Related Research Articles

The Alaska Permanent Fund (APF) is a constitutionally established permanent fund managed by a state-owned corporation, the Alaska Permanent Fund Corporation (APFC). It was established in Alaska in 1976 by Article 9, Section 15 of the Alaska State Constitution under Governor Jay Hammond and Attorney General Avrum Gross. From February 1976 until April 1980, the Department of Revenue Treasury Division managed the state's Permanent Fund assets, until, in 1980, the Alaska State Legislature created the APFC.

The Government Pension Fund of Norway comprises two entirely separate sovereign wealth funds owned by the government of Norway.

The North Dakota Legislative Assembly is the state legislature of the U.S. state of North Dakota. The Legislative Assembly consists of two chambers, the lower North Dakota House of Representatives, with 94 representatives, and the upper North Dakota Senate, with 47 senators. The state is divided into 47 constituent districts, with two representatives and one senator elected from each district. Due to the Legislative Assembly being a biennial legislature, with the House and Senate sitting for only 80 days in odd-numbered years, a Legislative Council oversees legislative affairs in the interim periods, doing longer-term studies of issues, and drafting legislation for consideration of both houses during the next session.

The Permanent University Fund (PUF) is a sovereign wealth fund created by the State of Texas to fund public higher education within the state. A portion of the returns from the PUF are annually directed towards the Available University Fund (AUF), which distributes the funds according to provisions set forth by the 1876 Texas Constitution, subsequent constitutional amendments, and the board of regents of the Texas A&M University System and University of Texas System. The PUF provides extra funds, above monies from tax revenues, to the UT System and the Texas A&M System which collectively have approximately 50 percent of state public university students. The PUF does not provide any funding to other public Universities in the State of Texas.

The Kuwait Investment Authority (KIA) is the Middle East's oldest sovereign wealth fund, managing the state’s reserve and the state’s future generation fund (FGF).

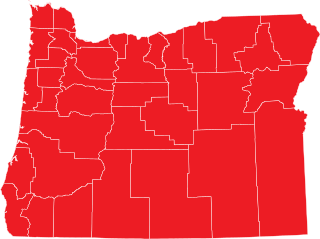

Oregon ballot measure 48 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. Measure 48 was an initiated constitutional amendment ballot measure. Oregon statute currently limits state appropriations to 8% of projected personal income in Oregon. If Governor declares emergency, legislature may exceed current statutory appropriations limit by 60% vote of each house. This measure would have added a constitutional provision limiting any increase in state spending from one biennium to next biennium to the percentage increase in state population, plus inflation, over previous two years. Certain exceptions to limit, including spending of: federal, donated funds; proceeds from selling certain bonds, real property; money to fund emergency funds; money to fund tax, "kicker," other refunds were included in the provisions of the measure. It also would have provided that spending limit may be exceeded by amount approved by two-thirds of each house of legislature and approved by majority of voters voting in general election.

The Stabilization fund of the Russian Federation was a sovereign wealth fund established based on a resolution of the Government of Russia on 1 January 2004, as a part of the federal budget to balance the federal budget at the time of when oil price falls below a cut-off price, currently set at US$27 per barrel.

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

The Alberta Heritage Savings Trust Fund(HSTF) is a sovereign wealth fund established in 1976 by the Government of Alberta under then-Premier Peter Lougheed. The Heritage Savings Trust Fund was created with three objectives: "to save for the future, to strengthen or diversify the economy, and to improve the quality of life of Albertans." The operations of the Heritage Savings Trust Fund are subject to the Alberta Heritage Savings Trust Fund Act and with the goal of providing "prudent stewardship of the savings from Alberta's non-renewable resources by providing the greatest financial returns on those savings for current and future generations of Albertans." Between 1976 and 1983 the Government of Alberta deposited a portion of oil revenue into the fund. The Heritage Savings Trust Fund used oil revenues to invest for the long term in such areas as health care, education and research and as a way of ensuring that the development of non-renewable resources would be of long-term benefit to Alberta. The strategy and goals of the fund have changed through successive provincial governments which moved away from direct investments in Alberta to a diversified approach, which now includes stocks, bonds, real estate and other ventures.

