In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

Prediction markets, also known as betting markets, information markets, decision markets, idea futures or event derivatives, are open markets that enable the prediction of specific outcomes using financial incentives. They are exchange-traded markets established for trading bets in the outcome of various events. The market prices can indicate what the crowd thinks the probability of the event is. A typical prediction market contract is set up to trade between 0 and 100%. The most common form of a prediction market is a binary option market, which will expire at the price of 0 or 100%. Prediction markets can be thought of as belonging to the more general concept of crowdsourcing which is specially designed to aggregate information on particular topics of interest. The main purposes of prediction markets are eliciting aggregating beliefs over an unknown future outcome. Traders with different beliefs trade on contracts whose payoffs are related to the unknown future outcome and the market prices of the contracts are considered as the aggregated belief.

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options.

The Commodity Futures Modernization Act of 2000 (CFMA) is United States federal legislation that ensured financial products known as over-the-counter (OTC) derivatives remained unregulated. It was signed into law on December 21, 2000 by President Bill Clinton. It clarified the law so most OTC derivative transactions between "sophisticated parties" would not be regulated as "futures" under the Commodity Exchange Act of 1936 (CEA) or as "securities" under the federal securities laws. Instead, the major dealers of those products would continue to have their dealings in OTC derivatives supervised by their federal regulators under general "safety and soundness" standards. The Commodity Futures Trading Commission's (CFTC) desire to have "functional regulation" of the market was also rejected. Instead, the CFTC would continue to do "entity-based supervision of OTC derivatives dealers". The CFMA's treatment of OTC derivatives such as credit default swaps has become controversial, as those derivatives played a major role in the financial crisis of 2008 and the subsequent 2008–2012 global recession.

Foreign exchange fraud is any trading scheme used to defraud traders by convincing them that they can expect to gain a high profit by trading in the foreign exchange market. Currency trading became a common form of fraud in early 2008, according to Michael Dunn of the U.S. Commodity Futures Trading Commission.

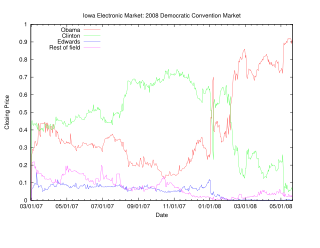

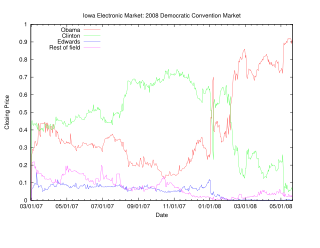

The Iowa Electronic Markets (IEM) are a group of real-money prediction markets/futures markets operated by the University of Iowa Tippie College of Business. Unlike normal futures markets, the IEM is not-for-profit; the markets are run for educational and research purposes.

Options Clearing Corporation (OCC) is a United States clearing house based in Chicago. It specializes in equity derivatives clearing, providing central counterparty (CCP) clearing and settlement services to 16 exchanges. It was started by Wayne Luthringshausen and carried on by Michael Cahill. Its instruments include options, financial and commodity futures, security futures, and securities lending transactions.

Intrade.com was a web-based trading exchange whose members "traded" contracts between each other on the probabilities of various events occurring. After having been forced to exclude US traders in 2012, on 10 March 2013 Intrade suspended all trading, citing possible "financial irregularities". For a time after the suspension, the intrade.com website stated that they were working on a relaunch of the site, called "Intrade 2.0", but as of August 2014 it states that "It appears very unlikely now that Intrade will resume trading services in the way it had operated previously", and announced plans to close all accounts and refund monies by 31 December 2014.

iPredict was a New Zealand prediction market that offered prediction exchanges on current events, political issues and economic issues. iPredict was jointly owned by the New Zealand Institute for the Study of Competition and Regulation and Victoria University of Wellington. The site launched on 9 September 2008 and closed 1 December 2016.

In finance, box office futures is a type of futures contract in which investors speculate on upcoming movies based on their predicted performance.

