Redlining is a discriminatory practice in which financial services are withheld from neighborhoods that have significant numbers of racial and ethnic minorities. Redlining has been most prominent in the United States, and has mostly been directed against African-Americans. The most common examples involve denial of credit and insurance, denial of healthcare, and the development of food deserts in minority neighborhoods.

Predatory lending refers to unethical practices conducted by lending organizations during a loan origination process that are unfair, deceptive, or fraudulent. While there are no internationally agreed legal definitions for predatory lending, a 2006 audit report from the office of inspector general of the US Federal Deposit Insurance Corporation (FDIC) broadly defines predatory lending as "imposing unfair and abusive loan terms on borrowers", though "unfair" and "abusive" were not specifically defined. Though there are laws against some of the specific practices commonly identified as predatory, various federal agencies use the phrase as a catch-all term for many specific illegal activities in the loan industry. Predatory lending should not be confused with predatory mortgage servicing which is mortgage practices described by critics as unfair, deceptive, or fraudulent practices during the loan or mortgage servicing process, post loan origination.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining.

North Lawndale is one of the 77 community areas of the city of Chicago, Illinois, located on its West Side. The area contains the K-Town Historic District, the Foundation for Homan Square, the Homan Square interrogation facility, and the greatest concentration of greystones in the city. In 1968, Rev. Dr. Martin Luther King Jr. stayed in an apartment in North Lawndale to highlight the dire conditions in the area and used the experience to pave the way to the Fair Housing Act.

Flipping is a term used to describe purchasing a asset and quickly reselling it for profit.

Old Brooklyn is a neighborhood on the West Side of Cleveland, Ohio, United States, located approximately five miles south of downtown Cleveland. It extends east-to-west from the Cuyahoga River to the city of Brooklyn and north-to-south from the Brookside Park Valley to the city of Parma. It is home to the Cleveland Metroparks, including the Cleveland Zoo; the Jesse Owens tree at James Ford Rhodes High School; and the Benjamin Franklin Community Garden, the largest urban community garden in Cuyahoga County. Old Brooklyn has recently adopted the slogan "Old Brooklyn, a great place to grow" to commemorate its history and potential growth.

A community development financial institution (US) or community development finance institution (UK) - abbreviated in both cases to CDFI - is a financial institution that provides credit and financial services to underserved markets and populations, primarily in the USA but also in the UK. A CDFI may be a community development bank, a community development credit union (CDCU), a community development loan fund (CDLF), a community development venture capital fund (CDVC), a microenterprise development loan fund, or a community development corporation.

Chicago Community Loan Fund (CCLF) is a certified community development financial institution (CDFI) that provides loans and grants to community development organizations engaged in affordable housing, social service and economic development initiatives in Chicago.

Broadway–Slavic Village is a neighborhood on the Southeast side of Cleveland, Ohio. One of the city's oldest neighborhoods, it originated as the township of Newburgh, first settled in 1799. Much of the area has historically served as home to Cleveland's original Czech and Polish immigrants. While demographics have shifted over the decades, the largest part of Broadway today, Slavic Village, is named for these earlier communities.

Ukrainian Village is a Chicago neighborhood located on the near west side of Chicago. Its boundaries are Division Street to the north, Grand Avenue to the south, Western Avenue to the west, and Damen Avenue to the east. It is one of the neighborhoods in the West Town community area, and has one of the largest concentrations of Ukrainians in the United States.

Mortgage discrimination or mortgage lending discrimination is the practice of banks, governments or other lending institutions denying loans to one or more groups of people primarily on the basis of race, ethnic origin, sex or religion.

Self-Help is a national community development financial institution headquartered in Durham, North Carolina. Between the years of 1980-2017, Self-Help reportedly provided over $7 billion in financing to 146,000 families, individuals and businesses. It aims to drive economic development and strengthen communities by providing financial services, lending to individuals, small businesses and nonprofits. It also aims to develop real estate and promote fair financial practices across the nation. Through its credit union network, Self-Help serves 150,000 members in North Carolina, California, Illinois, South Carolina, Virginia, Wisconsin and Florida.

The National Community Stabilization Trust is a Washington, D.C.-based non-profit organization that facilitates the transfer of foreclosed and abandoned properties from financial institutions nationwide to local housing organizations to promote property reuse and neighborhood stability. According to U.S. Banker, the Stabilization Trust was "created to act as a middleman between cities looking to acquire abandoned properties and the lenders looking to unload them."

A bank walkaway is a decision by a mortgage lender to not foreclose on a defaulted mortgage, or to not complete foreclosure proceedings. These are sometimes referred to as abandoned foreclosures or stalled foreclosures, though this latter term is also used more broadly when the foreclosure process has stalled for other reasons.

Occupy Homes or Occupy Our Homes is part of the Occupy movement which attempts to prevent the foreclosure of people's homes. Protesters delay foreclosures by camping out on the foreclosed property. They also stage protests at the banks responsible for the ongoing foreclosure crisis, sometimes blocking their entrances. It has been compared to the direct action taken by people to prevent home foreclosures during the Great Depression in the United States.

Transfiguration Church, was a Catholic parish church in Cleveland, Ohio, in the United States. Part of the Roman Catholic Diocese of Cleveland, it was located at the southwest corner of the intersection of Broadway Avenue and Fullerton Avenue in a part of the South Broadway neighborhood previously known in Polish as Warszawa, also referred to today as Slavic Village. The church suffered a severe structure fire in 1990. The parish closed in 1992, and the church was demolished in early 1993. The records of this church, and all churches closed after 1975, can be found in the Catholic Diocese of Cleveland Archives. Diocesan policy is to keep all archive records closed.

The Broadway Avenue Historic District is a historic commercial district in the Broadway–Slavic Village neighborhood of Cleveland, Ohio, in the United States. The commercial district is the historic center of Cleveland's Czech community, and is an excellent example of a district that grew along a streetcar line. The historic district includes 43 buildings constructed between 1888 and 1930, including the Hruby Conservatory of Music and Our Lady of Lourdes Church and School. The commercial district was added to the National Register of Historic Places on October 19, 1988.

The Union Miles Development Corporation is a nonprofit community development corporation serving the Union-Miles Park statistical planning area in Cleveland, Ohio, in the United States. Created in 1981 by the Union Miles Community Coalition, it was successful in drawing national attention to discriminatory practices in lending practices and won passage of an Ohio law reforming housing foreclosure procedures.

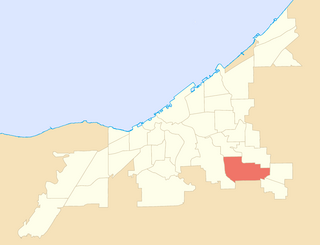

Union–Miles Park is a neighborhood on the Southeast side of Cleveland, Ohio, in the United States. The neighborhood draws its name from Union Avenue, and Miles Park in its far southwest corner.

Third Federal S&L is a major savings and loan association in Cleveland, Ohio, founded in 1938 amid the Great Depression as Cleveland was the 5th largest city at the time with many young homeowners, before the United States entry into World War II. It does business in Ohio, Florida, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Kentucky, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Tennessee, Virginia, Washington, and Wisconsin