Conflict of laws is the set of rules or laws a jurisdiction applies to a case, transaction, or other occurrence that has connections to more than one jurisdiction. This body of law deals with three broad topics: jurisdiction, rules regarding when it is appropriate for a court to hear such a case; foreign judgments, dealing with the rules by which a court in one jurisdiction mandates compliance with a ruling of a court in another jurisdiction; and choice of law, which addresses the question of which substantive laws will be applied in such a case. These issues can arise in any private-law context, but they are especially prevalent in contract law and tort law.

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

The Uniform Commercial Code (UCC), first published in 1952, is one of a number of Uniform Acts that have been established as law with the goal of harmonizing the laws of sales and other commercial transactions across the United States through UCC adoption by all 50 states, the District of Columbia, and the Territories of the United States.

Structured finance is a sector of finance - specifically financial law - that manages leverage and risk. Strategies may involve legal and corporate restructuring, off balance sheet accounting, or the use of financial instruments.

The direct holding system is a traditional system of securities clearance, settlement and ownership in which owners of securities had a direct relationship with the issuer. Investors would either be recorded on the issuer's register or be in physical possession of bearer securities certificates.

The Convention on the law applicable to certain rights in respect of securities held with an intermediary, or Hague Securities Convention is an international multilateral treaty intended to remove, globally, legal uncertainties for cross-border securities transactions. The Convention was drafted under the auspices of the Hague Conference on Private International Law, which as resulted in several Conflict of Laws conventions.

The look-through approach is a conflict of laws rule applied to the proprietary aspects of security transactions. It is an application of the traditional lex rei sitae test.

Choice of law is a procedural stage in the litigation of a case involving the conflict of laws when it is necessary to reconcile the differences between the laws of different legal jurisdictions, such as sovereign states, federated states, or provinces. The outcome of this process is potentially to require the courts of one jurisdiction to apply the law of a different jurisdiction in lawsuits arising from, say, family law, tort, or contract. The law which is applied is sometimes referred to as the "proper law." Dépeçage is an issue within choice of law.

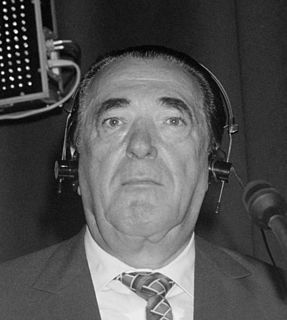

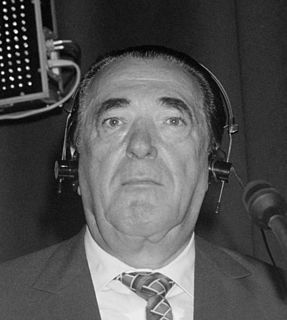

Macmillan Inc v Bishopsgate Investment Trust plc [1995] EWCA Civ 55, [1996] WLR 387 is a judicial decision relating to English trusts law and conflict of laws case from the Court of Appeal. The issue arose in relation to frauds conducted by the late Robert Maxwell.

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations. One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

Lex causae, in conflict of laws, is the law chosen by the forum court from the relevant legal systems when it judges an international or interjurisdictional case. It refers to the usage of particular local laws as the basis or "cause" for the ruling, which would itself become part of referenced legal canon.

Lex loci celebrationis is a Latin term for a legal principle in English common law, roughly translated as "the law of the land where the marriage was celebrated". It refers to the validity of the union, independent of the laws of marriage of the countries involved: where the two individuals have legal nationality or citizenship, or where they live. The assumption under the common law is that such a marriage, when lawfully and validly celebrated under the relevant law of the land, is also lawful and valid.

In the conflict of laws, the lex loci contractus is the Latin term for "law of the place where the contract is made".

Lex loci solutionis, in conflict of laws, is the law applied in the place of an event.

The lex loci delicti commissi or lex loci delictus is the Latin term for "law of the place where the delict [tort] was committed" in the conflict of laws. Conflict of laws is the branch of law regulating all lawsuits involving a "foreign" law element where a difference in result will occur depending on which laws are applied.

In law, perfection relates to the additional steps required to be taken in relation to a security interest in order to make it effective against third parties or to retain its effectiveness in the event of default by the grantor of the security interest. Generally speaking, once a security interest is effectively created, it gives certain rights to the holder of the security and imposes duties on the party who grants that security. However, in many legal systems, additional steps --- perfection of the security interest --- are required to enforce the security against third parties such as a liquidator.

The Hague Convention on the Law Applicable to Trusts and on their Recognition, or Hague Trust Convention is a multilateral treaty developed by the Hague Conference on Private International Law on the Law Applicable to Trusts. It concluded on 1 July 1985, entered into force 1 January 1992, and is as of September 2017 ratified by 14 countries. The Convention uses a harmonised definition of a trust, which is the subject of the convention, and sets Conflict rules for resolving problems in the choice of the applicable law. The key provisions of the Convention are:

The Unidroit convention on substantive rules for intermediated securities, also known as the Geneva Securities Convention, was adopted on 9 October 2009. It has been signed by only one of the 40 negotiating States (Bangladesh), but not entered into force. The official commentary was published in 2012.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Financial law is the law and regulation of the insurance, derivatives, commercial banking, capital markets and investment management sectors. Understanding Financial law is crucial to appreciating the creation and formation of banking and financial regulation, as well as the legal framework for finance generally. Financial law forms a substantial portion of commercial law, and notably a substantial proportion of the global economy, and legal billables are dependent on sound and clear legal policy pertaining to financial transactions. Therefore financial law as the law for financial industries involves public and private law matters. Understanding the legal implications of transactions and structures such as an indemnity, or overdraft is crucial to appreciating their effect in financial transactions. This is the core of Financial law. Thus, Financial law draws a narrower distinction than commercial or corporate law by focusing primarily on financial transactions, the financial market, and its participants; for example, the sale of goods may be part of commercial law but is not financial law. Financial law may be understood as being formed of three overarching methods, or pillars of law formation and categorised into five transaction silos which form the various financial positions prevalent in finance.