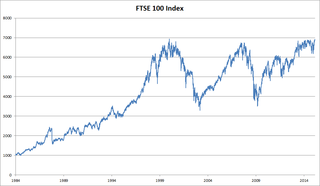

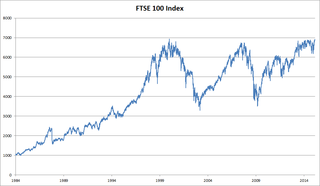

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

Hess Corporation is an American global independent energy company involved in the exploration and production of crude oil and natural gas. It was formed by the merger of Hess Oil and Chemical and Amerada Petroleum in 1968. Leon Hess served as CEO from the early 1960s through 1995, after which his son John B Hess succeeded him as chairman and CEO.

Eni S.p.A. is an Italian multinational oil and gas company headquartered in Rome. Considered one of the seven "supermajor" oil companies in the world, it has operations in 66 countries with a market capitalization of US$36.08 billion, as of 31 December 2020. The Italian government owns a 30.33% golden share in the company, 4.37% held through the state treasury and 25.96% through the Cassa Depositi e Prestiti. The company is a component of the Euro Stoxx 50 stock market index.

Capricorn Energy PLC is a British oil and gas exploration and development company and is listed on the London Stock Exchange. Capricorn has discovered and extracted oil and gas in a variety of locations around the world. Capricorn Energy has a primary listing on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Enterprise Oil was a major UK independent exploration and production company based in Europe, with core areas of activity in the United Kingdom and Ireland, mainland Europe, Brazil and the Gulf of Mexico. The Company was once a constituent of the FTSE 100 Index but was acquired by Royal Dutch Shell.

Premier Oil plc was an independent UK oil company with gas and oil interests in the UK, Asia, Africa and Mexico. It was devoted entirely to the 'upstream' sector of the industry - the exploitation of oil and gas - as opposed to the 'downstream' refining and retail sector. It was listed on the London Stock Exchange until it was acquired by Chrysaor Holdings and then merged into Harbour Energy in March 2021.

Eastern Electricity plc was an electricity supply and distribution utility serving eastern England, including East Anglia and part of Greater London. It was renamed Eastern Group under which name it was listed on the London Stock Exchange and was a constituent of the FTSE 100 Index until it was acquired by Hanson plc in 1995, before being purchased by Texas Utilities in 1998.

Oil and Gas Development Company Limited, commonly known as OGDCL is a Pakistani oil and gas company. It has a primary listing on the Pakistan Stock Exchange, and secondary listing on the London Stock Exchange. Established in 1961 by the Government of Pakistan, it was turned into a public listed company on 23 October 1997. Today it is involved in exploring, drilling, refining and selling oil and gas in Pakistan. It is based on Jinnah Avenue, Blue Area in Islamabad, with the Government of Pakistan holding 74% stake in the company. Rest are held by private investors. In 2013, it has revenue of Rs. 223.365 billion and profit before tax soaring at Rs. 90.777 billion.

Burren Energy plc was a British oil exploration and production company founded in 1994 by Finian O’Sullivan who served as its CEO and, latterly, president. The company originally began as an oil transportation company in the Caspian Sea region, but later diversified into oil production in Turkmenistan, and in 2002 acquired Tacoma Resources, a company developing oil reserves in the Republic of Congo.

Atlantic Petroleum P/FP/F is an oil and gas company situated in Tórshavn, Faroe Islands and has technical offices located in London and Bergen (Norway). It participates in exploration on the Faroese Continental Shelf, offshore Norway, Ireland, and United Kingdom. The company has production from three fields in the United Kingdom's sector of the North Sea and also participates in development projects.

The National Oil Corporation is the national oil company of Libya. It dominates Libya's oil industry, along with a number of smaller subsidiaries, which combined account for around 70% the country's oil output. Of NOC's subsidiaries, the largest oil producer is the Waha Oil Company (WOC), followed by the Arabian Gulf Oil Company (Agoco), Zueitina Oil Company (ZOC), and Sirte Oil Company (SOC).

The Elephant Field is an oil field located in onshore in Libya's Murzuq Basin.

Hardy Oil and Gas plc is a leading British-based oil and gas exploration and production business. It is headquartered in Aberdeen and is a former constituent of the FTSE 250 Index.

JKX Oil & Gas plc is a British-based hydrocarbon exploration and production company, listed on the London Stock Exchange. JKX operates primarily in Russia and Ukraine, but has a presence in six other countries in Europe and North America. In June 2011, VTB Capital plc, a subsidiary of Russian state bank VTB, increased its share in JKX Oil & Gas to 6.4%. The deal makes VTB bank the fourth largest shareholder in the company. Ihor Kolomoyskyi, the co-owner of Privat Group, remains the largest shareholder in JKX with a 27.06% stake.

Venture Production ltd was a leading British-based oil and gas exploration and production business. Its activities were focused on the North Sea. It was a constituent of the FTSE 250 Index, but was delisted following Centrica's purchase of the company in August 2009.

William Samuel Hugh Laidlaw is the Executive Chairman of Neptune Energy, the independent E&P company. He is former chief executive officer of Centrica, the British natural gas and electricity company.

Ultramar plc was a leading British oil and gas exploration and production business. It was listed on the London Stock Exchange and was a constituent of the FTSE 100 Index.

Oando Plc is a Nigerian multinational energy company operating in the upstream, midstream and downstream.

The Meadville Corporation was an oil company based in Haverford, Pennsylvania. It was founded in 1930 in Elizabeth, New Jersey. Fuel was sold at retail gas stations under the brand name "Merit", the logo consisting of a red "M" with the right vertical support cut off. Merit gas stations could be found throughout the Northeastern United States. For many years, Amerada Hess had a large stake in the company. In 2000, Hess acquired the remainder of the Meadville Corporation and rebranded its 178 Merit gas stations as Hess. Those stations became part of Marathon Petroleum's Speedway brand due to the latter company's purchase of Hess's retail assets in 2014. 7 years later, Japanese-based Seven & I Holdings purchased Speedway, making those stations a part of the 7-Eleven family.