A cognitive bias is a systematic pattern of deviation from norm or rationality in judgment. Individuals create their own "subjective reality" from their perception of the input. An individual's construction of reality, not the objective input, may dictate their behavior in the world. Thus, cognitive biases may sometimes lead to perceptual distortion, inaccurate judgment, illogical interpretation, and irrationality.

A heuristic, or heuristic technique, is any approach to problem solving or self-discovery that employs a practical method that is not guaranteed to be optimal, perfect, or rational, but is nevertheless sufficient for reaching an immediate, short-term goal or approximation. Where finding an optimal solution is impossible or impractical, heuristic methods can be used to speed up the process of finding a satisfactory solution. Heuristics can be mental shortcuts that ease the cognitive load of making a decision.

Bounded rationality is the idea that rationality is limited when individuals make decisions, and under these limitations, rational individuals will select a decision that is satisfactory rather than optimal.

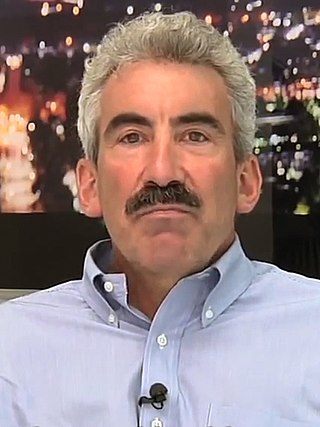

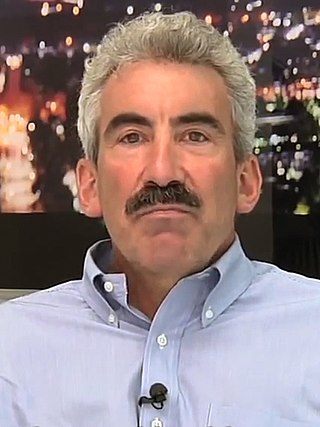

Daniel Kahneman is an Israeli-American psychologist and economist notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences. His empirical findings challenge the assumption of human rationality prevailing in modern economic theory.

In economics, time preference is the current relative valuation placed on receiving a good or some cash at an earlier date compared with receiving it at a later date.

Decision theory is a branch of applied probability theory and analytic philosophy concerned with the theory of making decisions based on assigning probabilities to various factors and assigning numerical consequences to the outcome.

Loss aversion is a psychological and economic concept which refers to how outcomes are interpreted as gains and losses where losses are subject to more sensitivity in people's responses compared to equivalent gains acquired. Kahneman and Tversky (1992) have suggested that losses can be twice as powerful, psychologically, as gains. When defined in terms of the utility function shape as in the Cumulative Prospect Theory (CPT), losses have a steeper utility than gains, thus being more "painful" than the satisfaction from a comparable gain as shown in Figure 1. Loss aversion was first proposed by Amos Tversky and Daniel Kahneman as an important framework for Prospect Theory - an analysis of decision under risk.

Status quo bias is an emotional bias; a preference for the maintenance of one's current or previous state of affairs, or a preference to not undertake any action to change this current or previous state. The current baseline is taken as a reference point, and any change from that baseline is perceived as a loss or gain. Corresponding to different alternatives, this current baseline or default option is perceived and evaluated by individuals as a positive.

Affective forecasting is the prediction of one's affect in the future. As a process that influences preferences, decisions, and behavior, affective forecasting is studied by both psychologists and economists, with broad applications.

George Loewenstein is an American educator and economist. He is the Herbert A. Simon Professor of Economics and Psychology in the Social and Decision Sciences Department at Carnegie Mellon University and director of the Center for Behavioral Decision Research. He is a leader in the fields of behavioral economics, neuroeconomics, Judgment and Decision Making.

In psychology, a dual process theory provides an account of how thought can arise in two different ways, or as a result of two different processes. Often, the two processes consist of an implicit (automatic), unconscious process and an explicit (controlled), conscious process. Verbalized explicit processes or attitudes and actions may change with persuasion or education; though implicit process or attitudes usually take a long amount of time to change with the forming of new habits. Dual process theories can be found in social, personality, cognitive, and clinical psychology. It has also been linked with economics via prospect theory and behavioral economics, and increasingly in sociology through cultural analysis.

Dysrationalia is defined as the inability to think and behave rationally despite adequate intelligence. It is a concept in educational psychology and is not a clinical disorder such as a thought disorder. Dysrationalia can be a resource to help explain why smart people fall for Ponzi schemes and other fraudulent encounters.

In psychology, the human mind is considered to be a cognitive miser due to the tendency of humans to think and solve problems in simpler and less effortful ways rather than in more sophisticated and effortful ways, regardless of intelligence. Just as a miser seeks to avoid spending money, the human mind often seeks to avoid spending cognitive effort. The cognitive miser theory is an umbrella theory of cognition that brings together previous research on heuristics and attributional biases to explain when and why people are cognitive misers.

Attribute substitution is a psychological process thought to underlie a number of cognitive biases and perceptual illusions. It occurs when an individual has to make a judgment that is computationally complex, and instead substitutes a more easily calculated heuristic attribute. This substitution is thought of as taking place in the automatic intuitive judgment system, rather than the more self-aware reflective system. Hence, when someone tries to answer a difficult question, they may actually answer a related but different question, without realizing that a substitution has taken place. This explains why individuals can be unaware of their own biases, and why biases persist even when the subject is made aware of them. It also explains why human judgments often fail to show regression toward the mean.

Heuristics is the process by which humans use mental short cuts to arrive at decisions. Heuristics are simple strategies that humans, animals, organizations, and even machines use to quickly form judgments, make decisions, and find solutions to complex problems. Often this involves focusing on the most relevant aspects of a problem or situation to formulate a solution. While heuristic processes are used to find the answers and solutions that are most likely to work or be correct, they are not always right or the most accurate. Judgments and decisions based on heuristics are simply good enough to satisfy a pressing need in situations of uncertainty, where information is incomplete. In that sense they can differ from answers given by logic and probability.

Cognitive bias mitigation is the prevention and reduction of the negative effects of cognitive biases – unconscious, automatic influences on human judgment and decision making that reliably produce reasoning errors.

The cognitive reflection test (CRT) is a task designed to measure a person's tendency to override an incorrect "gut" response and engage in further reflection to find a correct answer; however, the validity of the assessment as a measure of "cognitive reflection" or "intuitive thinking" is under question. It was first described in 2005 by psychologist Shane Frederick. The CRT has a moderate positive correlation with measures of intelligence, such as the Intelligence Quotient test, and it correlates highly with various measures of mental heuristics. Some research argue that the CRT is actually measuring cognitive abilities.

The Rationality Debate—also called the Great Rationality Debate—is the question of whether humans are rational or not. This issue is a topic in the study of cognition and is important in fields such as economics where it is relevant to the theories of market efficiency.

Gretchen Chapman is a cognitive psychologist known for her work on judgment and decision making in health-related contexts, such as clinical decision making and patient preferences, preventive health behavior, and vaccination. She is Professor of Social and Decision Sciences at Carnegie Mellon University. Chapman served as an Editor of the journal Psychological Science and is a Fellow of the Association for Psychological Science.