Related Research Articles

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) may be more useful when comparing living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the per capita GDP.

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income. All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them.

In economics, the GDP deflator is a measure of the money price of all new, domestically produced, final goods and services in an economy in a year relative to the real value of them. It can be used as a measure of the value of money. GDP stands for gross domestic product, the total monetary value of all final goods and services produced within the territory of a country over a particular period of time.

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United States and its various units—states, cities/towns/townships/villages/counties, and metropolitan areas. They also provide information about personal income, corporate profits, and government spending in their National Income and Product Accounts (NIPAs).

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government and takes into account public social security obligations.

Output in economics is the "quantity of goods or services produced in a given time period, by a firm, industry, or country", whether consumed or used for further production. The concept of national output is essential in the field of macroeconomics. It is national output that makes a country rich, not large amounts of money.

The PCE price index (PePP), also referred to as the PCE deflator, PCE price deflator, or the Implicit Price Deflator for Personal Consumption Expenditures by the Bureau of Economic Analysis (BEA) and as the Chain-type Price Index for Personal Consumption Expenditures (CTPIPCE) by the Federal Open Market Committee (FOMC), is a United States-wide indicator of the average increase in prices for all domestic personal consumption. It is benchmarked to a base of 2012 = 100. Using a variety of data including U.S. Consumer Price Index and Producer Price Index prices, it is derived from the largest component of the GDP in the BEA's National Income and Product Accounts, personal consumption expenditures.

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment. These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign residents, minus income earned in the domestic economy by nonresidents. Comparing GNI to GDP shows the degree to which a nation's GDP represents domestic or international activity. GNI has gradually replaced GNP in international statistics. While being conceptually identical, it is calculated differently. GNI is the basis of calculation of the largest part of contributions to the budget of the European Union. In February 2017, Ireland's GDP became so distorted from the base erosion and profit shifting ("BEPS") tax planning tools of U.S. multinationals, that the Central Bank of Ireland replaced Irish GDP with a new metric, Irish Modified GNI. In 2017, Irish GDP was 162% of Irish Modified GNI.

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting. Stated otherwise, national accounts as systems may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy is a social accounting matrix with accounts in each respective row-column entry.

Consumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process of generating new output, and because unlike depreciation it is not valued at historic cost but at current market value ; CFC may also include other expenses incurred in using or installing fixed assets beyond actual depreciation charges. Normally the term applies only to producing enterprises, but sometimes it applies also to real estate assets.

The circular flow of income or circular flow is a model of the economy in which the major exchanges are represented as flows of money, goods and services, etc. between economic agents. The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts and hence of macroeconomics.

In economics, aggregate expenditure (AE) is a measure of national income. Aggregate expenditure is defined as the current value of all the finished goods and services in the economy. The aggregate expenditure is thus the sum total of all the expenditures undertaken in the economy by the factors during a given time period. It is the expenditure incurred on consumer goods, planned investment and the expenditure made by the government in the economy. In an open economy scenario, aggregate expenditure also includes the difference between the exports and the imports.

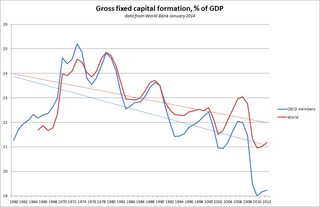

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.

Intermediate consumption is an economic concept used in national accounts, such as the United Nations System of National Accounts (UNSNA), the US National Income and Product Accounts (NIPA) and the European System of Accounts (ESA).

Operating surplus is an accounting concept used in national accounts statistics and in corporate and government accounts. It is the balancing item of the Generation of Income Account in the UNSNA. It may be used in macro-economics as a proxy for total pre-tax profit income, although entrepreneurial income may provide a better measure of business profits. According to the 2008 SNA, it is the measure of the surplus accruing from production before deducting property income, e.g., land rent and interest.

Net output is an accounting concept used in national accounts such as the United Nations System of National Accounts (UNSNA) and the NIPAs, and sometimes in corporate or government accounts. The concept was originally invented to measure the total net addition to a country's stock of wealth created by production during an accounting interval. The concept of net output is basically "gross revenue from production less the value of goods and services used up in that production". The idea is that if one deducts intermediate expenditures from the annual flow of income generated by production, one obtains a measure of the net new value in the new products created.

Aggregate income is the total of all incomes in an economy without adjustments for inflation, taxation, or types of double counting. Aggregate income is a form of GDP that is equal to Consumption expenditure plus net profits. 'Aggregate income' in economics is a broad conceptual term. It may express the proceeds from total output in the economy for producers of that output. There are a number of ways to measure aggregate income, but GDP is one of the best known and most widely used.

In economics, personal income refers to an individual's total earnings from wages, investment enterprises, and other ventures. It is the sum of all the incomes received by all the individuals or household during a given period. Personal income is that income which is received by the individuals or households in a country during the year from all sources. In general, it refers to all products and money that you receive.

The annual United Kingdom National Accounts records and describes economic activity in the United Kingdom and as such is used by government, banks, academics and industries to formulate the economic and social policies and monitor the economic progress of the United Kingdom. It also allows international comparisons to be made. The Blue Book is published by the UK Office for National Statistics alongside the United Kingdom Balance of Payments – The Pink Book.

References

- J. Steven Landefeld, Eugene P. Seskin, and Barbara M. Fraumeni. 2008. "Taking the Pulse of the Economy: Measuring GDP". Journal of Economic Perspectives, 22(2), pp. 193–216. PDF link Archived August 9, 2017, at the Wayback Machine (press +).

- Ott, Mack (2008). "National Income Accounts". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.