Related Research Articles

A nonprofit organization (NPO), also known as a non-business entity, not-for-profit organization, or nonprofit institution, is an organization traditionally dedicated to furthering a particular social cause or advocating a shared point of view. In economic terms, it is an organization using the surplus of its revenues to further its objective, rather than distributing its income to the organization's shareholders, leaders, or members. Being public extensions of a nation's revenue department, nonprofits are tax-exempt or charitable, meaning they do not pay income tax on the money that they receive for their organization. They can operate in religious, scientific, research, or educational settings.

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

Nonpartisanism is a lack of affiliation with, and a lack of bias toward, a political party.

The Center for Responsive Politics (CRP) is a non-profit, nonpartisan research group based in Washington, D.C., that tracks the effects of money and lobbying on elections and public policy. It maintains a public online database of its information.

Americans United for Separation of Church and State is a 501(c)(3) nonprofit organization that advocates separation of church and state. The separation of church and state in the United States is often accepted to be provided in the Establishment Clause of the First Amendment to the United States Constitution, which states "Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof."

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Section 501(c) and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

Association law is a term used in the United States for the law governing not-for-profit corporations under various tax codes. This includes charitable organizations, which are generally classified under 501(c)3 in the IRS Tax Code, professional societies, guilds and trade associations, which are classified under 501(c)6, and homeowner associations, which are classified under 501(c)4. There are other classification types, but these are the primary ones.

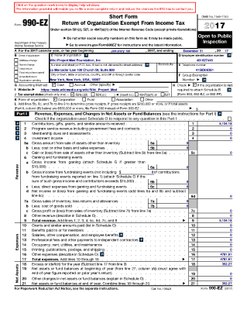

Form 990 is a United States Internal Revenue Service form that provides the public with financial information about a nonprofit organization. It is often the only source of such information. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other health care organizations.

Regan v. Taxation with Representation of Washington, 461 U.S. 540 (1983), was a case in which the United States Supreme Court upheld lobbying restrictions imposed on tax-exempt non-profit corporations.

American Crossroads is a Super PAC that raises funds from donors to advocate for certain candidates of the Republican Party. It has pioneered many of the new methods of fundraising opened up by the Supreme Court's ruling in Citizens United. Its president is Steven J. Law, a former United States Deputy Secretary of Labor for President George W. Bush and the Chairman of the Board of Directors is former Republican National Committee chairman Mike Duncan. Advisers to the group include Senior Advisor and former White House Deputy Chief of Staff Karl Rove and former Mississippi Governor Haley Barbour.

The Johnson Amendment is a provision in the U.S. tax code, since 1954, that prohibits all 501(c)(3) non-profit organizations from endorsing or opposing political candidates. Section 501(c)(3) organizations are the most common type of nonprofit organization in the United States, ranging from charitable foundations to universities and churches. The amendment is named for then-Senator Lyndon B. Johnson of Texas, who introduced it in a preliminary draft of the law in July 1954.

In 2013, the United States Internal Revenue Service (IRS) revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. This led to wide condemnation of the agency and triggered several investigations, including a Federal Bureau of Investigation (FBI) criminal probe ordered by United States Attorney General Eric Holder.

The bill H.Res. 565, official title "Calling on Attorney General Eric H. Holder, Jr., to appoint a special counsel to investigate the targeting of conservative nonprofit groups by the Internal Revenue Service," was passed by the United States House of Representatives during the 113th United States Congress. The simple resolution asks U.S. Attorney General Eric Holder to appoint a special counsel to investigate that 2013 IRS scandal. The Internal Revenue Service revealed in 2013 that it had selected political groups applying for tax-exempt status for closer scrutiny based on their names or political themes.

SAVE is a grassroots nonprofit political advocacy organization located in Miami, Florida. Founded in 1993, the organization's stated mission is to "promote, protect and defend equality for people in South Florida who are lesbian, gay, bisexual and transgender."

Every Voice is an American nonprofit, progressive liberal political advocacy organization. The organization was formed in 2014 upon the merger of the Public Campaign Action Fund, a 501(c)(4) group, and the Friends of Democracy. Every Voice, along with its affiliated Super PAC, Every Voice Action, advocates for campaign finance reform in the United States via public financing of political campaigns and limitations on political donations. The organization's president, David Donnelly, has said "We fully embrace the irony of working through a Super PAC to fight the influence of Super PACs."

