Related Research Articles

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position.

A chief executive officer (CEO) is the highest officer charged with the management of an organization – especially a company or nonprofit institution.

A shareholder rights plan, colloquially known as a "poison pill", is a type of defensive tactic used by a corporation's board of directors against a takeover.

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 41 countries and more than 75,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 61 in the 2023 Fortune 500 list of the largest United States corporations by total revenue.

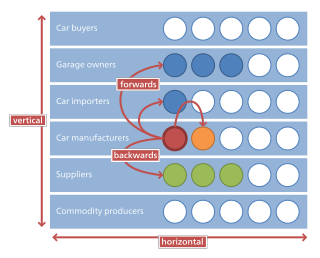

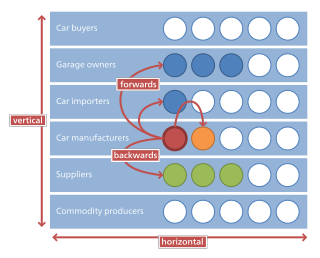

Horizontal integration is the process of a company increasing production of goods or services at the same level of the value chain, in the same industry. A company may do this via internal expansion, acquisition or merger.

In microeconomics, management and international political economy, vertical integration is an arrangement in which the supply chain of a company is integrated and owned by that company. Usually each member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It contrasts with horizontal integration, wherein a company produces several items that are related to one another. Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership but also into one corporation.

Corporate governance are mechanisms, processes and relations by which corporations are controlled and operated ("governed").

Managerial economics is a branch of economics involving the application of economic methods in the organizational decision-making process. Economics is the study of the production, distribution, and consumption of goods and services. Managerial economics involves the use of economic theories and principles to make decisions regarding the allocation of scarce resources. It guides managers in making decisions relating to the company's customers, competitors, suppliers, and internal operations.

A golden parachute is an agreement between a company and an employee specifying that the employee will receive certain significant benefits if employment is terminated. These may include severance pay, cash bonuses, stock options, or other benefits. Most definitions specify the employment termination is as a result of a merger or takeover, also known as "change-in-control benefits", but more recently the term has been used to describe perceived excessive CEO severance packages unrelated to change in ownership.

The overconfidence effect is a well-established bias in which a person's subjective confidence in their judgments is reliably greater than the objective accuracy of those judgments, especially when confidence is relatively high. Overconfidence is one example of a miscalibration of subjective probabilities. Throughout the research literature, overconfidence has been defined in three distinct ways: (1) overestimation of one's actual performance; (2) overplacement of one's performance relative to others; and (3) overprecision in expressing unwarranted certainty in the accuracy of one's beliefs.

Management is a type of labor with a special role of coordinating the activities of inputs and carrying out the contracts agreed among inputs, all of which can be characterized as "decision making". Managers usually face disciplinary forces by making themselves irreplaceable in a way that the company would lose without them. A manager has an incentive to invest the firm's resources in assets whose value is higher under him than under the best alternative manager, even when such investments are not value-maximizing.

Corporate synergy refers to a financial benefit that a corporation expects to realize when it merges with or acquires another corporation. Corporate synergy occurs when corporations interact congruently with one another, creating additional value.

Post-merger integration or PMI is the process of combining and rearranging businesses to materialize potential efficiencies and synergies that usually motivate mergers and acquisitions. The PMI is a critical aspect of mergers; it involves combining the original logistical-socio-technical systems of the merging organizations into one newly combined system.

David Hirshleifer is an American economist who is currently a Distinguished Professor of Finance and Economics at the University of California, Irvine, where he also holds the Merage Chair in Business Growth. From 2018 to 2019, he served as President of the American Finance Association, and is an associate at the NBER. Previously, he was a professor at UCLA, the University of Michigan, and Ohio State University. His research is mostly related to behavioral finance and informational cascades. In 2007, he was listed as one of the 100 most-cited economists in the world by Web of Science.

Ulrike M. Malmendier is a German economist who is currently a professor of economics and finance at the University of California, Berkeley. Her work focuses on behavioral economics, corporate finance, and law and economics. In 2013, she was awarded the Fischer Black Prize by the American Finance Association.

Maria Goranova is professor of management at the University of Wisconsin Milwaukee. She conducts research on shareholder empowerment and activism, corporate governance, and corporate strategy. She serves as editor of Corporate Governance: An International Review, and on the editorial board of Journal of Management, and is a member of the Academy of Management, International Association for Business and Society, and Strategic Management Society. Her research has been published in a number of leading journals including Strategic Management Journal, Journal of Management Studies, Organization Science, Journal of Management, Academy of Management Perspectives, Journal of Business Research, and Academy of Management Proceedings. She is also recipient of Distinguished Paper and Best Reviewer Awards from the Academy of Management.

Gender representation on corporate boards of directors refers to the proportion of men and women who occupy board member positions. To measure gender diversity on corporate boards, studies often use the percentage of women holding corporate board seats and the percentage of companies with at least one woman on their board. Globally, men occupy more board seats than women. As of 2018, women held 20.8% of the board seats on Russell 1000 companies. Most percentages for gender representation on corporate boards refer only to public company boards. Private companies are not required to disclose information on their board of directors, so the data is less available.

A founder CEO, often written as founder / CEO and also as founder & CEO is an individual who establishes a company as a founding CEO and holds its chief executive officer (CEO) position. If the firm's CEO is not a founder or the founder CEO has succeeded, the firm is said to be led by a non-founder CEO or successor CEO.

Catherine M. Schrand is an American academic and the Celia Z. Moh Professor of Accounting at the Wharton School at the University of Pennsylvania.

Sarah Louise Zechman (née Center) is the Tisone Memorial Fellow Professor at the Leeds School of Business, University of Colorado Boulder.

References

- ↑ Malmendier, Ulrike; Tate, Geoffrey (2008). "Who makes acquisitions? CEO overconfidence and the market's reaction". Journal of Financial Economics . 89 (1): 20–43. doi:10.1016/j.jfineco.2007.07.002. S2CID 12354773.

- ↑ Twardawski, Torsten; Kind, Axel (2023). "Board overconfidence in mergers and acquisitions". Journal of Business Research . 165 (1). doi:10.1016/j.jbusres.2023.114026.

- ↑ Jay B. Barney and William S. Hesterly (2008). Strategic Management and Competitive Advantages. Pearson Prentice Hall. pp. 380. ISBN 0-13-613520-X.