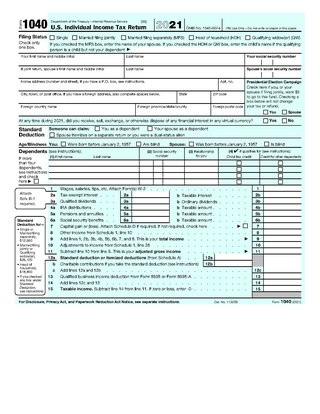

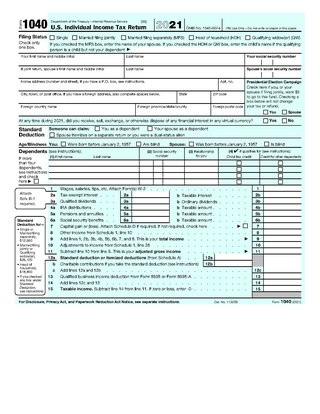

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

In Canada, there are two types of sales taxes levied. These are :

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority.

The Canada Revenue Agency is the revenue service of the Canadian federal government, and most provincial and territorial governments. The CRA collects taxes, administers tax law and policy, and delivers benefit programs and tax credits. Legislation administered by the CRA includes the Income Tax Act, parts of the Excise Tax Act, and parts of laws relating to the Canada Pension Plan, employment insurance (EI), tariffs and duties. The agency also oversees the registration of charities in Canada, and enforces much of the country's tax laws.

A registered retirement savings plan (RRSP), or retirement savings plan (RSP), is a type of financial account in Canada for holding savings and investment assets. RRSPs have various tax advantages compared to investing outside of tax-preferred accounts. They were introduced in 1957 to promote savings for retirement by employees and self-employed people.

In Canada, taxation is a prerogative shared between the federal government and the various provincial and territorial legislatures.

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

The T1 General or T1 is the form used in Canada by individuals to file their personal income tax return. Individuals with tax payable during a calendar year must use the T1 to file their total income from all sources, including employment and self-employment income, interest, dividends, and capital gains, rental income, and so on. Foreign income must also be declared and included in the total income. After applicable deductions and adjustments, the net income and taxable income are determined, from which the federal tax and the provincial or territorial tax are calculated to give the total payable. Subtracting total credits, which include the tax withheld, the filer will either receive a refund or have balance owing, which may be zero.

Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada, and of the governments of the Provinces of Canada. In the fiscal year ending March 31, 2018, the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

In the United States, Tax Day is the day on which individual income tax returns are due to be submitted to the federal government. Since 1955, Tax Day has typically fallen on or just after April 15. Tax Day was first introduced in 1913, when the Sixteenth Amendment was ratified.

Tax preparation is the process of preparing tax returns, often income tax returns, often for a person other than the taxpayer, and generally for compensation. Tax preparation may be done by the taxpayer with or without the help of tax preparation software and online services. Tax preparation may also be done by a licensed professional such as an attorney, certified public accountant or enrolled agent, or by an unlicensed tax preparation business. Because United States income tax laws are considered to be complicated, many taxpayers seek outside assistance with taxes.

The Canadian Scientific Research and Experimental Development Tax Incentive Program provides support in the form of tax credits and/or refunds, to corporations, partnerships or individuals who conduct scientific research or experimental development in Canada.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

A Health and welfare trust (HAWT) or Health and welfare plan (HAWP) is a tax-free vehicle for financing a corporation's healthcare costs for their employees. They were introduced in 1986 by Canada Revenue Agency (CRA) in their interpretation bulletin entitled IT-85R2. Many companies offer this product to Canadian employers.

The Disability Tax Credit (DTC) is a non-refundable tax credit in Canada for individuals who have a severe and prolonged impairment in physical or mental function. An impairment qualifies as prolonged if it is expected to or has lasted at least 12 months. The DTC is required in order to qualify for the Registered Disability Savings Plan, the working income tax benefit, and the child disability benefit. Families using a Henson trust, the Canada Disability Child Benefit other estate planning methods for children with Disabilities are not excluded from the DTC. While the credit is valuable, many have found qualifying for it challenging.

The Canada Workers Benefit (CWB) is a refundable tax credit in Canada. Introduced in 2007 under the name Workers Income Tax Benefit (WITB), it offers tax relief to working low-income individuals and encourages others to enter the workforce. The WITB has been expanded considerably since its introduction, and restructured in depth by the 2018 Canadian federal budget when it was renamed the Canada Workers Benefit.

Corporate taxes in Canada are regulated at the federal level by the Canada Revenue Agency (CRA). As of January 1, 2019 the "net tax rate after the general tax reduction" is fifteen per cent. The net tax rate for Canadian-controlled private corporations that claim the small business deduction, is nine per cent.