The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a unique price given the risk of the security and its expected return. The equation and model are named after economists Fischer Black and Myron Scholes; Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited.

Vanderbilt University is a private research university in Nashville, Tennessee. Founded in 1873, it was named in honor of shipping and rail magnate Cornelius Vanderbilt, who provided the school its initial $1-million endowment; Vanderbilt hoped that his gift and the greater work of the university would help to heal the sectional wounds inflicted by the Civil War.

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on October 19, 1987. In Australia and New Zealand, the day is also referred to as Black Tuesday because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39%, and three by more than 40%. The least affected was Austria while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression.

William Henry Vanderbilt was an American businessman and philanthropist. He was the eldest son of Commodore Cornelius Vanderbilt, an heir to his fortune and a prominent member of the Vanderbilt family. Vanderbilt became the richest American after he took over his father's fortune in 1877 until his own death in 1885, passing on a substantial part of the fortune to his wife and children, particularly to his sons Cornelius II and William. He inherited nearly $100 million from his father. The fortune had doubled when he died less than nine years later.

DeVry University is a private for-profit university with its headquarters in Naperville, Illinois, and campuses throughout the United States. Founded in 1931 by Herman A. DeVry, the school is accredited by the Higher Learning Commission.

Volatility risk is the risk of a change of price of a portfolio as a result of changes in the volatility of a risk factor. It usually applies to portfolios of derivatives instruments, where the volatility of its underlying is a major influencer of prices.

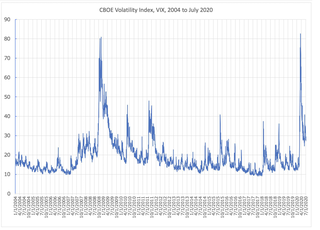

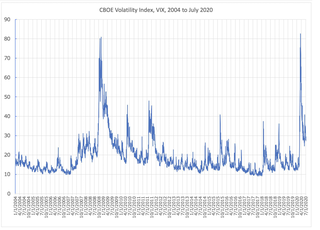

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

The CBOE S&P 500 BuyWrite Index is a benchmark index designed to show the hypothetical performance of a portfolio that engages in a buy-write strategy using S&P 500 index call options.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset value, time until expiration, market volatility, and other factors. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, orderly markets in the form of standardized contracts.

The Vanderbilt University Owen Graduate School of Management is the graduate business school of Vanderbilt University in Nashville, Tennessee, United States. Founded in 1969, Owen awards six degrees: a standard 2-year Master of Business Administration (MBA), an Executive MBA, a Master of Finance, a Master of Accountancy, a Master of Accountancy-Valuation, and a Master of Management in Health Care, as well as a large variety of joint professional and MBA degree programs. Owen also offers non-degree programs for undergraduates and executives.

Hans Reiner Stoll Died March 20, 2020, in Nashville, TN) was the Anne Marie and Thomas B. Walker, Jr. Professor of Finance and Director of the Financial Markets Research Center at Vanderbilt University's Owen Graduate School of Management. He was a Public Director of Interactive Brokers Group, Inc.

Robert James Shiller is an American economist, academic, and best-selling author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for Finance. Shiller has been a research associate of the National Bureau of Economic Research (NBER) since 1980, was vice president of the American Economic Association in 2005, its president-elect for 2016, and president of the Eastern Economic Association for 2006–2007. He is also the co‑founder and chief economist of the investment management firm MacroMarkets LLC.

Alberta Investment Management Corporation (AIMCo) is a Canadian Crown corporation and institutional investor established to manage several public funds and pensions headquartered in Edmonton, Alberta. AIMCo was established by an Act of the Legislative Assembly of Alberta in 2008 under the government of Progressive Conservative Premier Ed Stelmach.

Richard L. Daft is an American organizational theorist and the Brownlee O. Currey, Jr. Professor of Management at the Owen Graduate School of Management, Vanderbilt University.

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, algorithmic trading and investment management. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns. The resulting strategies may involve high-frequency trading.

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets.

Campbell Russell "Cam" Harvey is a Canadian economist, known for his work on asset allocation with changing risk and risk premiums and the problem of separating luck from skill in investment management. He is currently the J. Paul Sticht Professor of International Business at Duke University's Fuqua School of Business in Durham, North Carolina, as well as a research associate with the National Bureau of Economic Research in Cambridge, Massachusetts. He is also a research associate with the Institute of International Integration Studies at Trinity College Dublin and a visiting researcher at the University of Oxford. He served as the 2016 president of the American Finance Association.

Richard L. Sandor is an American businessman, economist, and entrepreneur. He is chairman and CEO of the American Financial Exchange (AFX) established in 2015, which is an electronic exchange for direct interbank/financial institution lending and borrowing. The AFX flagship product, the AMERIBOR benchmark index, reflects the actual borrowing costs of thousands of regional and community banks across the U.S. and is one of the short-term borrowing rates, along with the Secured Overnight Financing Rate, vying to replace U.S. dollar Libor as a benchmark in the U.S.

Nasdaq OMX Alpha Indexes measure the relative performance of an underlying stock or exchange-traded fund (ETF) against another benchmark ETF using a proprietary calculation. The first component in the index is the “Target Component”, such as Apple (AAPL), and the second component is identified as a “Benchmark Component”, such as the S&P 500 ETF (SPY).

Daniel Diermeier is a German-American political scientist and university administrator. He is currently serving as the ninth Chancellor of Vanderbilt University. Previously, Diermeier was the David Lee Shillinglaw Distinguished Service Professor at the University of Chicago, where he also served as Provost. He succeeded Eric Isaacs on July 1, 2016, and was succeeded by Ka Yee Lee on February 1, 2020.