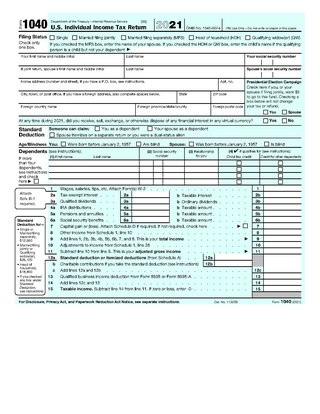

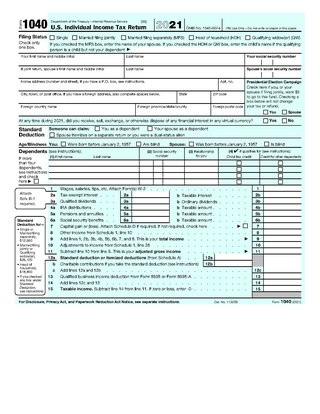

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

A flat tax is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation.

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax.

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available.

Under United States tax law, the standard deduction is a dollar amount that non-itemizers may subtract from their income before income tax is applied. Taxpayers may choose either itemized deductions or the standard deduction, but usually choose whichever results in the lesser amount of tax payable. The standard deduction is available to individuals who are US citizens or resident aliens. The standard deduction is based on filing status and typically increases each year, based on inflation measurements from the previous year. It is not available to nonresident aliens residing in the United States. Additional amounts are available for persons who are blind and/or are at least 65 years of age.

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada, and of the governments of the Provinces of Canada. In the fiscal year ending March 31, 2018, the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

The marriage penalty in the United States refers to the higher taxes required from some married couples with both partners earning income that would not be required by two otherwise identical single people with exactly the same incomes. There is also a marriage bonus that applies in other cases. Multiple factors are involved, but in general, in the current U.S. system, single-income married couples usually benefit from filing as a married couple, while dual-income married couples are often penalized. The percentage of couples affected has varied over the years, depending on shifts in tax rates.

In the United States tax law, an above-the-line deduction is a deduction that the Internal Revenue Service allows a taxpayer to subtract from his or her gross income in arriving at "adjusted gross income" for the taxable year. These deductions are set forth in Internal Revenue Code Section 62. A taxpayer's gross income minus his or her above-the-line deductions is equal to the adjusted gross income. Because these deductions are taken before adjusted gross income is calculated, they are designated "above-the-line". Thus, those deductions allowed in computing "taxable income" under section 63 of the IRC are "below-the-line deductions". Above-the-line deductions may be more valuable to high-income taxpayers than below-the-line deductions. Since tax year 2018, above-the-line deductions are reported on Schedule 1 of IRS Form 1040.

A casualty loss is a type of tax loss that is a sudden, unexpected, or unusual event. Damage or loss resulting from progressive deterioration of property through a steadily operating cause would not be a casualty loss. “Other casualty” are events similar to “fire, storm, or shipwreck.” It is generally held that wherever force is applied to property which the owner-taxpayer is either unaware of because of the hidden nature of such application or is powerless to act to prevent the same because of the suddenness thereof or some other disability and damage results.

In the United States tax system, the two-percent haircut, otherwise known as the two-percent floor, is a limitation on miscellaneous itemized income tax deductions and is codified under Internal Revenue Code IRC § 67(a).

Commissioner v. Banks, 543 U.S. 426 (2005), together with Commissioner v. Banaitis, was a case decided before the Supreme Court of the United States, dealing with the issue of whether the portion of a money judgment or settlement paid to a taxpayer's attorney under a contingent-fee agreement is income to the taxpayer for federal income tax purposes. The Supreme Court held when a taxpayer's recovery constitutes income, the taxpayer's income includes the portion of the recovery paid to the attorney as a contingent fee. Employment cases are an exception to this Supreme Court ruling because of the Civil Rights Tax Relief in the American Jobs Creation Act of 2004. The Civil Rights Tax Relief amended Internal Revenue Code § 62(a) to permit taxpayers to subtract attorney's fees from gross income in arriving at adjusted gross income.

A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is secured by their principal residence. The mortgage deduction makes home purchases more attractive, but contributes to higher house prices.

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Government of the Commonwealth of Puerto Rico. Payment of taxes to the federal government, both personal and corporate, is done through the federal Internal Revenue Service (IRS), while payment of taxes to the Commonwealth government is done through the Puerto Rico Department of Treasury.

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer.

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, Pub. L.Tooltip Public Law 115–97 (text)(PDF), is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. The legislation is commonly referred to in media as the Trump tax cuts, as it was a key agenda piece of the Trump adminstration. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and reducing the penalty for violating the individual mandate of the Affordable Care Act (ACA) to $0. The New York Times has described the TCJA as "the most sweeping tax overhaul in decades".