In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a unique price given the risk of the security and its expected return. The equation and model are named after economists Fischer Black and Myron Scholes. Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

In finance, a forward contract, or simply a forward, is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on in the contract, making it a type of derivative instrument. The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the delivery price, which is equal to the forward price at the time the contract is entered into.

In finance, an equity derivative is a class of derivatives whose value is at least partly derived from one or more underlying equity securities. Options and futures are by far the most common equity derivatives, however there are many other types of equity derivatives that are actively traded.

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. The list of assets that each ETF owns, as well as their weightings, is posted on the website of the issuer daily, or quarterly in the case of active non-transparent ETFs. Many ETFs provide some level of diversification compared to owning an individual stock.

In finance, a contract for difference (CFD) is a legally binding agreement that creates, defines, and governs mutual rights and obligations between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time. If the closing trade price is higher than the opening price, then the seller will pay the buyer the difference, and that will be the buyer's profit. The opposite is also true. That is, if the current asset price is lower at the exit price than the value at the contract's opening, then the seller, rather than the buyer, will benefit from the difference.

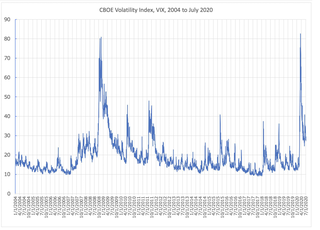

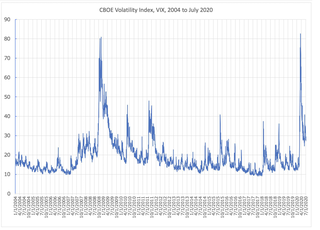

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

A property derivative is a financial derivative whose value is derived from the value of an underlying real estate asset. In practice, because individual real estate assets fall victim to market inefficiencies and are hard to accurately price, property derivative contracts are typically written based on a real estate property index. In turn, the real estate property index attempts to aggregate real estate market information to provide a more accurate representation of underlying real estate asset performance. Trading or taking positions in property derivatives is also known as synthetic real estate.

In finance, a stock market index future is a cash-settled futures contract on the value of a particular stock market index. The turnover for the global market in exchange-traded equity index futures is notionally valued, for 2008, by the Bank for International Settlements at US$130 trillion.

An inverse exchange-traded fund is an exchange-traded fund (ETF), traded on a public stock market, which is designed to perform as the inverse of whatever index or benchmark it is designed to track. These funds work by using short selling, trading derivatives such as futures contracts, and other leveraged investment techniques.

An exchange-traded product (ETP) is a regularly priced security which trades during the day on a national stock exchange. ETPs may embed derivatives but it is not a requirement that they do so – and the investment memorandum should be read with care to ensure that the pricing methodology and use of derivatives is explicitly stated. Typically, individual underlying securities, such as stocks and bonds, are not considered ETPs.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.

In finance, a dividend future is an exchange-traded derivative contract that allows investors to take positions on future dividend payments. Dividend futures can be on a single company, a basket of companies, or on an Equity index. They settle on the amount of dividend paid by the company, the basket of companies, or the index during the period of the contract.

Bitfinex is a cryptocurrency exchange owned and operated by iFinex Inc, and is registered in the British Virgin Islands. Bitfinex was founded in 2012. It was originally a peer-to-peer Bitcoin exchange, and later added support for other cryptocurrencies.

A cryptocurrency bubble is a phenomenon where the market increasingly considers the going price of cryptocurrency assets to be inflated against their hypothetical value. The history of cryptocurrency has been marked by several speculative bubbles.

Bakkt Holdings, Inc., headquartered in Alpharetta, Georgia, provides a software as a service (SaaS) and API platform for owning and trading cryptocurrency and redeeming loyalty points. Bakkt was founded by and is 55.6% owned by Intercontinental Exchange (ICE), which also owns the New York Stock Exchange. Bakkt earns revenue from commissions for payments and purchases and sales of cryptocurrency.

BitMEX is a cryptocurrency exchange and derivative trading platform. It is owned and operated by HDR Global Trading Limited, which is registered in the Seychelles.

bitFlyer is a private company headquartered in Tokyo, Japan and founded in 2014. It operates one of the largest cryptocurrency exchanges with 2.5 million users and develops other crypto-related technology.

ProShares is an issuer of exchange-traded funds, including inverse exchange-traded funds, and similar products.