The 2003 mutual fund scandal was the result of the discovery of illegal late trading and market timing practices on the part of certain hedge fund and mutual fund companies.

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

Skandia is a Swedish financial services corporation that provides insurance, banking and asset management services.

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. As of 2023, AIG employed 25,200 people. The company operates through three core businesses: general insurance, life & retirement, and a standalone technology-enabled subsidiary. General Insurance includes Commercial, Personal Insurance, U.S. and International field operations. Life & Retirement includes Group Retirement, Individual Retirement, Life, and Institutional Markets. AIG is the title sponsor of the AIG Women's Open golf tournament. In 2023, for the sixth consecutive year, DiversityInc named AIG among the Top 50 Companies for Diversity list.

Prudential plc is a British multinational insurance company headquartered in London, England. It was founded in London in May 1848 to provide loans to professional and working people.

The Charles Schwab Corporation is an American multinational financial services company. It offers banking, commercial banking, investing and related services including consulting, and wealth management advisory services to both retail and institutional clients. It has over 380 branches, primarily in financial centers in the United States and the United Kingdom. It ranks tenth on the list of largest banks in the United States by assets. As of December 31, 2023, it had $8.5 trillion in client assets, 34.8 million active brokerage accounts, 5.2 million corporate retirement plan participants, and 1.8 million banking accounts. It also offers a donor advised fund for clients seeking to donate securities. It was founded in San Francisco, California, and is headquartered in Westlake, Texas.

Ameriprise Financial, Inc. is a diversified financial services company and bank holding company incorporated in Delaware and headquartered in Minneapolis, Minnesota. It provides financial planning products and services, including wealth management, asset management, insurance, annuities, and estate planning.

Bache & Company was a securities firm that provided stock brokerage and investment banking services. The firm, which was founded in 1879, was based in New York, New York.

TD Ameritrade was a stockbroker that offered an electronic trading platform for the trade of financial assets including common stocks, preferred stocks, futures contracts, exchange-traded funds, forex, options, mutual funds, fixed income investments, margin lending, and cash management services. The company received revenue from interest income on margin balances, commissions for order execution, and payment for order flow.

A.G. Edwards, Inc. was an American financial services holding company; its principal wholly owned subsidiary was A.G. Edwards & Sons, Inc., which operated as a full-service securities broker-dealer in the United States and Europe. The firm was acquired by Wachovia to be folded into Wachovia Securities; Wachovia was subsequently acquired by Wells Fargo, and the securities division was folded into Wells Fargo Advisors. The firm provided securities and commodities brokerage, investment banking, trust services, asset management, financial and retirement planning, private client services, investment management, and other related financial services to individual, governmental, and institutional clients.

AIA Group Limited, often known as AIA, is a Hong Kong-based multinational insurance and finance corporation. It is the largest publicly listed life insurance group in Asia-Pacific. It offers insurance and financial services, writing life insurance for individuals and businesses, as well as accident and health insurance, and offers retirement planning, and wealth management services, variable contracts, investments and securities.

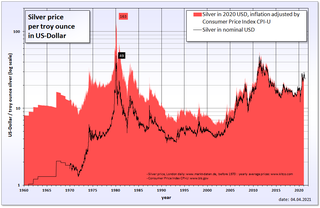

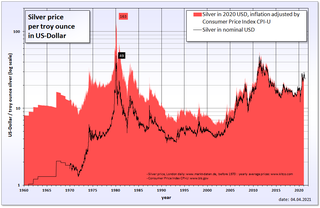

Silver Thursday was an event that occurred in the United States silver commodity markets on Thursday, March 27, 1980, following the attempt by brothers Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt to corner the silver market. A subsequent steep fall in silver prices led to panic on commodity and futures exchanges.

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important financial institution according to the Financial Stability Board, and is considered one of the "Big Four Banks" in the United States, alongside JPMorgan Chase, Bank of America, and Citigroup.

The government interventions during the subprime mortgage crisis were a response to the 2007–2009 subprime mortgage crisis and resulted in a variety of government bailouts that were implemented to stabilize the financial system during late 2007 and early 2008.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

Wachovia Securities was the trade name of Wachovia's retail brokerage and institutional capital markets and investment banking subsidiaries. Following Wachovia's merger with Wells Fargo and Company on December 31, 2008, the retail brokerage became Wells Fargo Advisors on May 1, 2009 and the institutional capital markets and investment banking group became Wells Fargo Securities on July 6, 2009.

Prudential Securities, formerly known as Prudential Securities Incorporated (PSI), was an American financial services arm of the insurer, Prudential Financial. In 2003, Prudential Securities was merged into Wachovia Securities, a division of Wachovia Bank.

Merrill, previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment banking arm, both firms engage in prime brokerage and broker-dealer activities. The firm is headquartered in New York City, and once occupied the entire 34 stories of 250 Vesey Street, part of the Brookfield Place complex in Manhattan. Merrill employs over 14,000 financial advisors and manages $2.8 trillion in client assets. The company also operates Merrill Edge, a division for investment and related services, including call center counsultancy.

FWD Group is a multinational insurance company based in Hong Kong. Founded in 2013 as the insurance arm of Pacific Century Group, FWD Group sells life and medical insurance, general insurance and employee benefits in Asia. The company had USD$50.9 billion in assets under management in 2020 and in 2021 was managing US$63 billion in assets. On March 13, 2023, FWD Group refiled its Main Board listing application with The Stock Exchange of Hong Kong. The initial filing was made on February 28, 2022. In 2023, FWD celebrated its 10th anniversary, and currently operates in Hong Kong, Japan, Macau, Singapore, Thailand, Philippines, Indonesia, Vietnam, Malaysia and Cambodia.