RepresentUs is a nonpartisan, nonprofit organization founded in November 2012 that advocates for state and local laws based on model legislation called the American Anti-Corruption Act. It is a proposal to overhaul lobbying, transparency, and campaign finance laws. RepresentUs is headquartered in Florence, Massachusetts and is supported by a national network of volunteer-led chapters.

Form 1023 is a United States IRS tax form, also known as the Application for Recognition of Exemption Under 501(c)(3) of the Internal Revenue Code. It is filed by nonprofits to get exemption status.

A 501(h) election or Conable election is a procedure in United States tax law that allows a 501(c)(3) non-profit organization to participate in lobbying limited only by the financial expenditure on that lobbying, regardless of its overall extent. This allows organizations taking the 501(h) election to potentially perform a large amount of lobbying if it is done using volunteer labor or through inexpensive means. The 501(h) election is available to most types of 501(c)(3) organizations that are not churches or private foundations. It was introduced by Representative Barber Conable as part of the Tax Reform Act of 1976 and codified as , and the corresponding Internal Revenue Service (IRS) regulations were finalized in 1990.

In the United States of America, Pulpit Freedom Sunday is an annual event which is held in churches. It was founded in 2008 by Alliance Defending Freedom (ADF) to challenge the prohibition on places of worship from endorsing political candidates. According to The New York Times, ADF's campaign has become "perhaps its most aggressive effort."

References

- ↑ 26 U.S.C. § 501(c)

- ↑ "IRS Rules Allow Nonpartisan Voter Education and Participation Activity by Charities". NP Action.

- ↑ Exempt Purposes - Internal Revenue Code Section 501(c)(3)

- ↑ IRS Publication 557 "Tax-Exempt Status For Your Organization", Page 19, (Rev. June 2008), Cat. No 46573C., Retrieved 3/9/2009

- ↑ "The Restriction of Political Campaign Intervention by Section 501(c)(3) Tax-Exempt Organizations". Irs.gov. 2009-05-11. Retrieved 2009-05-28.

- 1 2 "Legal Rules for Nonpartisan Voter Education, Outreach, and Participation by Nonprofits". NP Action.

- 1 2 "Political and Lobbying Activities". Irs.gov. 2009-05-11. Archived from the original on 2009-05-07. Retrieved 2009-05-28.

- ↑ "Exemption Requirements". Irs.gov. 2009-05-11.

- ↑ See 26 U.S.C. § 501(c)(4)(A).

- ↑ "FAQ's - 501(c)(4) Status for Nonprofit Organizations". T-tlaw.com. Archived from the original on 2009-06-24. Retrieved 2009-05-28.

- ↑ MacKenzie Canter, III (2009). "Primer on Federal Tax Rules Pertaining to Lobbying". Copilevitz & Canter, LLC.

- ↑ "Lobbying Guidelines for AGI and its Member Societies". American Geological Institute. 2003-12-02.

- 1 2 "IRS Releases New Guidance and Results of Political Intervention Examinations". Internal Revenue Service. 2006-02-24.

- ↑ Joshua Rhett Miller (2009-09-14). "Republican Lawmakers Turn Up the Heat on ACORN". Fox News.

- ↑ CRS report: ACORN didn't break law Politico; December 23, 2009

- 1 2 Charles C. Haynes. "The Case Against All Saints: Has The IRS Gone Too Far?". First Amendment Center.

- 1 2 Stephanie Strom (2006-10-26). "Watchdog Group Accuses Churches of Political Action". New York Times.

- ↑ Anita Vogel (2008-11-07). "Protests Over Gay-Marriage Ban Escalate in California". Fox News.

- ↑ David J. Jefferson (2008-11-15). "How Getting Married Made Me An Activist". Newsweek.

- ↑ Chino Blanco (2009-05-08). "The LDS Church, Proposition 8, and the Federal Law of Charities". Latter Day Main Street.

- ↑ Robert Marus (2007-09-28). "California church leaders question IRS investigation into war sermon". Associated Baptist Press.

- 1 2 Jane Lampman (2008-09-26). "Pulpit politics: Pastors to defy IRS". Christian Science Monitor.