Related Research Articles

The Carlyle Group Inc. is a multinational private equity, alternative asset management and financial services corporation based in the United States with $376 billion of assets under management. It specializes in private equity, real assets, and private credit. It is one of the largest mega-funds in the world. In 2015, Carlyle was the world's largest private equity firm by capital raised over the previous five years, according to the PEI 300 index. In the 2023 ranking however, it had slipped to fifth place.

In the field of finance, private equity (PE) is capital stock in a private company that does not offer stock to the general public. Private equity is offered instead to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage, "private equity" can refer to these investment firms rather than the companies that they invest in.

Darl Charles McBride is an entrepreneur and CEO of Shout TV Inc. McBride is known as the former CEO of The SCO Group. On March 7, 2003, during McBride's tenure as CEO of the company, The SCO Group initiated litigation against IBM, alleging breach of contract and copyright infringement claims connected to Unix. SCO Group lost in a series of court battles, and was eventually forced into bankruptcy.

The SCO Group was an American software company in existence from 2002 to 2012 that became known for owning Unix operating system assets that had belonged to the Santa Cruz Operation, including the UnixWare and OpenServer technologies, and then, under CEO Darl McBride, pursuing a series of high-profile legal battles known as the SCO-Linux controversies.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

UnixWare is a Unix operating system. It was originally released by Univel, a jointly owned venture of AT&T's Unix System Laboratories (USL) and Novell. It was then taken over by Novell. Via Santa Cruz Operation (SCO), it went on to Caldera Systems, Caldera International, and The SCO Group before it was sold to UnXis. UnixWare is typically deployed as a server rather than a desktop. Binary distributions of UnixWare are available for x86 architecture computers. UnixWare is primarily marketed as a server operating system.

In a series of legal disputes between SCO Group and Linux vendors and users, SCO alleged that its license agreements with IBM meant that source code IBM wrote and donated to be incorporated into Linux was added in violation of SCO's contractual rights. Members of the Linux community disagreed with SCO's claims; IBM, Novell, and Red Hat filed claims against SCO.

Beginning in 2003, The SCO Group was involved in a dispute with various Linux vendors and users. SCO initiated a series of lawsuits, the most known of which were SCO v. IBM and SCO v. Novell, that had implications upon the futures of both Linux and Unix. SCO claimed that Linux violated some of SCO's intellectual properties. Many industry observers were skeptical of SCO's claims, and they were strongly contested by SCO's opponents in the lawsuits, some of which launched counter-claims. By 2011, the lawsuits fully related to Linux had been lost by SCO or rendered moot and SCO had gone into bankruptcy. However the SCO v. IBM suit continued for another decade, as it included contractual disputes related to both companies' involvement in Project Monterey in addition Linux-related claims. Finally in 2021 a settlement was reached in which IBM paid the bankruptcy trustee representing what remained of SCO the sum of $14.25 million.

Xinuos OpenServer, previously SCO UNIX and SCO Open Desktop, is a closed source computer operating system developed by Santa Cruz Operation (SCO), later acquired by SCO Group, and now owned by Xinuos. Early versions of OpenServer were based on UNIX System V, while the later OpenServer 10 is based on FreeBSD 10. However, OpenServer 10 has not received any updates since 2018 and is no longer marketed on Xinuos's website, while OpenServer 5 Definitive and 6 Definitive are still supported.

Goldman Sachs Asset Management Private Equity is the private equity arm of Goldman Sachs, focused on leveraged buyout and growth capital investments globally. The group, which is based in New York City, was founded in 1986.

AlpInvest Partners is a global private equity asset manager with over $85 billion of committed capital since inception as of December 31, 2022. The firm invests on behalf of more than 450 institutional investors from North America, Asia, Europe, South America and Africa.

The history of private equity, venture capital, and the development of these asset classes has occurred through a series of boom-and-bust cycles since the middle of the 20th century. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel, although interrelated tracks.

Private equity in the 1980s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.

Private equity in the 1990s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital, experienced growth along parallel although interrelated tracks.

Private equity in the 2000s represents one of the major growth periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital expanded along parallel and interrelated tracks.

Castle Harlan is a private equity firm based in New York City. The company focuses on buyouts and growth capital investments in middle-market companies across a range of industries. Founded in 1987, Castle Harlan invests in controlling interests in middle-market companies in North America and Europe, Australia and Southeast Asia through Castle Harlan Australian Mezzanine Partners.

Xinuos is an American software company that was created in 2011 and was first called UnXis until assuming its current name in 2013. Xinuos develops and markets the Unix-based OpenServer 6, OpenServer 5, and UnixWare 7 operating systems under SCO branding. Xinuos formerly sold the FreeBSD-based OpenServer 10 operating system.

