The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The Chicago Board of Trade (CBOT), established on April 3, 1848, is one of the world's oldest futures and options exchanges. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other exchanges now operate as designated contract markets (DCM) of the CME Group.

Leo Melamed is an American attorney, finance executive, and a pioneer of financial futures. He is the chairman emeritus of CME Group.

Charles E. Phillips is an American business executive in the tech industry. He is the co-founder of Recognize, a focused investment firm. From 2010 to 2019, he was the CEO of Infor, a company that specializes in enterprise software applications for specific industries.

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

CME Group Inc., headquartered in Chicago, operates financial derivatives exchanges including the Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, and The Commodity Exchange. The company also owns 27% of S&P Dow Jones Indices. It is the world's largest operator of financial derivatives exchanges. Its exchanges are platforms for trading in agricultural products, currencies, energy, interest rates, metals, futures contracts, options, stock indexes, and cryptocurrencies futures.

NEX Group plc, formerly known as ICAP plc, is a UK-based business focused on electronic financial markets and post trade business for other financial institutions rather than private individuals. They are known as an inter-broker dealer. The company operates BrokerTec and EBS, respectively among the largest treasuries and foreign exchange markets in the world. NEX was listed on the London Stock Exchange until it was acquired by CME Group in November 2018.

John Francis Sandner was an American business executive and community leader. He served three stints as the chairman of the Chicago Mercantile Exchange (CME), now the CME Group, in the 1980s and 1990s.

Colliers International Group Inc. is a Canada-based diversified professional services and investment management company with approximately 18,000 employees in more than 400 offices in 65 countries.

William J. Brodsky is an American businessman working as a director of the Securities Investor Protection Corporation, executive chairman of the Chicago Board Options Exchange, and chairman of the World Federation of Exchanges.

Exor N.V. is a Dutch holding company incorporated in the Netherlands and controlled by the Agnelli family through privately held company Giovanni Agnelli B.V. In 2021 it recorded revenues of more than $136 billion, with a Net Asset Value (NAV) of around $31 billion, becoming the 37th largest group in the world by revenue, according to the 2021 Fortune Global 500 List. It has a history of investments running over a century, which currently include auto and truck manufacturers Stellantis, Ferrari and Iveco, agricultural and construction firm CNH Industrial, the association football club Juventus F.C., the international newspaper The Economist, and the Italian media company GEDI. In May 2023 Exor launched its investment management company, Lingotto.

OneChicago was a US-based all-electronic futures exchange with headquarters in Chicago, Illinois. The exchange offered approximately 12,509 single-stock futures (SSF) products with names such as IBM, Apple and Google. All trading was cleared through Options Clearing Corporation (OCC). The OneChicago exchange closed in September 2020.

Fortune Brands Innovations, Inc. is an American manufacturer of home and security products, headquartered in Deerfield, Illinois. Its portfolio of businesses and brands includes Moen and the House of Rohl; outdoor living and security products from Therma-Tru, Larson, Fiberon, Master Lock and SentrySafe; and MasterBrand Cabinets. Fortune Brands is a Fortune 500 company and part of the S&P 400 Index. As of December 31, 2021, the company reported employing approximately 28,000 associates and posted full-year 2021 net sales of $7.7 billion.

R1 RCM Inc. is an American revenue cycle management company servicing hospitals, health systems and physician groups across the United States. The company provides end-to-end revenue cycle management services as well as modular services targeted across the revenue cycle including pre-registration, financial clearance, debt collection, charge capture, coding, billing and follow-up, u and denials management.

James J. McNulty was C.E.O. of the Chicago Mercantile Exchange from 2000 to 2004. He administered the Exchange’s transition through demutualization to a publicly traded firm. His initial contract was not renewed by the Board, which had voted out the then Chairman who supported McNulty. Prior to assuming the positions of President and C.E.O. of the Chicago Mercantile Exchange, McNulty had 25 years experience in global financial markets. McNulty received a B.A. in liberal arts from the University of Illinois, Chicago and an M.A. in Anglo-Irish studies from University College, Dublin. In 2007, McNulty was inducted into the Future Industry Associations Future’s Hall of Fame. McNulty has nurtured press relations and a reputation as an "intellectual" (Crain's). McNulty joined the Board of Directors of NYSE Group, Inc. in 2005. Since 2008, he has been the Chairman of the Board of Directors of NYSE Liffe.

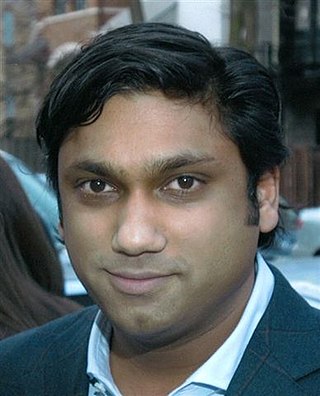

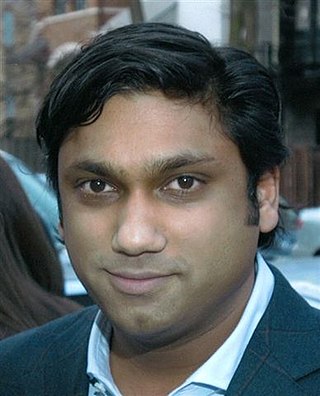

Rajiv K. "Raj" Fernando is an American businessman, political fundraiser and donor, and philanthropist. He is the current Chairman and CEO of Workstorm.com and the former CEO of Chopper Trading.

Alameda Research was a cryptocurrency trading firm, co-founded in September 2017 by Sam Bankman-Fried and Tara Mac Aulay.