The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

In economic policy, austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow or meet their existing obligations to pay back loans. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to creditors and credit rating agencies and make borrowing easier and cheaper as a result.

Fiscal policy is any changes the government makes to the national budget to influence a nation's economy. "An essential purpose of this Financial Report is to help American citizens understand the current fiscal policy and the importance and magnitude of policy reforms essential to make it sustainable. A sustainable fiscal policy is explained as the debt held by the public to Gross Domestic Product which is either stable or declining over the long term". The approach to economic policy in the United States was rather laissez-faire until the Great Depression. The government tried to stay away from economic matters as much as possible and hoped that a balanced budget would be maintained. Prior to the Great Depression, the economy did have economic downturns and some were quite severe. However, the economy tended to self-correct so the laissez faire approach to the economy tended to work.

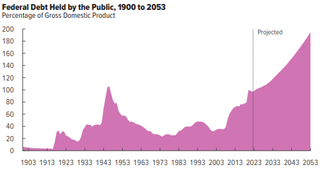

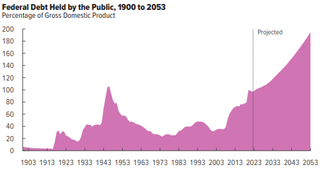

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The history of the United States public debt started with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously had a fluctuating public debt since then, except for about a year during 1835–1836. To allow comparisons over the years, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

The economic policy and legacy of the George W. Bush administration was characterized by significant income tax cuts in 2001 and 2003, the implementation of Medicare Part D in 2003, increased military spending for two wars, a housing bubble that contributed to the subprime mortgage crisis of 2007–2008, and the Great Recession that followed. Economic performance during the period was adversely affected by two recessions, in 2001 and 2007–2009.

The Great Recession was a period of marked general decline observed in national economies globally, i.e. a recession, that occurred from late 2007 to 2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

The 2008–09 Chinese economic stimulus plan was a RMB¥ 4 trillion stimulus package aiming to minimize the impact of the financial crisis of 2007–2008 on the Chinese economy. It was announced by the State Council of the People's Republic of China on 9 November 2008. The economic stimulus plan was seen as a success: While China's economic growth fell to almost 6% by the end of 2008, it had recovered to over 10% by in mid-2009. Critics of China's stimulus package have blamed it for causing a surge in Chinese debt since 2009, particularly among local governments and state-owned enterprises. The World Bank subsequently went on to recommend similar public works spending campaigns to western governments experiencing the effects of the financial crisis, but the US and EU instead decided to pursue long-term policies of quantitative easing.

The European recession is part of the Great Recession that began in mid-2007. The crisis spread rapidly and affected much of the region, with several countries already in recession as of February 2009, and most others suffering marked economic setbacks. The global recession was first seen in Europe, as Ireland was the first country to fall into recession from Q2-Q3 2007 – followed by temporary growth in Q4 2007 – and then a two-year-long recession.

While beginning in the United States, the Great Recession spread to Asia rapidly and has affected much of the region.

On 26 November 2008, the European Commission proposed a European stimulus plan amounting to 200 billion euros to cope with the effects of the global financial crisis on the economies of the members countries. It aims at limiting the economic slowdown of the economies through national economic policies, with measures extended over a period of two years.

In economics, stimulus refers to attempts to use monetary policy or fiscal policy to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing.

The economic policy of the Barack Obama administration, or in its colloquial portmanteau form "Obamanomics", was characterized by moderate tax increases on higher income Americans designed to fund health care reform, reduce the federal budget deficit, and decrease income inequality. President Obama's first term (2009–2013) included measures designed to address the Great Recession and subprime mortgage crisis, which began in 2007. These included a major stimulus package, banking regulation, and comprehensive healthcare reform. As the economy improved and job creation continued during his second term (2013–2017), the Bush tax cuts were allowed to expire for the highest income taxpayers and a spending sequester (cap) was implemented, to further reduce the deficit back to typical historical levels. The number of persons without health insurance was reduced by 20 million, reaching a record low level as a percent of the population. By the end of his second term, the number of persons with jobs, real median household income, stock market, and real household net worth were all at record levels, while the unemployment rate was well below historical average.

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, was a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone member states were unable to repay or refinance their government debt or to bail out over-indebted banks under their national supervision without the assistance of third parties like other eurozone countries, the European Central Bank (ECB), or the International Monetary Fund (IMF).

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis, it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country.

The United Kingdom national debt is the total quantity of money borrowed by the Government of the United Kingdom at any time through the issue of securities by the British Treasury and other government agencies.

Political debates about the United States federal budget discusses some of the more significant U.S. budgetary debates of the 21st century. These include the causes of debt increases, the impact of tax cuts, specific events such as the United States fiscal cliff, the effectiveness of stimulus, and the impact of the Great Recession, among others. The article explains how to analyze the U.S. budget as well as the competing economic schools of thought that support the budgetary positions of the major parties.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

Abenomics refers to the economic policies implemented by the Government of Japan led by the Liberal Democratic Party (LDP) since the December 2012 general election. They are named after Shinzō Abe, who served a second stint as Prime Minister of Japan from 2012 to 2020. Abe was the longest-serving prime minister in Japanese history. After Abe resigned in September 2020, his successor, Yoshihide Suga, has stated that his premiership will focus on continuing the policies and goals of the Abe administration, including the Abenomics suite of economic policies.

The Economic Stimulus Appropriations Act of 1977 was a stimulus package enacted by the 95th Congress and signed into law by President Jimmy Carter on 13 May 1977. Developed in response to the longest and deepest economic recession post World War II, the primary objective of the stimulus package was to provide the economy with a boost.