Related Research Articles

Steven A. Cohen is an American hedge-fund manager and owner of the New York Mets of Major League Baseball since September 14, 2020, owning just over 97% of the team. He is the founder of hedge fund Point72 Asset Management and S.A.C. Capital Advisors, which closed after pleading guilty to insider trading and other financial crimes.

Paul Tudor Jones II is an American billionaire hedge fund manager, conservationist and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm headquartered in Stamford, Connecticut. Eight years later, he founded the Robin Hood Foundation, which focuses on poverty reduction. As of April 2022, his net worth was estimated at US$7.3 billion.

James Harris Simons is an American hedge fund manager, investor, mathematician, and philanthropist. He is the founder of Renaissance Technologies, a quantitative hedge fund based in East Setauket, New York. He and his fund are known to be quantitative investors, using mathematical models and algorithms to make investment gains from market inefficiencies. Due to the long-term aggregate investment returns of Renaissance and its Medallion Fund, Simons is described as the "greatest investor on Wall Street", and more specifically "the most successful hedge fund manager of all time".

David Alan Tepper is an American billionaire hedge fund manager. He is the owner of the Carolina Panthers of the National Football League (NFL) and Charlotte FC in Major League Soccer (MLS). Tepper is the founder and president of Appaloosa Management, a global hedge fund based in Miami Beach, Florida.

Richard Kinder is an American businessman. He is the co-founder and executive chairman of Kinder Morgan Inc., an energy and pipeline corporation.

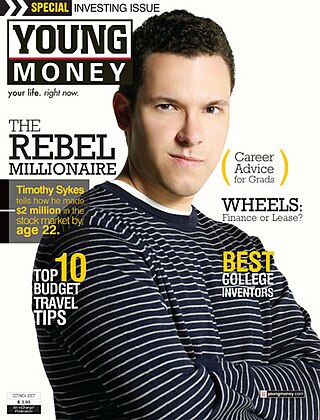

Timothy Sykes is a penny stock trader who earned $1.65 million from a $12,415 Bar mitzvah gift through day trading while in college.

Raymond Thomas Dalio is an American investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York.

The Children's Investment Fund Foundation (UK) (CIFF) is an independent philanthropic organisation with offices in Addis Ababa, Beijing, London, Nairobi and New Delhi. It is a registered charity in England and Wales and in 2021 disbursed $468 million and committed $772 million in charitable investments. With assets of GBP £5.2 billion (USD $6.6 billion), it is the 5th largest global development philanthropy in the world based on annual disbursements. According to OECD published data, it is the world's second largest private funder of reproductive health and environmental protection globally and the largest philanthropy that focuses specifically on improving children's lives. In 2021, CIFF pledged $500 million towards gender equality over five years as part of the generation equality forum.

Dustin Aaron Moskovitz is an American billionaire internet entrepreneur who co-founded Facebook, Inc. with Mark Zuckerberg, Eduardo Saverin, Andrew McCollum and Chris Hughes. In 2008, he left Facebook to co-found Asana with Justin Rosenstein. In March 2011, Forbes reported Moskovitz to be the youngest self-made billionaire in the world, on the basis of his then 2.34% share in Facebook. As of October 2023, his net worth is estimated at US$18.0 billion by the Bloomberg Billionaires Index.

The Giving Pledge is a charitable campaign, founded by Bill Gates and Warren Buffett, to encourage wealthy people to contribute a majority of their wealth to philanthropic causes. As of June 2022, the pledge has had 236 signatories from 28 countries. Most of the signatories of the pledge are billionaires, and as of 2023, their pledges are estimated at a total of US$600 billion. However, there is no enforcement mechanism, and no restrictions on the charitable causes that signatories are allowed to support.

Glenn Russell Dubin is an American billionaire hedge fund manager and the Principal of Dubin & Co. LP, a private investment company. He is the co-founder of Highbridge Capital Management, an alternative asset management company based in New York City, and a founding board member of the Robin Hood Foundation.

Leon G. Cooperman is an American billionaire investor and hedge fund manager. He is the chairman and CEO of Omega Advisors, a New York-based investment advisory firm managing over $3.3 billion in assets under management, the majority consisting of his personal wealth.

Good Ventures is a private foundation and philanthropic organization in San Francisco, and the fifth largest foundation in Silicon Valley. It was co-founded by Cari Tuna, a former Wall Street Journal reporter, and her husband Dustin Moskovitz, one of the co-founders of Facebook. Good Ventures adheres to principles of Effective Altruism and aims to spend most or all of its money before Moskovitz and Tuna die. Good Ventures does not have any full-time staff, and instead distributes grants according to recommendations from Open Philanthropy.

Arnold VenturesLLC is focused on evidence-based giving in a wide range of categories including: criminal justice, education, health care, and public finance. The organization was founded by billionaires John D. Arnold and Laura Arnold in 2010.

William O. Perkins III is an American hedge fund manager, film producer, author, and high stakes poker player. Perkins manages Skylar Capital, an energy trading hedge fund that had approximately $500 million in assets under management as of 2023.

