Pump and dump (P&D) is a form of securities fraud that involves artificially inflating the price of an owned stock through false and misleading positive statements (pump), in order to sell the cheaply purchased stock at a higher price (dump). Once the operators of the scheme "dump" (sell) their overvalued shares, the price falls and investors lose their money. This is most common with small-cap cryptocurrencies and very small corporations/companies, i.e. "microcaps".

Stratton Oakmont, Inc. v. Prodigy Services Co., 23 Media L. Rep. 1794, is a 1995 decision of the New York Supreme Court holding that online service providers can be liable for the speech of their users. The ruling caused controversy among early supporters of the Internet, including some lawmakers, leading to the passage of Section 230 of the Communications Decency Act in 1996.

Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC) uses the term "Penny stock" to refer to a security, a financial instrument which represents a given financial value, issued by small public companies that trade at less than $5 per share. Penny stocks are priced over-the-counter, rather than on the trading floor. The term "penny stock" refers to shares that, prior to the SEC's classification, traded for "pennies on the dollar". In 1934, when the United States government passed the Securities Exchange Act to regulate any and all transactions of securities between parties which are "not the original issuer", the SEC at the time disclosed that equity securities which trade for less than $5 per share could not be listed on any national stock exchange or index.

In business, the term boiler room refers to an outbound call center selling questionable investments by telephone. It usually refers to a room where salespeople work using unfair, dishonest sales tactics, sometimes selling penny stocks or private placements or committing outright stock fraud. A common boiler room tactic is the use of falsified and bolstered information in combination with verified company-released information. The term is pejorative: it is often used to imply high-pressure sales tactics and, sometimes, poor working conditions.

Henry McKelvey Blodget is an American businessman, investor and journalist. He is notable for his former career as an equity research analyst who was senior Internet analyst for CIBC Oppenheimer and the head of the global Internet research team at Merrill Lynch during the dot-com era. Blodget was charged with civil securities fraud by the U.S. Securities and Exchange Commission and settled the charges. Blodget is the co-founder and former CEO of Business Insider.

Churning is the practice of executing trades for an investment account by a salesperson or broker in order to generate commission from the account. It is a breach of securities law in many jurisdictions, and it is generally actionable by the account holder for the return of the commissions paid, and any losses occasioned by the broker's choice of stocks.

The OTC (Over-The-Counter) Bulletin Board or OTCBB was a United States quotation medium operated by the Financial Industry Regulatory Authority (FINRA) for its subscribing members. FINRA closed the OTCBB on November 8, 2021.

Steven Madden is an American fashion designer and businessman. He is the founder and former chief executive officer of Steven Madden, Ltd., a publicly traded company. He was forced to resign as an executive following a conviction for financial crimes.

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information. The setups are generally made to result in monetary gain for the deceivers, and generally result in unfair monetary losses for the investors. They are generally violating securities laws.

Anthony Elgindy, was an American stock broker, and financial commentator who founded Pacific Equity Investigations. Elgindy gained a reputation for his "investigations" of companies. Towards the end of his life, Elgindy was convicted of insider trading and served seven years in federal prison.

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Association of Securities Dealers, Inc. (NASD) as well as to the member regulation, enforcement, and arbitration operations of the New York Stock Exchange. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

Microcap stock fraud is a form of securities fraud involving stocks of "microcap" companies, generally defined in the United States as those with a market capitalization of under $250 million. Its prevalence has been estimated to run into the billions of dollars a year. Many microcap stocks are penny stocks, which the SEC defines as a security that trades at less than $5 per share, is not listed on a national exchange, and fails to meet other specific criteria.