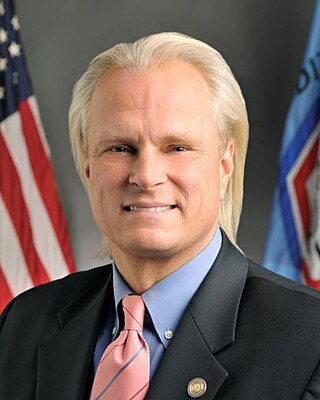

Sean O'Brien Cota is an American businessman, energy market expert, financial commentator, and policy advisor on American energy and financial market transparency and reform measures. As the President of a third generation family-owned oil company, Cota & Cota Oil, Inc. in Bellows Falls, VT, whom he has worked for since 1977, he became extremely involved in energy commodity trading in 1988. In 2010, he was named Chairman of the Petroleum Marketers Association of America.

Bartholomew Hamilton Chilton was an American civil servant.

A Swap Execution Facility (SEF) is a platform for financial swap trading that provides pre-trade information and a mechanism for executing swap transactions among eligible participants.

A commodity trading advisor (CTA) is US financial regulatory term for an individual or organization who is retained by a fund or individual client to provide advice and services related to trading in futures contracts, commodity options and/or swaps. They are responsible for the trading within managed futures accounts. The definition of CTA may also apply to investment advisors for hedge funds and private funds including mutual funds and exchange-traded funds in certain cases. CTAs are generally regulated by the United States federal government through registration with the Commodity Futures Trading Commission (CFTC) and membership of the National Futures Association (NFA).

A managed futures account (MFA) or managed futures fund (MFF) is a type of alternative investment in the US in which trading in the futures markets is managed by another person or entity, rather than the fund's owner. Managed futures accounts include, but are not limited to, commodity pools. These funds are operated by commodity trading advisors (CTAs) or commodity pool operators (CPOs), who are generally regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. As of June 2016, the assets under management held by managed futures accounts totaled $340 billion.

Banc De Binary was an Israeli financial firm with a history of regulatory issues on three continents. On January 9, 2017, the company announced that it would be closing due to negative press coverage and its tarnished reputation. The firm also surrendered its brokerage license with the Cyprus Securities and Exchange Commission (CySEC) removing its ability to legally trade in the European Union. Its 2014 revenues were reported as $100 million.

Heath Price Tarbert is an American lawyer and former government official who most recently served as the 14th Chairman and a Commissioner of the Commodity Futures Trading Commission (CFTC). Prior to leading the CFTC, he served as Assistant Secretary of the Treasury for International Markets and Development and as acting Under Secretary of the Treasury for International Affairs. As of July 1, 2023, he is Chief Legal Officer and Head of Corporate Affairs for Circle.

Rostin Behnam (born February 16, 1978) is an American lawyer and government official who currently serves as the 15th chairman of the Commodity Futures Trading Commission (CFTC). Prior to leading the CFTC, he served as one of five-member CFTC commissioners, having been nominated on July 13, 2017 by President Donald Trump to fulfill a term expiring June 19, 2021. Behnam was unanimously confirmed by the Senate on August 3, 2017, and sworn in as commissioner on September 6, 2017. On January 21, 2021, the commission members unanimously elected Behnam to be acting chairman following President Joe Biden' s inauguration and the resignation of Heath Tarbert, who served as chairman since July 15, 2019. Behnam was re-nominated by President Biden as a commissioner, and simultaneously nominated to chair the agency for a new 5-year term through June 19, 2026. Behnam was unanimously confirmed by the Senate on December 15, 2021, and sworn in as CFTC's chairman and chief administrative officer on January 4, 2022.

Kalshi Inc. is a U.S.-based financial exchange and prediction market offering event contracts. The platform was launched in July 2021. Kalshi has been described as a potential "new competitor for PredictIt", though Kalshi does not currently oversee election contracts.

Polymarket is a decentralized prediction market platform that allows users to place bets on world events. Users buy and sell shares using cryptocurrency to bet on the likelihood of future events taking place.