A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses, including self-employment and businesses that do not intend to go public, startups are new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential.

Venture capital is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology.

Sequoia Capital is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

An entrepreneur in residence, or executive in residence (EIR), is a position most often held by successful entrepreneurs in venture capital firms, private equity firms, startup accelerators, law firms or business schools. The EIR typically leads, or has led, a small, early-stage, emerging company deemed to have high-growth potential, or which has demonstrated high growth in its number of employees, annual revenue, or both. An institutional fund may provide an entrepreneur in residence, or executive in residence, with the working capital to nurture expansion, new-product development, or restructuring of a company's operations, management, or ownership.

An angel investor is an individual who provides capital to a business or businesses, including startups, usually in exchange for convertible debt or ownership equity. Angel investors often provide support to startups at a very early stage, once or in a consecutive manner, and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital and provide advice to their portfolio companies. The number of angel investors has greatly increased since the mid-20th century.

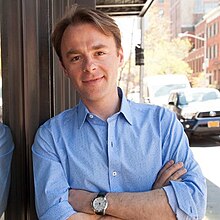

James W. Breyer is an American venture capitalist, founder and chief executive officer of Breyer Capital, an investment and venture philanthropy firm, and a former managing partner at Accel Partners, a venture capital firm. Breyer has invested in over 40 companies that have gone public or completed a merger, with some of these investments, including Facebook, earning over 100 times cost and many others over 25 times cost. On the Forbes 2021 list of the 400 richest Americans, he was ranked #389, with a net worth of US$2.9 billion.

Startup accelerators, also known as seed accelerators, are fixed-term, cohort-based programs, that include mentorship and educational components and culminate in a public pitch event or demo day. While traditional business incubators are often government-funded, generally take no equity, and rarely provide funding, accelerators can be either privately or publicly funded and cover a wide range of industries. Unlike business incubators, the application process for seed accelerators is open to anyone but highly competitive. There are specific accelerators, such as corporate accelerators, which are often subsidiaries or programs of larger corporations that act like seed accelerators.

AngelList is a U.S. website for fundraising and connecting startups, angel investors, and limited partners. Founded in 2010, it started as an online introduction board for tech startups that needed seed funding. Since 2015, the site allows startups to raise money from angel investors free of charge. Created by serial entrepreneur Naval Ravikant and Babak Nivi in 2010, Avlok Kohli has been leading AngelList as its CEO since 2019.

Fear of missing out (FOMO) is the feeling of apprehension that one is either not in the know about or missing out on information, events, experiences, or life decisions that could make one's life better. FOMO is also associated with a fear of regret, which may lead to concerns that one might miss an opportunity for social interaction, a novel experience, a memorable event, or a profitable investment. It is characterized by a desire to stay continually connected with what others are doing, and can be described as the fear that deciding not to participate is the wrong choice. FOMO could result from not knowing about a conversation, missing a TV show, not attending a wedding or party, or hearing that others have discovered a new restaurant. FOMO in recent years has been attributed to a number of negative psychological and behavioral symptoms.

Zoomcar is an Indian carsharing platform, headquartered in Bangalore. The company was founded in 2013 by David Back and Greg Moran. It currently operates in 34+ cities.

OurCrowd is an online global venture investing platform that empowers institutions and individual accredited investors to invest and engage in emerging technology companies at an early stage while still privately held. Based in Jerusalem, the company launched in February 2013, and has since opened overseas branches in the United States, the United Kingdom, Canada, Australia, Spain, Singapore, Brazil, and the UAE.

Vishen Lakhiani. is a Malaysian entrepreneur, author, and motivational speaker, of Indian descent. He is the founder and CEO of Mindvalley and the author of two books: The Code of the Extraordinary Mind and The Buddha and the Badass.

In business, a unicorn is a privately held startup company valued at over US$1 billion. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures.

Eureeca is an equity crowdfunding platform with presence in Europe, the Middle East and South East Asia that allows early-stage businesses and small and medium-sized enterprises (SMEs) to raise capital from a group of investors, who range from casual and angel investors to institutional firms, in exchange for equity. Eureeca serves as an alternative financing option to more traditional financing sources such as banks and venture capital firms.

StreetShares, Inc. is a financial technology company and small business funding marketplace based outside of Washington, D.C.

David Cancel is an American entrepreneur, investor, and founder of several software companies. He is the CEO and founder of Drift, a Cambridge, Massachusetts-based company which creates messaging software for businesses.

Alexandra Wilkis Wilson is an American entrepreneur and investor who co-founded the companies the Gilt Groupe, GlamSquad, and Fitz. She is currently co-founder and Managing Partner at Clerisy, a consumer-focused growth equity fund.

York Entrepreneurship Development Institute (YEDI) is a venture fund, startup accelerator, incubator and entrepreneurial community located within York University in Toronto, Ontario, Canada. YEDI facilitates collaboration between students, alumni, and academic and business leaders. The organization was founded in 2013 by businessman Dr. Marat Ressin, a native of Russia with close ties to the Jewish community in Canada.

Berkeley SkyDeck (SkyDeck) is a high-tech entrepreneurship startup accelerator and incubator program at the University of California, Berkeley serving as a joint venture between the Haas School of Business and Berkeley College of Engineering. Founded in 2012, SkyDeck promotes high-tech entrepreneurship in the Silicon Valley.

Eric Paley is an American entrepreneur and venture capitalist. He is the co-founder and managing partner of Founder Collective, a seed-stage venture capital fund based in Cambridge, Massachusetts.