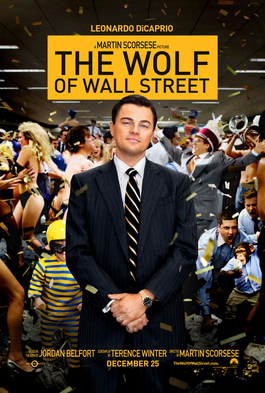

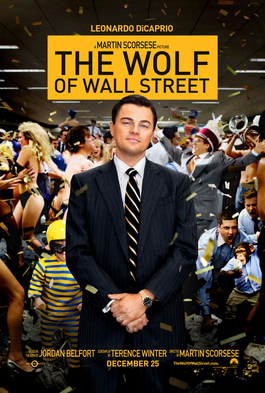

Jordan Ross Belfort is an American former stockbroker, financial criminal, entrepreneur, speaker, and author. He became an informant and wore a wire for the FBI and in 1999, he pleaded guilty to fraud and related crimes in connection with stock-market manipulation and running a boiler room as part of a penny-stock scam. Belfort spent 22 months in prison as part of an agreement under which he gave testimony against numerous partners and subordinates in his fraud scheme. He published the memoir The Wolf of Wall Street in 2007, which was adapted into a Martin Scorsese film of the same name released in 2013, in which he was played by Leonardo DiCaprio.

L.F. Rothschild was a merchant and investment banking firm based in the United States and founded in 1899. The firm collapsed following the 1987 stock market crash.

Appian Way Productions is a Los Angeles–based film and television production company founded in 2001 by actor and producer Leonardo DiCaprio. Jennifer Davisson serves as President of Production. Since its launch, Appian Way has released a diverse slate of films, including Academy Award–winning films The Aviator (2004) and The Revenant (2015), Academy Award–nominated films The Ides of March (2011) and The Wolf of Wall Street (2013), as well as the drama The Assassination of Richard Nixon (2004), the comedy-drama Gardener of Eden (2007), the biographical crime drama Public Enemies (2009), the psychological horror Orphan (2009), the psychological thriller Shutter Island (2010), the crime dramas Out of the Furnace (2013) and Live by Night (2016), and the biographical drama Richard Jewell (2019). The company has also produced the series Greensburg (2008–2010), Frontiersman, and The Right Stuff (2020) for Disney+.

The Wolf of Wall Street is a 2013 American epic biographical black comedy crime film co-produced and directed by Martin Scorsese and written by Terence Winter, based on Jordan Belfort's 2007 memoir of the same name. It recounts Belfort's career as a stockbroker in New York City and how his firm, Stratton Oakmont, engaged in rampant corruption and fraud on Wall Street, leading to his downfall. The film stars Leonardo DiCaprio as Belfort, Jonah Hill as his business partner and friend, Donnie Azoff, Margot Robbie as his second wife, Naomi Lapaglia, Matthew McConaughey as his mentor and former boss Mark Hanna, and Kyle Chandler as FBI agent Patrick Denham. It is DiCaprio's fifth collaboration with Martin Scorsese.

Daniel Mark Porush is an American businessman, former stock broker and convicted criminal who helped run a pump and dump stock fraud scheme in the 1990s at the Stratton Oakmont brokerage in collaboration with Jordan Belfort. In 1999, he was convicted of securities fraud and money laundering, for which he served 39 months in prison. After prison, Porush became involved with a Florida-based medical supply company, Med-Care, which was the subject of federal investigations. In the biographical 2013 film The Wolf of Wall Street, which focuses on the story of Belfort and Stratton Oakmont, Jonah Hill portrays Donnie Azoff, a character loosely based on Porush. Porush has called the portrayal inaccurate and threatened to sue the filmmakers to prevent him from being depicted.

The Wolf of Wall Street is a memoir by former stockbroker and trader Jordan Belfort, first published in September 2007 by Bantam Books, then adapted into a 2013 film of the same name. Belfort's autobiographical account was continued by Catching the Wolf of Wall Street, published in 2009.

Salvatore "Sal the Pizza Guy" Romano is a former member of the Gambino crime family and their operative on Wall Street, making millions of dollars for the Gambinos by way of stock fraud, first serving under the late John "Johnny G" Gammarano and later becoming a top earner for Michael "Mikey Scars" DiLeonardo, a capo in the Gambino crime family who was at one time considered a possible successor to John Gotti as boss of the family.

Nadine Macaluso, formerly Belfort, is a British-born American psychologist, author, internet personality, and former model. She was the second wife of the stockbroker and financial criminal Jordan Belfort, to whom she was married from 1991 to 2005. Throughout her marriage, she was referred to in the press as the "Duchess of Bay Ridge".