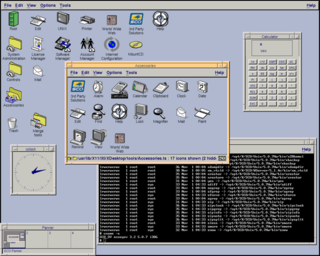

SCO Forum was a technical computer conference sponsored by the Santa Cruz Operation (SCO), briefly by Caldera International, and later The SCO Group that took place during the 1980s through 2000s. It was held annually, most often in August of each year, and typically lasted for much of a week. From 1987 through 2001 it was held in Santa Cruz, California, on the campus of the University of California, Santa Cruz. The scenic location, amongst redwood trees and overlooking Monterey Bay, was considered one of the major features of the conference. From 2002 through 2008 it was held in Las Vegas, Nevada, at one of several hotels on the Las Vegas Strip. Despite the name and location changes, the conference was considered to be the same entity, with both the company and attendees including all instances in their counts of how many ones they had been to.

MerchantBridge & Co. Ltd. was a London-based boutique private equity firm that specialized in investments in the Middle East and especially Iraq, where it was one of the largest such firms. It was in existence from 2001 to 2018.

References

- 1 2 3 4 "Form S-1". Securities and Exchange Commission . Global Digital Solutions. September 17, 2014. Retrieved April 7, 2024.

- ↑ Briody, Dan (2003). The Iron Triangle. John Wiley & Sons. pp. 51–59. ISBN 978-0-471-46969-8.

- 1 2 Vise, David A. (October 4, 1987). "Area Merchant Banking Firm Formed". The Washington Post . Retrieved April 15, 2024.

- 1 2 3 4 5 Mintz, John (January 8, 1995). "Founder Going Beyond The Carlyle Group". The Washington Post. Retrieved April 10, 2024.

- 1 2 Paul, Ryan (February 15, 2008). "Private equity firm pours $100 million into SCO money pit". Ars Technica.

- ↑ Flowers, John (February 14, 2008). "SCO Gets Up to $100 Million Financing". The Wall Street Journal.

- ↑ "Software company SCO gets help from Norris and a Middle East investor, hopes to go private". International Herald Tribune. Associated Press. February 15, 2008.

- ↑ Leong, Grace (April 3, 2008). "SCO negotiating new Ch. 11 plan". Daily Herald. Provo, Utah.

- ↑ Paul, Ryan (April 3, 2008). "Bankruptcy trustee skeptical as SCO punts on reorg plan". Ars Technica.

- ↑ Church, Steven (April 3, 2008). "Insolvent SCO scraps its reorganization plan". Deseret News. Bloomberg News. Archived from the original on April 7, 2008.

- ↑ "SCO Tec Forum 2008". The SCO Group. Retrieved December 21, 2019. See keynote presentation, slide 39ff.

- 1 2 Harvey, Tom (February 14, 2011). "Utah's SCO in deal to sell Unix operating system". The Salt Lake Tribune.

- ↑ Paul, Ryan (June 23, 2009). "SCO wants to keep waging legal war after $2.4M asset sale". Ars Technica.

- ↑ Leong, Grace (August 26, 2009). "SCO to resume fight with Novell, IBM". Daily Herald. Provo, Utah. p. B4 – via Newspapers.com.

- ↑ Jones, Pamela (April 7, 2010). "Darl Buys (Not Licenses) SCO's Mobility Assets for $100,000 - Updated 4Xs". Groklaw.

- ↑ Jackson, Joab (September 16, 2010). "SCO puts Unix assets up for auction". InfoWorld.

- 1 2 3 4 O'Gara, Maureen (March 13, 2011). "Bankruptcy Court Says SCO Can Sell Its OS Assets". SYS-CON Media.

- ↑ Harvey, Tom (March 8, 2011). "Judge approves sale of SCO's Unix system". The Salt Lake Tribune.

- 1 2 3 4 Harvey, Tom (April 11, 2011). "SCO closes sale of Unix system to Nevada company". The Salt Lake Tribune.

- 1 2 3 Vaughan-Nichols, Steven J. (April 14, 2011). "SCO is dead, SCO Unix lives on". ZDNet.

- 1 2 Harvey, Tom (August 10, 2012). "Former SCO Group wants bankruptcy converted to liquidation". The Salt Lake Tribune.

- 1 2 3 Loftin, Josh (April 14, 2011). "Las Vegas company buys Unix". The Spectrum & Daily News. St. George, Utah. Associated Press. p. C2 – via Newspapers.com.

- ↑ Hachman, Mark (April 12, 2011). "SCO Group Assets Officially Sold to UnXis". PC World.

- ↑ "UnXis, Inc. announced today that it has changed its corporate name to Xinuos, Inc" (Press release). Xinuos. June 12, 2013.

- ↑ "SCO Group plans to go private with $100 million investment". Deseret Morning News . Retrieved 2008-03-06.