The 75th Oregon Legislative Assembly convened beginning on January 12, 2009, for its biennial regular session. All of the 60 seats in the House of Representatives and half of the 30 seats in the State Senate were up for election in 2008; the general election for those seats took place on November 4.

A Frankenstein veto occurs when an American state governor selectively deletes words from a bill, stitching together the remainder to form a new bill different from that passed by the legislature.

The Budget of the State of Oklahoma is the governor's proposal to the Oklahoma Legislature which recommends funding levels to operate the state government for the next fiscal year, beginning July 1. Legislative decisions are governed by rules and legislation regarding the state budget process.

The Timor-Leste Petroleum Fund is a sovereign wealth fund into which the surplus wealth produced by East Timor petroleum and gas income is deposited by the East Timorese government.

The National Development Fund of Iran is Iran's sovereign wealth fund. It was founded in 2011 to supplement the Oil Stabilization Fund. NDFI is independent of the government's budget. Based on Article 84 of the Fifth Five-year Socio-Economic Development Plan (2010–2015), the National Development Fund was established to transform oil and gas revenues to productive investment for future generation. It is a member of the International Forum of Sovereign Wealth Funds and therefore is signed up to the Santiago Principles on best practice in managing sovereign wealth funds. Withdrawing any money from this fund requires Khamenei's permission.

The Texas Permanent School Fund is a sovereign wealth fund which serves to provide revenues for funding of public primary and secondary education in the US state of Texas. Its assets include many publicly owned lands within Texas and various other investments; as of the end of fiscal 2020, the fund had an endowment of $48.3 billion. The fund is distinct from the Permanent University Fund, which funds most institutions in the University of Texas System and the Texas A&M University System, but no other public universities or schools in the state.

The Nigeria Sovereign Investment Authority is a Nigerian establishment which manages the Nigeria sovereign wealth fund, into which the surplus income produced from Nigeria's excess oil reserves is deposited. This sovereign wealth fund was founded for the purpose of managing and investing these funds on behalf of the government of Nigeria. The fund was established by the Nigeria Sovereign Investment Authority Act 2011, signed in May 2011, and commenced operations in October 2012. It is intended to invest the savings gained on the difference between the budgeted and actual market prices for oil to earn returns that would benefit future generations of Nigerians. The fund was allocated an initial US$1 billion in seed capital, and, an additional $0.60billion has been contributed to date by the current administration. In October 2023, the fund has US$2.3 billion in assets under management.

A severance tax is an article of legislation that imposes a tax on the extraction of natural resources. In the United States, California is the only state that does not impose a significant severance tax. Instead, California imposes a statewide assessment fee, as set by the California Department of Conservation, and individual counties may choose to impose an ad valorem tax on a per county basis. Over the years, several measures have been introduced as ballot initiatives and legislation in an attempt to pass a statewide severance tax, though none has become law.

Oregon's Emergency Board is a statutory legislative committee composed of members of both houses of the Oregon Legislative Assembly. It has broad powers to allocate general fund resources, lottery revenue, and other state funds for unanticipated government requirements when the state legislature is not in session. The board can authorize an agency to overspend its approved budget or approve a new budget amount for specific agency tasks. It can also authorize the transfers of funds between agencies or budget accounts. The Emergency Board is jointly chaired by the President of the Oregon Senate and the Speaker of the Oregon House of Representatives.

The North Dakota Industrial Commission is the body that oversees the management of several separate programs and resources, including the Bank of North Dakota, North Dakota Mill and Elevator, and the Department of Mineral Resources. By law, it has three members: the Attorney General, the Agriculture Commissioner, and the Governor, who acts as chair.

References

- ↑ North Dakota State Constitution, Art. X, sec. 26.

- 1 2 3 "North Dakota's Legacy Fund: Building a Bridge to the Future" (PDF). betterenergy.org. p. 14. Retrieved 8 May 2024.

- ↑ "Legacy Fund". Retirement Investment Office. 19 June 2023.

- ↑ "North Dakota's Oil Boom is over. What Now?". The Atlantic . 27 June 2015.

- ↑ Turley, Jeremy (Feb 10, 2023). "Bill shapes spending of North Dakota Legacy Fund earnings". The Bismarck Tribune. Retrieved May 5, 2023.