In economics, a recession is a business cycle contraction that occurs when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster.

Neoliberalism, also neo-liberalism, is a term used to signify the late-20th century political reappearance of 19th-century ideas associated with free-market capitalism, which had fallen into decline following the Second World War. The term has multiple, competing definitions, and is often used pejoratively. In scholarly use, the term is frequently undefined or used to characterize a vast variety of phenomena.

The Four Asian Tigers are the developed East Asian economies of Hong Kong, Singapore, South Korea, and Taiwan. Between the early 1950s and 1990s, they underwent rapid industrialization and maintained exceptionally high growth rates of more than 7 percent a year.

Alan Greenspan is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates LLC.

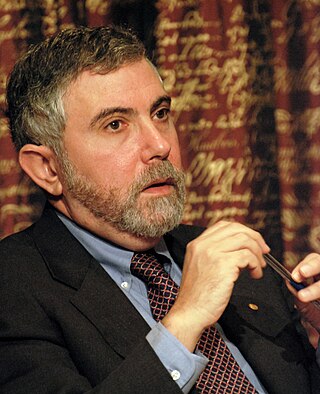

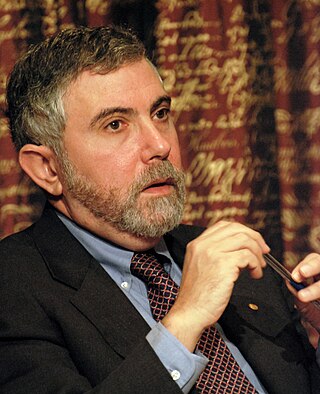

Paul Robin Krugman is an American economist who is the Distinguished Professor of Economics at the Graduate Center of the City University of New York and a columnist for The New York Times. In 2008, Krugman was the winner of the Nobel Memorial Prize in Economic Sciences for his contributions to new trade theory and new economic geography. The Prize Committee cited Krugman's work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of economies of scale and of consumer preferences for diverse goods and services.

Nouriel Roubini is a Turkish-born Iranian-American economic consultant, economist, and writer. He is a Professor Emeritus since 2021 at the Stern School of Business of New York University.

A real-estate bubble or property bubble is a type of economic bubble that occurs periodically in local or global real estate markets, and it typically follows a land boom. A land boom is a rapid increase in the market price of real property such as housing until they reach unsustainable levels and then declines. This period, during the run-up to the crash, is also known as froth. The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance, are answered differently by schools of economic thought, as detailed below.

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions of people losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

At the micro-economic level, deleveraging refers to the reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm. It is the opposite of leveraging, which is the practice of borrowing money to acquire assets and multiply gains and losses.

The Great Recession was a period of marked general decline observed in national economies globally, i.e. a recession, that occurred in the late 2000s. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

Mark M. Zandi is an American economist who is the chief economist of Moody's Analytics, where he directs economic research.

The Lost Decades is a lengthy period of economic stagnation in Japan precipitated by the asset price bubble's collapse beginning in 1990. The singular term Lost Decade originally referred to the 1990s, but the 2000s and the 2010s have been included by commentators as the phenomenon continued.

Andy Xie is an independent economist based in Shanghai, and the former Morgan Stanley star chief Asia-Pacific economist famous for his contrarian and provocative views. He left Morgan Stanley abruptly in October 2006 when an internal email that he penned was leaked. He derided Singapore as a money laundering centre for Indonesia, and the ASEAN group of nations as a failure.

Foreign trade of the United States comprises the international imports and exports of the United States. The country is among the top three global importers and exporters.

The 2005 Chinese property bubble was a real estate bubble in residential and commercial real estate in China. The New York Times reported that the bubble started to deflate in 2011, while observing increased complaints that members of the middle-class were unable to afford homes in large cities. The deflation of the property bubble is seen as one of the primary causes for China's declining economic growth in 2013.

Real estate in China is developed and managed by public, private, and state-owned red chip enterprises.

Scott B. Sumner is an American economist. He was previously the Director of the Program on Monetary Policy at the Mercatus Center at George Mason University, a Research Fellow at the Independent Institute, and a professor at Bentley University in Waltham, Massachusetts. His economics blog, The Money Illusion, popularized the idea of nominal GDP targeting, which says that the Federal Reserve and other central banks should target nominal GDP, real GDP growth plus the rate of inflation, to better "induce the correct level of business investment".

The 2007–2008 financial crisis, or Global Financial Crisis (GFC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a "perfect storm", which led to the Great Recession.

The economic policy of the Donald Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, immigration restriction, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.