethical behavior most beneficial for their clients." Since 1982, approximately 40,000 people have earned the ChFC through regionally accredited program courses and exams. Successful completion of the ChFC qualifies designees to register as an Investment Adviser Representative (IAR) with FINRA without sitting for the Series 65 examination.

Robo-advisors or robo-advisers are a class of financial adviser that provide financial advice and investment management online with moderate to minimal human intervention. They provide digital financial advice based on mathematical rules or algorithms. These algorithms are designed by financial advisors, investment managers and data scientists, and coded in software by programmers. These algorithms are executed by software and do not require a human advisor to impart financial advice to a client. The software utilizes its algorithms to automatically allocate, manage and optimize clients' assets for either short-run or long-run investment. Robo-advisors are categorized based on the extent of personalization, discretion, involvement, and human interaction.

Park Hyeon-joo, a South Korean billionaire business magnate and a representative investment strategist who is the founder of Mirae Asset Financial Group which consists of asset management, investment banking, stock brokerage, life insurance, venture capital, and other financial services.

The DWS Group commonly referred to as DWS, is a German asset management company. It previously operated as part of Deutsche Bank until 2018 where it became a separate entity through an initial public offering on the Frankfurt Stock Exchange. It is currently headquartered in Frankfurt, Germany and is a constituent member of the SDAX index.

Chartered Financial Divorce Specialist (CFDS) is a Canadian professional designation that can be earned by eligible individuals holding a recognized financial designation and have completed specific training in the financial aspects of life transitions with respect to collaborative (mediated) cohabitation, marriage agreements, relationships or marital breakdowns. It is based on professional best practice standards and a code of professional ethics, granted and monitored by the Academy of Financial Divorce Specialists in Ontario, Canada and other relevant licensing authorities.