Cari Tuna is an American nonprofit businessperson. Formerly a reporter for The Wall Street Journal, she co-founded and works for the organizations Open Philanthropy and Good Ventures.

John Albert Overdeck is an American hedge fund manager. Overdeck is the co-founder and co-chairman of Two Sigma Investments, a New York City-based hedge fund that uses a variety of technological methods, including artificial intelligence, machine learning, and distributed computing, for its trading strategies. In 2016, Overdeck reported $375 million in earnings and as of May 2017, Two Sigma Investments has $41 billion in assets under management.

Nathaniel Simons is an American billionaire hedge fund manager and philanthropist. He is the founder of Meritage Group, an investment management firm managing over $12 billion in assets, co-founder of Prelude Ventures, a clean tech investment fund, and is the former co-chair of Renaissance Technologies, one of the largest hedge funds in the world.

Laura Arnold is an American philanthropist and co-founder of Arnold Ventures LLC. In addition to serving as co-chair of Arnold Ventures, Arnold also hosts the podcast “Deep Dive with Laura Arnold” and serves as member of the Board of Directors for the REFORM Alliance, an organization that aims to transform probation and parole systems through legislative change. Prior to her work in philanthropy, she was a mergers-and-acquisitions lawyer and an executive at Cobalt International Energy.

References

- 1 2 "Billionaire John Arnold explains support for DISD home rule". The Dallas Morning News. 2014-03-28.

- 1 2 3 Apple, Sam (January 22, 2017). "The Young Billionaire Behind the War on Bad Science". Wired.

- ↑ Ahmed, Azam (2012-05-03). "John Arnold Is Said to Close Hedge Fund and Return Investor Money". The New York Times . Retrieved 2020-10-15.

- 1 2 3 4 "When a billionaire trader loses his edge - The Term Sheet: Fortune's deals blogTerm Sheet". Finance.fortune.cnn.com. 2012-05-04. Archived from the original on 2013-09-20. Retrieved 2013-10-08.

- 1 2 "Houston billionaire trader John Arnold retiring at 38 - Houston Chronicle". Chron.com. 2012-05-02. Retrieved 2013-10-08.

- 1 2 Kate Kelly (2012-05-02). "Legendary Energy Trader John Arnold to Retire". Cnbc.com. Retrieved 2013-10-08.

- 1 2 Kroll, Luisa. "Hedge Fund Billionaire John Arnold's Fund Was Up When He Announced He Was Getting Out". Forbes. Retrieved 2013-10-08.

- 1 2 "Ex-Trader at Enron to Retire From Hedge Fund". Online.wsj.com. Retrieved 2013-10-08.

- ↑ Vanian, Jonathan (2024-02-14). "Meta says Broadcom CEO Hock Tan is joining board of directors". CNBC. Retrieved 2024-02-14.

- 1 2 3 4 5 6 New York Times: "CORPORATE CONDUCT: THE TRADER; Enron Trader Had a Year To Boast of, Even If..." By DAVID BARBOZA July 09, 2002

- ↑ "Lambda Chi Alpha - Notable Alumni". lambdachi.org. 2013-08-14. Archived from the original on 2014-08-15. Retrieved 2013-10-08.

- ↑ "A speculator who is in for the long haul". Financial Times . May 14, 2008. Retrieved October 8, 2020.

- ↑ "Great Sites: EnronOnline". InformationWeek. 24 August 2001. Retrieved 2020-10-09.

- ↑ New York Times, "Energy Trading, Post-Enron", January 15, 2006

- ↑ Vardi, Nathan. "The King Of Natural Gas Quits". Forbes. Retrieved 2013-10-08.

- ↑ Demos, Telis (2009-11-24). "Centaurus's John Arnold: The king of natural gas - Nov. 24, 2009". Money.cnn.com. Archived from the original on 2013-12-13. Retrieved 2013-10-08.

- ↑ Seidman, Andrew (26 July 2018). "Meet the Texas billionaire who backed Philly soda tax — and now is funding attack ads in N.J. Senate race". Inquirer. Retrieved 2020-12-10.

- ↑ "House report" (PDF). Retrieved 2020-11-25.

- ↑ Tett, Gillian (2006-12-20). "Smart trades that made this a good year for some". FT.com. Retrieved 2013-10-08.

- ↑ Houston Business Journal , "Centaurus scoops up National Coal shares" August 29, 2008

- ↑ "Centaurus scoops up National Coal shares". www.bizjournals.com. 2008-08-29. Retrieved 2020-12-29.

- ↑ Demos, Telis (2009-11-24). "Centaurus's John Arnold: The king of natural gas - Nov. 24, 2009". Money.cnn.com. Retrieved 2013-10-08.

- ↑ "John D. Arnold's CFTC (U.S. Commodity Futures Trading Commission) speech" (PDF). Cftc.gov. Retrieved 2013-10-08.

- ↑ Hill, Glynn A. (2019-01-10). "Houston's World Cup bid adds a power player in John Arnold". HoustonChronicle.com. Retrieved 2020-11-02.

- 1 2 Preston, Caroline (October 16, 2011). "A Thirtysomething Billionaire Couple Take on Tough Issues Via Giving". Chronicle of Philanthropy.

- ↑ Barnum, Matt (2020-02-21). "The City Fund has given out over $100 million to support charter and charter-like schools". Chalkbeat . Retrieved 2020-11-23.

- ↑ Lev Facher, Lev, "How a billionaire couple greased the skids for Nancy Pelosi’s drug pricing bill , Stat News, November 26, 2019

- ↑ Piper, Kelsey (2019-02-07). "Why this billion-dollar foundation is becoming a corporation". Vox. Retrieved 2020-12-18.

- ↑ "Has the Giving Pledge Changed?". Philanthropy. 4 June 2019. Retrieved 2020-12-18.

- ↑ Preston, Caroline (October 16, 2011). "A Thirtysomething Billionaire Couple Take on Tough Issues Via Giving". Chronicle of Philanthropy .

- ↑ Moxley, Abby Schultz and Mitch. "Changemakers: The Leaders Reshaping Communities Around the World". www.barrons.com. Retrieved 2020-11-05.

- 1 2 3 4 "Two Texas Billionaires Think They Can Fix Philanthropy". Bloomberg.com. 2019-12-12. Retrieved 2020-11-16.

- ↑ Moxley, Abby Schultz and Mitch. "Changemakers: The Leaders Reshaping Communities Around the World". www.barrons.com. Retrieved 2020-12-18.

- ↑ Emma, Caitlin (2013-10-07). "Philanthropists pledge for Head Start". POLITICO. Retrieved 2022-08-05.

- ↑ Loftus, Peter (2018-10-21). "A Billionaire Pledges to Fight High Drug Prices, and the Industry Is Rattled". Wall Street Journal. ISSN 0099-9660 . Retrieved 2018-10-21.

- ↑ Roland, Denise (4 November 2019). "Obscure Model Puts a Price on Good Health—and Drives Down Drug Costs". Wall Street Journal. Retrieved April 28, 2021.

- ↑ Facher, Lev (2019-11-26). "How a Billionaire Couple Greased The Skids For Nancy Pelosi's Drug Pricing Bill". Stat News . ISSN 0099-9660 . Retrieved 2019-11-26.

- ↑ Candid. "Laura and John Arnold Foundation to Restructure as LLC". Philanthropy News Digest (PND). Retrieved 2019-06-10.

- ↑ Schleifer, Theodore (2019-07-25). "Why one billionaire is calling out Silicon Valley's favorite philanthropic loophole". Vox. Retrieved 2020-11-16.

- ↑ "Are Donor Advised Funds Good for Philanthropy? It Depends On Who You Talk To". Worth. 2019-10-30. Retrieved 2020-11-16.

- ↑ "How we Ranked Forbes 400 based on their giving". Forbes . Retrieved 2020-11-02.

- ↑ Wing, Nick (31 July 2017). "Dog The Bounty Hunter Joins Lawsuit Against Chris Christie Over Bail Reform". Huffington Post. Retrieved 6 March 2020.

- ↑ "June Rodgers v. Christopher Christie, No. 19-2616 (3d Cir. 2020)". Justia Law. Retrieved 2020-12-09.

- ↑ "A divided federal appeals court rules Baltimore's surveillance plane is constitutional, cites city's struggles". news.yahoo.com. Retrieved 2020-12-09.

- ↑ Whitlock, Kay; Heitzeg, Nancy (21 November 2019). "Billionaire-Funded Criminal Justice Reform Actually Expands Carceral System". Truthout. Retrieved 16 June 2021.

- ↑ Barboza, David (18 June 2002). "Officials Got a Windfall Before Enron's Collapse". New York Times. Retrieved April 28, 2021.

- ↑ Facher, Lev (26 November 2019). "How a billionaire couple greased the skids for Nancy Pelosi's drug pricing bill". Stat. Retrieved April 28, 2021.

- ↑ Mulligan, Thomas (2 February 2002). "CalPERS Doubted Enron Partnership". Los Angeles Times. Retrieved 16 June 2021.

- ↑ Taibbi, Matt (26 September 2013). "Looting the Pension Funds". Rolling Stone. Retrieved 16 June 2021.

- ↑ Anspon, Catherine D (18 July 2017). "Storied Texas Mansion Completely Demolished: The Bulldozer Brings Down Houston's Greatest Architect". PaperCity Magazine.

- ↑ "Big and Modern on Lazy Lane: John Arnold Tries House Trading | Swamplot". swamplot.com.

- ↑ Lori Williams (2008-09-26). "Laura Arnold named to BCM Board of Trustees". Baylor College of Medicine. Archived from the original on 2010-12-26.

- ↑ "Our Team | Laura and John Arnold Foundation". Arnoldfoundation.org. Archived from the original on 2015-02-08. Retrieved 2013-10-08.